It is the general framework under which monetary policy operates in Colombia. Banco de la República makes interest rate decisions with the intent of bringing inflation to the target and contributing to maintaining economic activity (the economy’s output) close to its potential level (the level of production when the economy operates at full capacity).

Recent installments of this Blog introduced crucial elements of monetary policy, such as the inflation target and the monetary policy interest rate. These elements are the building blocks of what is known as the target inflation framework —the general structure under which monetary policy operates in Colombia.

The target inflation framework was introduced in Colombia at the end of 1999, close to the time it was adopted by Brazil and Chile, and pursuant to the guidelines established by the central banks of New Zealand, Canada, and England, enacted in the early nineties. Since then, it has gained increasing acceptance from both markets and academia. A historical account of the target inflation framework in Colombia, prepared by Enrique López, Hernando Vargas, and Norberto Rodríguez, is available in Spanish in chapter 11 of the book Historia del Banco de la República, cien años.

The initial step in understanding this framework is to grasp its objective: to achieve an inflation target that helps maintain output growth near its potential capacity. As observed, this objective has two components; we will explain each separately and how they are connected.

The first component of the objective establishes the fulfillment of an inflation target. This statement is not just an aspirational proposal, but rather a commitment that plays a key role in the framework’s performance. Insofar as the monetary authority establishes a credible target, this becomes the inflationary anchor. The latter means inflation expectations will revolve around the target and, consequently, price adjustments introduced by economic agents —such as companies and households— based on their inflation expectations will be consistent with the target, concurrently contributing towards its fulfillment. Under these conditions, agents that implement price increases beyond the inflation target risk losing market share to competitors.

The use of an anchor is not a new idea in monetary policy. Historically, the most common nominal anchor linked the currency’s value to gold, otherwise known as the gold standard. Fixed exchange rates were also employed as anchors, coupling the local currency to a primary currency such as the US dollar or the British pound sterling. Monetary aggregates, such as total cash and bank deposits, also served as anchors, based on the impression that controlling the volume of money would enable low, stable inflation. The purpose of these anchors was to signal to the market that the monetary authority had a genuine commitment to price stability. Nonetheless, these anchors were progressively abandoned as changes in financial markets rendered them obsolete. The target inflation framework replaced the role the old anchors played in monetary policy, no longer based on the value of a particular variable but on a different logic: the credibility of the target.

