Methodological Notes of the Historical Statistical Series: Public Sector

The purpose of this methodology sheet is to outline the composition of Colombia’s public sector, provide essential definitions for interpreting the displayed data, and identify the various sources of information used to obtain the data. The first section exhibits how the public sector is structured in Colombia; the second highlights the main differences between fiscal data and budget data; the third contains definitions of key terms such as revenues, expenditures, debt, gross debt, net debt, and fiscal balance; and finally, the fourth section details the diverse sources of statistical information and their historical changes over time.

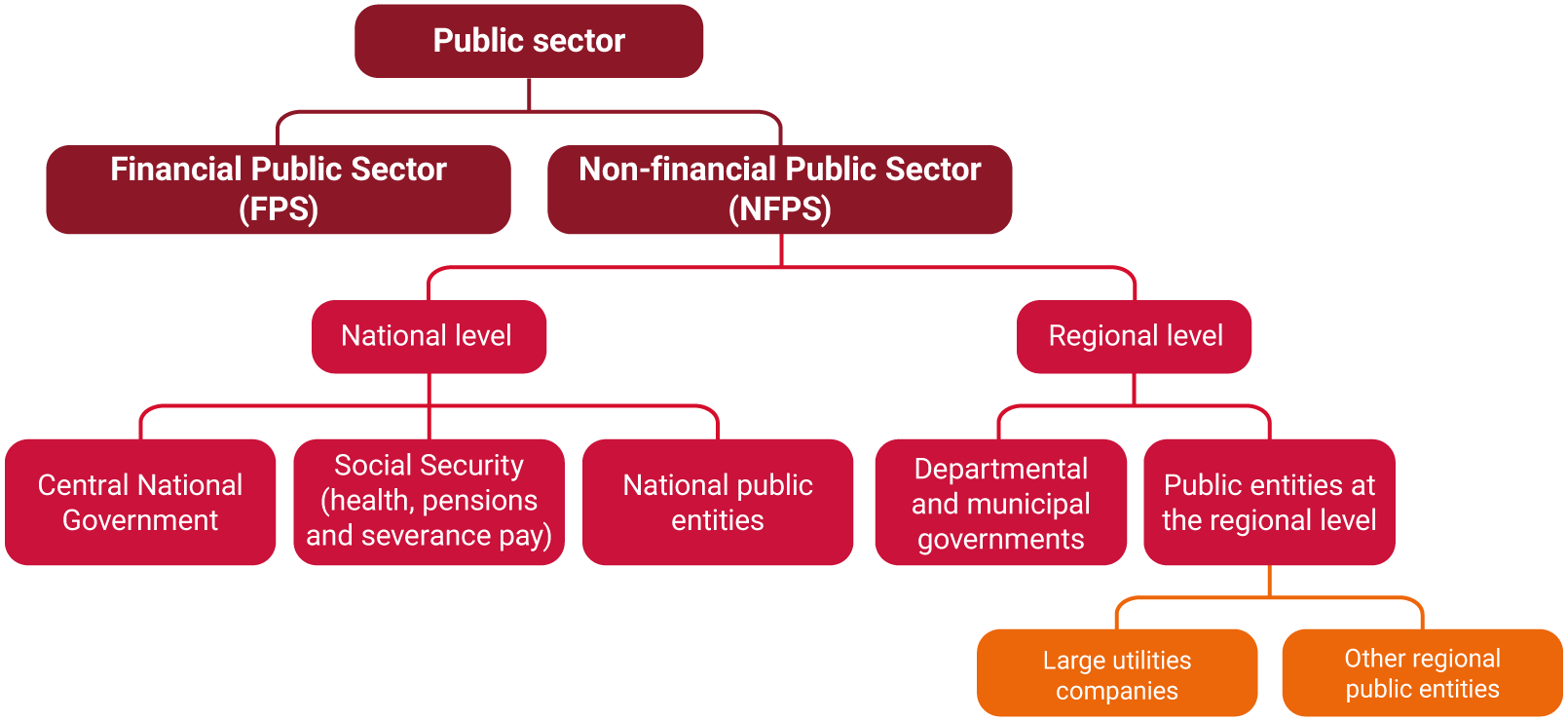

1. Structure of the public sector

Colombia’s public sector consists of two main components: the financial public sector (FPS) and the non-financial public sector (NFPS). In this analysis, we will focus on the NFPS, which comprises the national NFPS. The national NFPS, in turn, is composed of the Central National Government (referred to as GNC in Spanish), national public entities, and social security. Additionally, the regional NFPS encompasses departmental and municipal governments, as well as other public entities at the regional level, including local utilities companies.

