Foreign Reserves Management Report – 2025

The Political Constitution of Colombia and Article 14 of Law 31 of 1992 assign Banco de la República (the Central Bank of Colombia) the function of managing Colombia's foreign reserves. Las opiniones y posibles errores son responsabilidad exclusiva del autor y sus contenidos no comprometen al Banco de la República ni a su Junta Directiva.

Foreign reserves are managed by Banco de la República (the Central Bank of Colombia, BanRep) per the rules established by the Political Constitution of Colombia and Law 31 of 1992, and in line with the criteria of safety, liquidity, and return. Banco de la República maintains foreign reserves in the amounts it considers sufficient to preserve the country’s adequate external liquidity. The level of foreign reserves is a key determinant in the perception of creditworthiness of domestic borrowers.

Main Characteristics of Banco de la República’s Reserves Management Policy

- Reserves are invested in financial assets with high levels of safety and liquidity, characterized by a large secondary market.

- The percentage of reserves that remains available to cover immediate liquidity needs, known as working capital (i.e., invested at very short maturities), remains at low levels. This suggests that, under a floating exchange-rate regime, the probability and scale of any intervention in the foreign exchange market by the Central Bank are low.

- Considering the lower liquidity needs under the current exchange-rate regime, the remainder of the investment portfolio has longer maturities and higher expected returns, which maintain a low risk level.

- Reserve management policies are based on modern portfolio theory, which suggests the application of the diversification principle, given that it is not possible to predict the performance of each of the investments within a portfolio with certainty. In this regard, the portfolio’s safety, liquidity, and return are assessed as a whole, rather than by the performance of individual investments.

- The management of foreign reserve resources is carried out through portfolios managed directly by Banco de la República as well as those managed by specialized external firms.