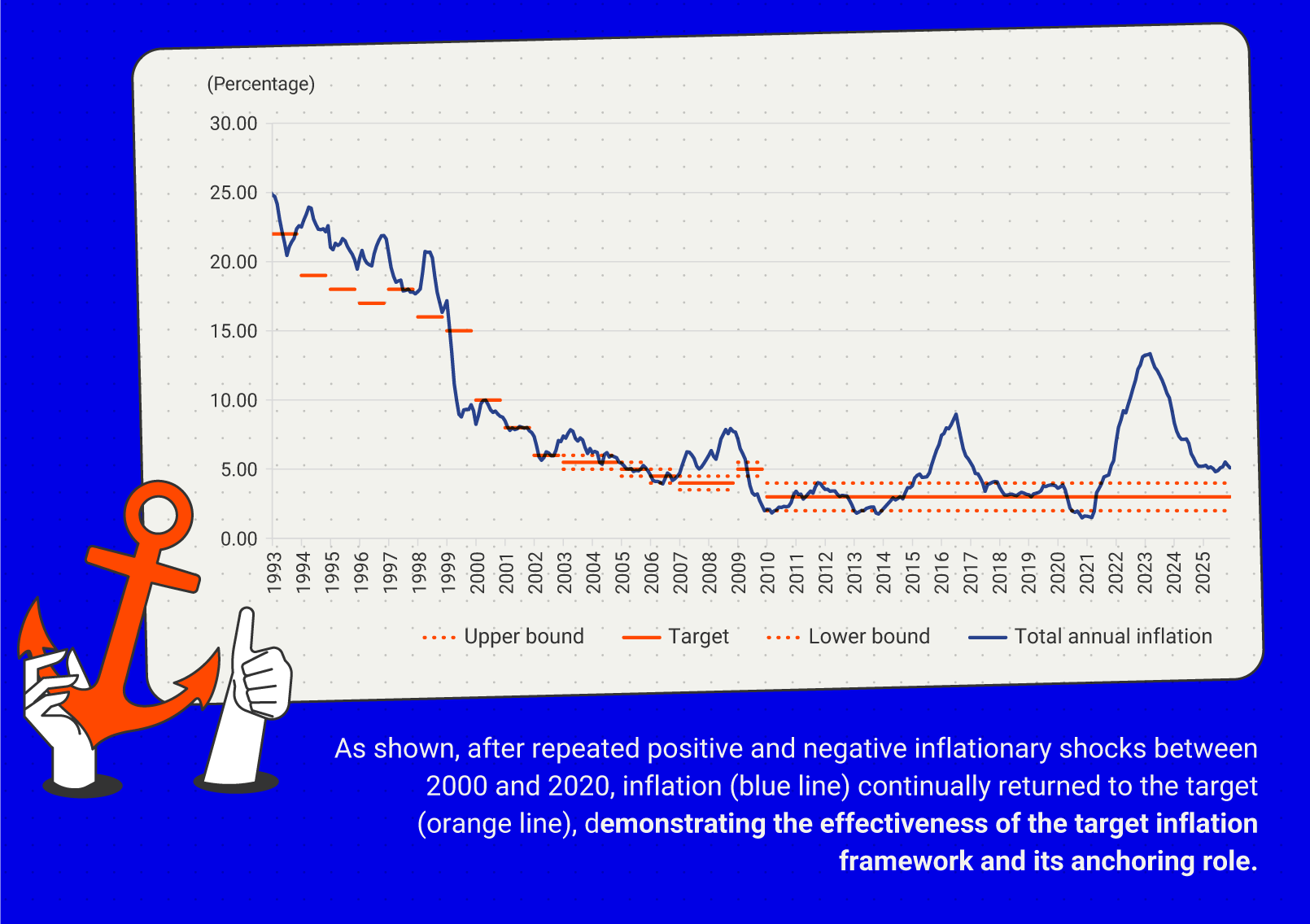

Banco de la República (the Central Bank of Colombia) began to publish inflation targets with the enactment of Law 31 of 1992. Graph 1 illustrates the progression of this target1. Although inflation targets were not met during the first few years, they helped steer annual inflation onto a downward path. With the adoption of the target inflation framework at the end of 1999, annual inflation targets were met more consistently. As shown, after repeated positive and negative inflationary shocks between 2000 and 2020, inflation continually returned to the target, demonstrating the effectiveness of the target inflation framework and its anchoring role. The current inflationary shock stands out as the most intense and prolonged since the target inflation framework began. The Board of Directors of Banco de la República maintains its commitment to restore credibility and revert inflation to the target, as has happened after previous shocks.

The second component of the target inflation framework objective seeks to maintain output growth at or near its potential capacity, which is the maximum level of production of goods and services using the available factors of production. This level of production depends on factors outside the realm of monetary policy, such as the number of workers (demographics), their educational level, capital investment, available land and technology, communications, transportation, and power generation infrastructure, among many others.

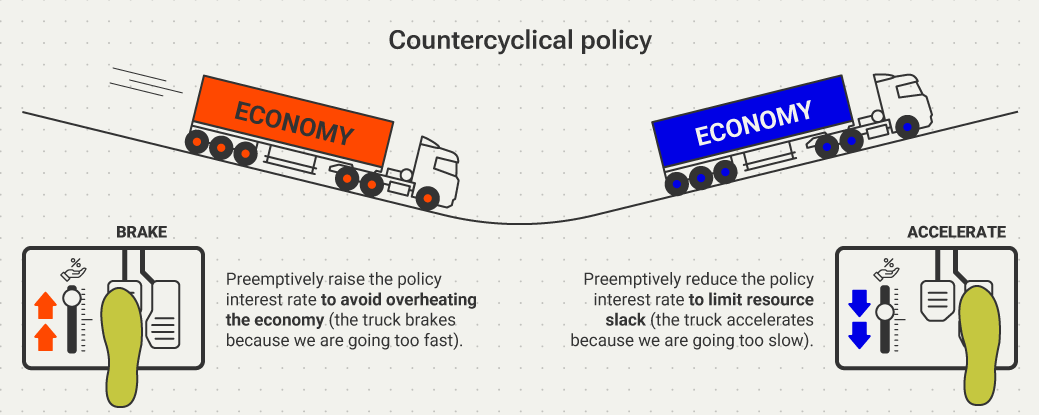

When inflation is close to the target and demand is expected to exceed what can be sustainably supplied by the economy’s productive level —thereby generating upward price pressures— the monetary authority must raise the policy interest rate to avoid overheating the economy. By doing so, it reduces excess demand, mitigates inflationary pressures, and stabilizes gross domestic product (GDP) growth, consistent with productive capacity.

Similarly, when a contraction in demand is foreseen, and output is below its potential, the monetary authority should preemptively reduce the policy interest rate to limit resource slack and support the economy’s return toward its potential level.

The above describes the countercyclical role of monetary policy under the target inflation framework. Note that this approach is consistent with avoiding deviations of inflation above or below the established target, while helping output growth remain close to its potential.

Beyond this countercyclical response to demand shocks that influence the business cycle, monetary policy under the target inflation framework also requires responding to supply or cost shocks that can affect inflation beyond changes in demand. For instance, this is the case with climatic factors that affect food prices, variations in international import prices, exchange rate fluctuations caused by international phenomena, and changes in taxes (VAT) or wages resulting from public policy decisions.

To the extent that these factors affect prices in a restrained and transitory manner, the monetary authority can anticipate and implement an effective communication strategy that explains the origins of said occurrence. However, should these shocks influence medium- and long-term inflation expectations and convert a transitory impact into a persistent one, the monetary authority must respond by raising or lowering the policy interest rate as appropriate to safeguard the credibility of the inflation target, even if the resulting action is not necessarily countercyclical.

1 ↑ The annual inflation targets are very specific. However, as of 2003, they were constrained within a range that initially was +/-0.5% and is now +/-1%. The purpose of these ranges is to accommodate supply shocks, which are generally temporary in nature. As of 2009, Banco de la República adopted 3% as its long-term annual inflation target.