Methodological Notes of the Historical Statistical Series: Financial Accounts

The National Accounts System (SNA) defines the analytical framework under which the non-financial and financial statistics of any economy in general are compiled. As mentioned above, the institution in charge of compiling non-financial statistics is the National Administrative Department of Statistics (DANE in Spanish), and the one in charge of financial statistics is Banco de la República (the Central Bank of Colombia).

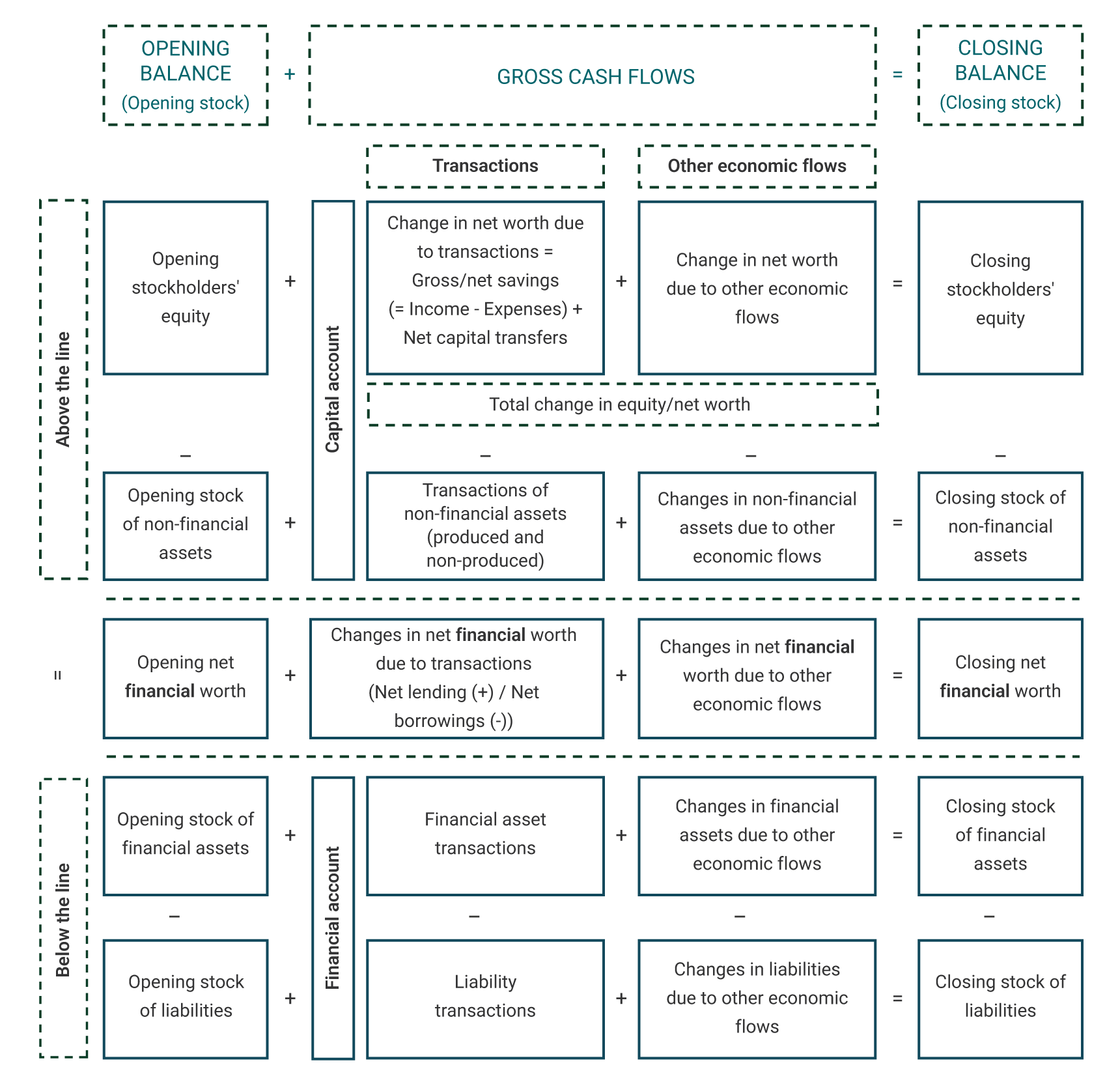

The following diagram defines the SNA’s analytical framework:

Table 1. Structure of the National Accounts System

The Colombian Financial Accounts System consists of a complete system comprising financial balances and flow accounts, which explain the variations between balances at the opening and closing of each period. The flow accounts are broken down into transaction and non-transaction accounts: a) revaluations, which reflect changes in the value of assets and liabilities as a result of changes in their prices or in the exchange rates of the currency in which they are denominated; and b) accounts of other changes in volume, which reflect changes in the balances of financial assets and liabilities for other reasons, such as credit write-offs or changes in sectorization.