Current Situation of Colombia’s Foreign Reserves

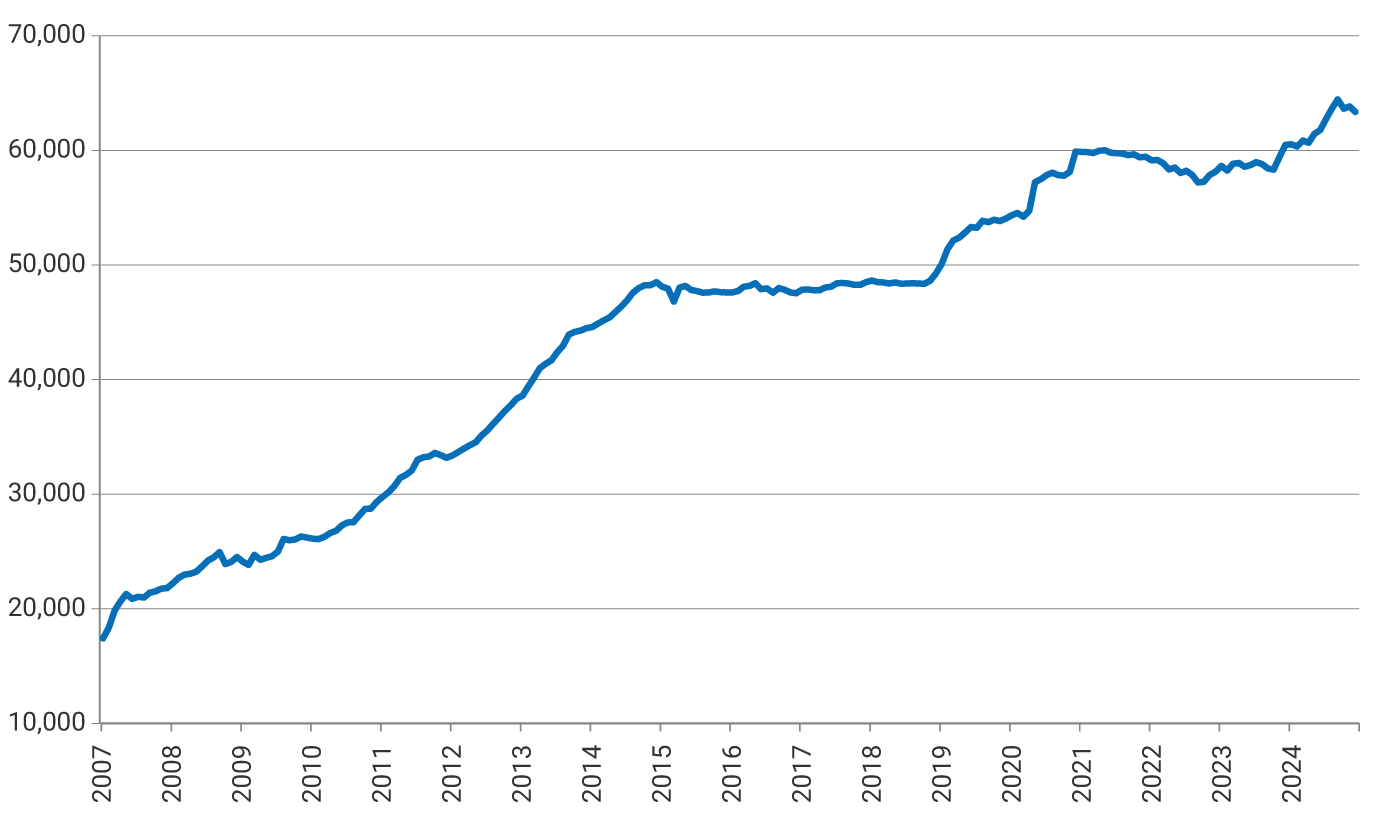

Net foreign reserves totaled USD 62,481 m as of 31 December 2024.

- Several indicators used to assess the level of foreign reserves suggest adequate levels for the country.

- One of the most widely used indicators worldwide to measure the adequate level of foreign reserves is the Assessing Reserve Adequacy (ARA) methodology. This metric, proposed by the International Monetary Fund (IMF), establishes that reserves should be able to mitigate the risk of a balance-of-payments crisis during periods of foreign exchange market stress. An economy is considered to have adequate reserve levels if the reserve adequacy ratio lies between 1.0 and 1.5. Based on figures as of December 2024, the IMF’s reserve adequacy ratio calculated for Colombia stood at 1.29.

