The interest rate on government bonds depends on the policy interest rate set by Banco de la República for short-term, risk-free operations, on the policy rate that bond investors expect in the future, and on the risk premium they require to cover the risks of long-term operations inherent to public debt.

Since early 2024, interest rates on long-term Colombian government debt bonds, hereafter referred to as government bonds, have been increasing. This means that the government must pay more interest on its debt, so a larger share of its revenues must be allocated to cover such interest payments instead of other expenditures such as healthcare, education, security, or infrastructure. Another way of looking at this is that if these other expenditures are not reduced, the government will have to take on more debt, which, in turn, will lead to higher interest payments. Therefore, it is essential to understand which factors explain the performance of interest rates on government bonds.

The interest rate on government bonds has two main components:

The first component corresponds to the interest rate at which investors would be willing to purchase government bonds if there were no repayment risks or unexpected changes in their prices. This rate is typically associated with Banco de la República’s (the Central Bank of Colombia, BanRep) policy interest rate, which applies to very short-term loans, generally overnight. However, since government bonds have longer maturities (e.g., 2, 5, 10, or even 30 years), it is necessary to consider not only BanRep’s current policy interest rate, but also the rate at which investors expect it to be in the future. These expectations about the policy interest rate are usually closely related to expectations about inflation dynamics, since Banco de la República must respond with higher interest rates when expected inflation is higher.

The second component is the additional risk premium required by buyers of government bonds for taking risks related to public debt. This risk premium depends on several factors, one of which is the strength of the government's finances. In general, investors consider that when public debt and the gap between government expenditures and revenues (known as the fiscal deficit) are low, the government has a strong financial position. Conversely, if government debt and the fiscal deficit rise rapidly and reach high levels, investors will perceive a deterioration in the government’s finances and will demand a risk premium for purchasing riskier bonds.

In summary, the interest rate on government bonds depends on the policy interest rate set by Banco de la República for short-term, risk-free operations, on the policy rate that investors expect in the future, and on the risk premium they require to cover long-term risks inherent in public debt.

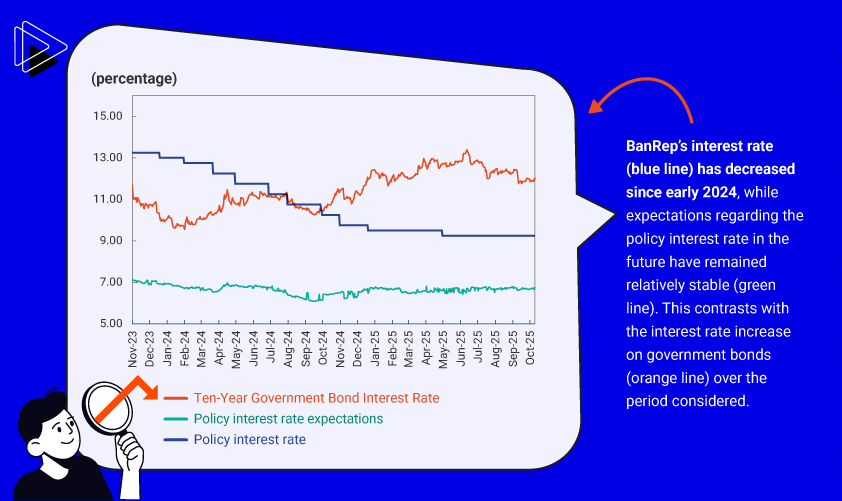

Graph 1 exhibits the performance of interest rates on 10-year government bonds, as well as BanRep’s observed and expected interest rates. As can be seen, the policy interest rate (blue line) has decreased by four percentage points, from 13.25% to 9.25%, since early 2024, which contrasts with the two-percentage-point increase in the interest rate on government bonds (orange line).

Therefore, the increase in government bond interest rates since early 2024 cannot be explained by the performance of Banco de la República’s policy interest rate, which, as noted, decreased during that period. Neither can it be explained by changes in expectations regarding the policy interest rate in the future, which remained relatively stable over the period considered, probably because medium- and long-term expected inflation also remained stable or trended downward. This is reflected in the green line in Graph 1, which measures the expected value of BanRep’s policy interest rate at each point in time.

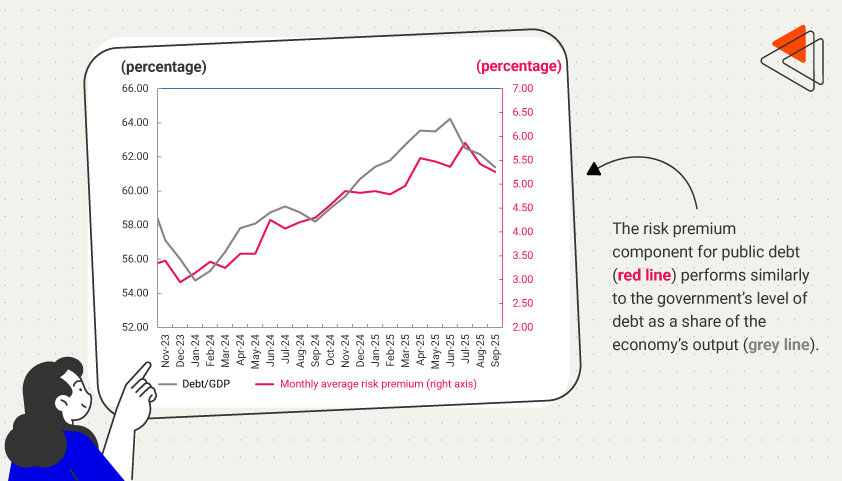

The increase in government bond interest rates shown in Graph 1 therefore reflects the risk premium component associated with public debt. This component is measured precisely by the difference between the interest rate on government bonds and policy interest rate expectations, that is, by the difference between the orange and green. This risk premium is shown by the red line in Graph 2, which, as shown, has risen considerably since early 2024, even when considering a partial reversal of that increase between July and October 2025.

As shown in Graph 2, the risk premium component for public debt (red line) performs similarly to the government’s level of debt as a share of the economy’s output (grey line). In other words, the risk premium required by investors to cover debt risk has increased in line with the deterioration of public finances, as indicated here through the government debt-to-GDP ratio.

In conclusion, the increase in government bond interest rates since early 2024 is mainly explained by the additional risk premium demanded by investors who purchase these securities to cover the risks associated with the public finances situation, and not by Banco de la República’s policy interest rate.