Thus, the Colombian Financial Accounts System is an integrated system of accounts in which, for each sector and subsector, the change between balances or financial statements at two different points in time is explained by two accounts: financial transactions and other flows different from transactions.

The Colombian Financial Accounts System is a system of standardized, complete, coherent, integrated, and internationally comparable accounts, which, in relation to financial instruments, allows the consistent compilation of financial balances and financial transactions and other economic flows (revaluations and other changes in volume) for all sectors and subsectors of the Colombian economy.

Before showing the composition of these accounts, it is important to define what is a transaction and other terms that will be shown later:

Transaction: “It is an economic flow consisting of an interaction between institutional units by mutual agreement" (3.51 SNA 2008).

Economic flow: This reflects “the creation, transformation, exchange, transfer, or extinction of economic value; they involve changes in the volume, composition, or value of the assets and liabilities of an institutional unit" (3.6 SNA 2008).

Stock: The position or holding of assets and liabilities at a point in time.

With the above definitions, the following economic equalities are obtained:

Stock t-1 + Economic flows t = Stock t

Economic flows t = Transactions t + Other economic flows t

Institutional sectors

An institutional sector is the grouping of institutional units into similar classes. Institutional units are economic entities with the capacity, "in their own right, to hold assets, incur into liabilities, and engage in economic activities and transactions with other entities" (4.2 SNA 2008). The classification is made "according to the nature of the economic activity they perform" (4.17 SNA 2008). Additionally, only those units whose predominant center of economic interest is the Colombian economy are considered. Thus, the institutional sectors are as follows:

Non-financial sector – S11

This sector is made up of units "whose main activity is the production of non-financial market goods or services" (4.94 SNA 2008). Companies such as Ecopetrol and the Empresa de Telecomunicaciones de Bogotá (ETB) are classified into this institutional sector.

Financial sector – S12

These are units "primarily engaged in providing financial services, including insurance and pension fund financing services, to other institutional units" (4.98 SNA 2008). Additionally, the country's monetary authority, Banco de la República, is classified into this sector. Commercial banks, commercial finance companies, and trusts are classified in this sector.

General Government – S13

These are institutions "created through political procedures and vested with legislative, judicial, or executive power over other institutional units in a given area" (4.117 SNA 2008). They also assume "responsibility for the provision of goods and services to the community or individual households and finance such provision from taxes or other revenues, redistribute income and wealth through transfers, and engage in non-market production" (4.117 SNA 2008). This sector includes ministries, department governorates, and mayor’s offices.

Households – S14

"A household can be defined as a group of people who share the same dwelling, who pool, in whole or in part, their income and wealth, and who collectively consume certain types of goods and services, especially those related to food and shelter" (4.149 SNA 2008). It is assumed that every decision made by an individual and which affects the household is made by the household as a whole.

Non-profit institutions serving households – S15

"Non-profit institutions are legal or social institutions created to produce goods and services whose bylaws do not allow them to be a source of income, profit, or other financial gain for the units that establish, control, or finance them" (4.83 SNA 2008). In addition, these units are non-market producers and are not controlled by the government.

Financial instruments

Before defining a financial instrument, it is necessary to know what a financial asset and a liability are. A financial asset, according to the SNA, "is a store of value that generates a benefit or series of accrued benefits for its economic owner through its possession or use during a period" (10.8 SNA 2008) and also "enables value to be transferred from one accounting period to another" (10.8 SNA 2008). Similarly, a liability "is established when one unit (the debtor) is obliged, under certain circumstances, to make a payment or series of payments to another unit (the creditor)" (11.5 SNA 2008).

It should be noted that in financial accounts, the financial asset of one unit will usually be the liability of another. For example, a banknote in the hands of a person is a financial asset for that person and a liability for Banco de la República. Or when someone uses a credit card to make a purchase, for the person using the card, the value of the purchase is a liability, while for the commercial bank that allows them to use the card, it is a financial asset.