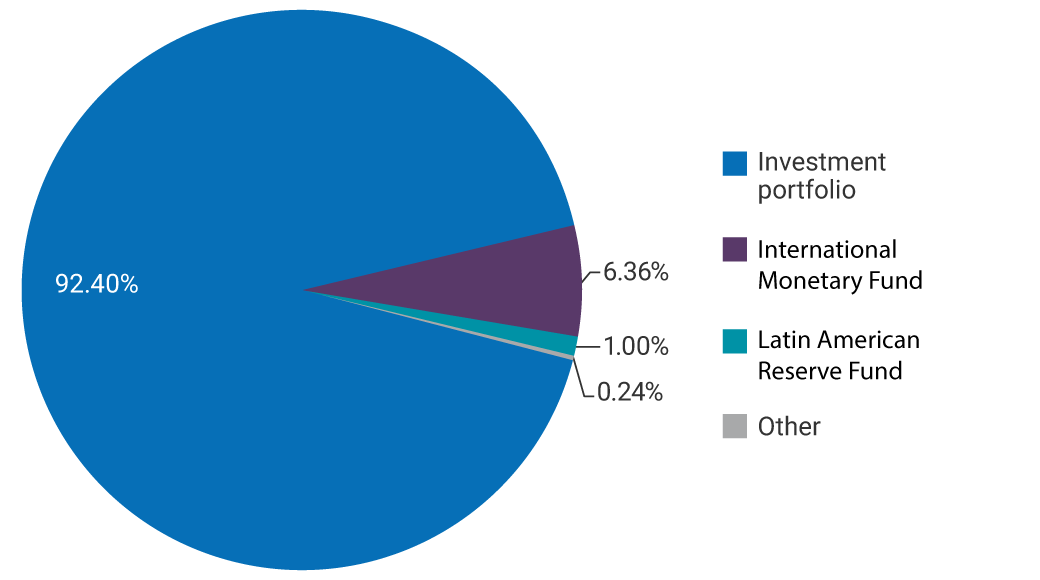

Composition of Foreign Reserves

The investment portfolio is the main component of foreign reserves, accounting for 92.40% of the total. The remaining balance is distributed among the position in the International Monetary Fund (IMF) and Special Drawing Rights (SDR), contributions to the Latin American Reserve Fund (FLAR in Spanish), and others.

The investment portfolio is composed of a short-term and a medium-term tranche.

- The short-term tranche is intended to cover the potential liquidity needs of the reserves over a twelve-month horizon.

- The medium-term tranche seeks to increase the long-term expected return of foreign reserves, preserving a conservative portfolio, with an expected return profile higher than that of the short-term tranche.

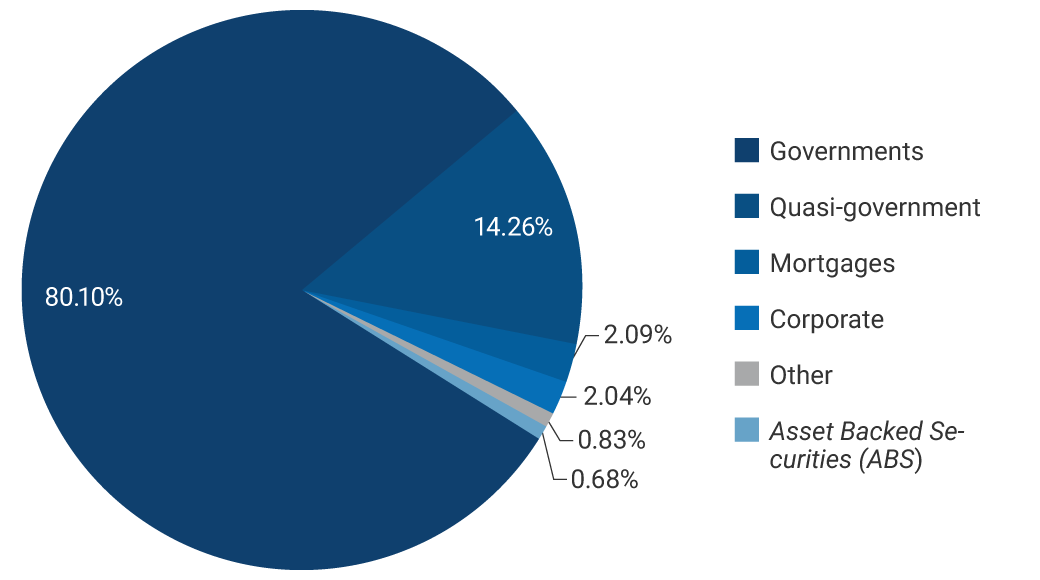

Composition of the Investment Portfolio by sector

As of the end of December 2024, foreign reserves consisted primarily of securities issued by governments and government-related entities.