2. Fiscal vs. budgetary data

Budget accounts and GNC accounts are two related but distinct concepts. Budget accounts pertain to the planning and allocation of a government’s financial resources over a specific period, typically a fiscal year. They encompass the government’s revenues, expenditures, and the objectives and priorities for utilizing public funds. Additionally, budget accounts include current appropriations and budgetary reserves, as well as accounts payable.

In contrast, GNC accounts refer to the accounting records of revenues and expenses incurred within a given year. These accounts cover floating debt and interest expenses. Typically, the central government includes ministries and other government agencies directly controlled by the Colombian Government. GNC accounts serve as a crucial instrument for assessing the country’s economic and fiscal stability.

3. Definitions

The published series contain data on income, expenses, debt and fiscal balance.:

- Revenues:Represent the resources received by the Government. They consist of:

- Current revenues: These include tax revenues and non-tax revenues. Tax revenues are generated from daily activities, while non-tax revenues encompass other income sources.

- Capital resources: These include financial surpluses, yields, reimbursements, and non-appropriated resources. Capital resources can come from domestic and external credit sources, as well as portfolio recovery (revenues generated through asset sales).

- Expenditures: Refer to how the Government allocates the revenues it receives. They fall into three categories:

- Operating expenses: These cover general expenses, personnel costs, and transfers.

- Investment: Investment expenses include infrastructure construction.

- Debt service: Debt service involves payments for amortization and interest.

- Debt: Represents the obligations the Government assumes to meet its payment commitments. It can be held by private and/or public agents, both within and outside the country. There is gross debt and net debt. The main difference between these two is that net debt excludes the government's financial assets, i.e., checking accounts, certificates of deposit (CDTs), bonds, public funds, and portfolios abroad.

- Fiscal balance: describes the relationship between government expenditures and revenues. It is calculated as the difference between revenues and expenditures. A positive difference is called a surplus, and a negative difference is called a deficit. It is an indicator that assesses the stability of a country's public finances.

4. Calculation of the fiscal deficit

In Colombia, various methodologies have been employed to calculate the fiscal balance over time. Prior to 1986, the balance was determined by using budgetary data (essentially, what was executed during the current year). In 1986, the International Monetary Fund (IMF) published a manual on public finance statistics aiming to establish a clearer methodology for economic measurement. This manual emphasized the importance of calculating based on effective cash transactions.

In 2001, the IMF updated its public finance manual. The key change was that fiscal balance sheet accounts should now include overdue obligations, debt arrears, interest payments, and payments for goods and services. Since then, Colombia’s Ministry of Finance and Public Credit (MHCP) has gradually incorporated some of these modifications into its fiscal reporting.

Subsequently, in 2014, a new public finance statistics manual was introduced, which was a modernization and expansion of the 2001 manual. This updated manual proposed a complete transition to calculating fiscal balance using accrual accounting rather than relying solely on effective cash transactions. Although this new methodology has not been fully implemented in Colombia, the MHCP continues to work toward the transition.

5. Sources of information

Since 1923, annual fiscal data has been publicly available in Colombia. The Office of the Comptroller General took on this responsibility that year. In 1986, the International Monetary Fund (IMF) introduced the public finance statistics manual, which the National Planning Department (DNP) was the first to implement. Subsequently, Law 38 of 1989 established the Fiscal Policy Board (CONFIS), an institution under the Ministry of Finance and Public Credit. The CONFIS directed fiscal policy and coordinated the budget system, becoming the official body responsible for monitoring the country’s public finances and their corresponding statistics.

In mid-2006, the CONFIS ceased publishing this data, prompting the General Office of Macroeconomic Policy at the Ministry of Finance and Public Credit to assume responsibility for data updates. For this report, information was gathered from various sources, depending on the specific observation period.

Historical data from 1924 to 1995 has its origins in the commemorative journal of Banco de la República’s 75th anniversary. During the period 1996-1997, data was extracted from the journal of Banco de la República (Volume 74, issue 883, May 2001). For 1998-1999, the source is Banco de la República’s journal (Volume 76, issue 914, December 2003). Since 2000, the Ministry of Finance and Public Credit has been responsible for providing the data.