Having defined financial assets and liabilities, it is now possible to define a financial instrument. A financial instrument groups different financial assets and liabilities into similar categories.

Financial instruments are classified as follows:

Monetary gold and Special Drawing Rights (SDRs) – F1

This instrument is generally held by the monetary authorities; in Colombia, the authority is Banco de la República. Monetary gold consists of gold bullion and unallocated gold accounts with non-residents that entitle them to claim delivery of the gold. The International Monetary Fund creates SDRs to supplement its members' foreign reserves assets.

Currency and deposits – F2

Currency comprises coins, banknotes, or other means of payment issued or authorized by the monetary authority. Deposits are non-negotiable contracts open to the public that allow the placement of a variable amount of money and are generally issued by commercial banks. Savings deposits are an example of such deposits.

Debt instruments – F3

It is a negotiable instrument that represents the existence of a debt. In the Colombian economy, the main issuer of this instrument is the General Government under the name of Títulos de tesorería or TES (treasury bonds issued by the Colombian government and managed by Banco de la República).

Loans – F4

Loans are generated when a debtor receives funds from a creditor through a non-negotiable document. Commercial, consumer, or mortgage loans are examples of loans.

Equity and investment fund shares – F5

This instrument represents the owner's funds in the institutional unit that issued it. Additionally, this investment gives them a residual right over the issuer's assets in case the latter goes into liquidation. The shares issued by Ecopetrol are an example of this instrument.

Insurance, pension, and standardized guarantee schemes – F6

Some examples of this instrument include fire insurance or pensions. In the first case, upon payment of one or more premiums, the individual is entitled to receive a payment or a series of payments subject to the occurrence of an event, such as a fire. In the second case, upon contributing to the pension system, the individual is entitled to receive the pension if they meet a series of requirements, such as age and a minimum number of weeks of contributions in the Colombian case.

In technical terms, this instrument comprises one or several series of prepayments made by the holder, which entitle him/her to receive one or several series of payments subject to a contingent event.

Financial derivatives and employee stock options (ESOs) – F7

A derivative is an instrument linked to another financial instrument or commodity, also known as the underlying, and serves to negotiate the risks associated with the underlying. An ESO is a contract that allows the employee of an institution/company to purchase a certain number of shares of the same at a fixed price and within a certain period of time after the subscription of this contract.

Other accounts receivable and payable – F8

This group includes trade credit and advances and all accounts receivable or payable other than the instruments described above. Dividends payable or the accrual and non-payment of salaries, rent, or social contributions are classified in this instrument.

Table 2 shows the equivalence of the financial instruments from previous methodologies (1968 rev. III and 1993) to the current one (2008), used in this repository.

Table 2. Equivalence of the different methodologies

| SCN 1968 rev. III | SCN 1993 | SCN 2008 |

|---|---|---|

| I. Means of payment reserved to the monetary authority | F1. SDR monetary gold and Andean pesos | F1. Monetary gold and SDRs |

| II. Fiduciary currency and monetary deposits III. Non-cash deposits | F2. Legal tender and deposits | F2. Legal tender and deposits |

| IV. Short-term debt instruments V. Long-term debentures and bonds | F3. Debt securities | F3. Debt securities |

| VII. Short-term loans VIII. Long-term loans | F4. Loans | F4. Loans |

| VI. Shares and other equity investments X. Rights of owners in quasi-corporations | F5. Shares and other equity investments | F5. Equity and investment fund shares |

| IX. Mathematical reserves for life insurance and severance pay | F6. Insurance technical reserves | F6. Insurance, pension, and standardized guarantee schemes |

| F7. Financial derivatives and employee stock options | ||

| XI. Commercial loans XII. Accounts payable or receivable, paid or received in advance | F7. Other accounts receivable and payable | F8. Other accounts receivable/ payable |

Sources of information

For the preparation of the financial accounts, the financial statements of the different institutions and companies whose economic territory is Colombia are used as the main source. For this reason, the Bank receives information from institutions and companies that report mainly to the following public entities:

- Financial Superintendency of Colombia

- Superintendency of Private Corporations

- Superintendency of Health

- Superintendency of Solidary Economy

- Superintendency of Family Subsidy

- Superintendency of Public Utilities

- Office of the National Accountant

Additionally, the information contained in the financial statements is complemented by sources of information other than the financial statements, such as the proformas by the Financial Superintendency of Colombia, reciprocal transactions of the Office of the National Accountant, the annexes of the Superintendency of Private Corporations, among others.