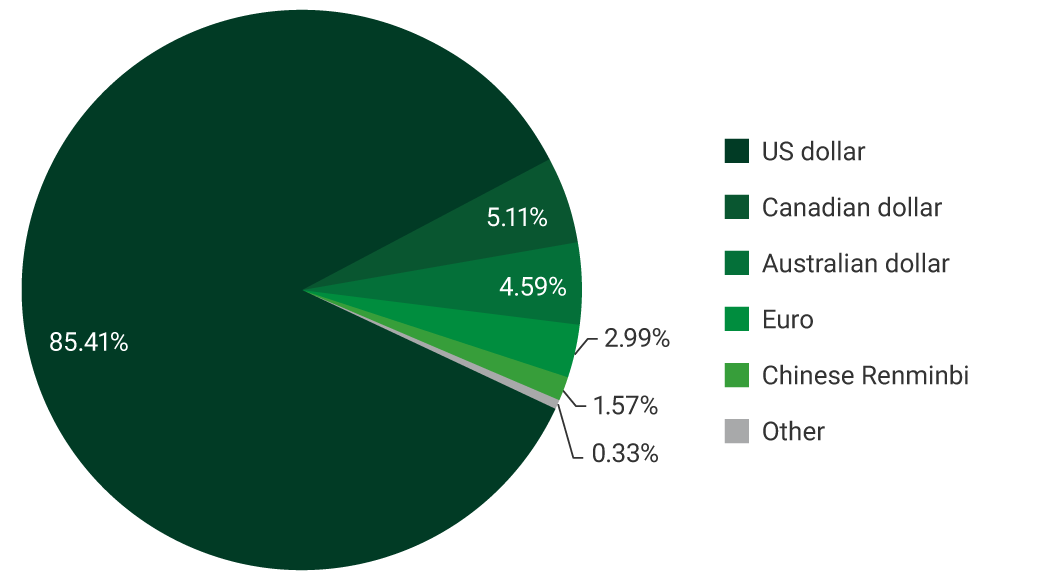

Currency Composition of the Investment Portfolio

Foreign reserves are comprised of currencies characterized by high daily trading volumes and belong to countries with high credit ratings, with the US dollar being the currency accounting for the largest share.

Composition of the Investment Portfolio by Credit Rating

The composition of the portfolio by credit rating highlights the high credit quality of the assets in which the portfolio is invested. As of 31 December 2024, 21.72% and 74.45% of the portfolio were invested in AAA and AA-rated instruments, respectively.

Management of Risks Associated with the Investment of Foreign Reserves

The safety criterion under which foreign reserves are managed in Colombia entails the proper control of risks to which investments are exposed. Some of the main risk management policies are as follows:

- To manage liquidity risk, BanRep defines investment tranches in line with the portfolio’s liquidity and return objectives, and invests in financial assets that are easy to liquidate in the secondary market.

- Banco de la República seeks to limit market risk by investing in a limited group of eligible assets with moderate sensitivity to interest rate movements.

- BanRep establishes minimum credit ratings and maximum concentration limits per issuer to prevent credit events and mitigate their impact. Currently, the minimum long-term credit rating for debt securities eligible for the reserve portfolio is A-.

- To invest reserves with high safety and liquidity, investments in the following currencies were permitted at the end of 2024: US dollar, Canadian dollar, Australian dollar, New Zealand dollar, Hong Kong dollar, Singapore dollar, Swedish krona, British pound, Swiss franc, euro, yen, Norwegian krone, renminbi, and Korean won. All these currencies are characterized by large public debt markets, highly traded foreign currencies, and governments with credit ratings that comply with Banco de la República’s investment guidelines.

- To mitigate counterparty risk, payment-on-delivery mechanisms are used, requirements and exposure limits are established for the counterparties with which the portfolio transactions are carried, and master agreements are signed with such counterparties.

Recuadros

- Box 1: Real-time forecast of quarterly GDP growth using nowcasting techniques (only in Spanish)

- Box 2: Criteria for defining the eligible asset universe and their maximum weights in strategic asset allocation (only in Spanish)

- Box 3: Active management of foreign reserves (only in Spanish)

- Box 4: Trends in reserve management (only in Spanish)

- Box 5: Monitoring geopolitical factors in the investment portfolios of foreign reserves (only in Spanish)

- Box 6: Liquidity risk management in foreign reserves (only in Spanish)

- Box 7: A review of sustainability practices and the adoption of sustainability criteria in the management of foreign reserves (only in Spanish)