Report of the Board of Directors to the Congress of Colombia - July 2025

Pursuant to Article 5 of Law 31 of 1992, the Board of Directors of Banco de la República (the Central Bank of Colombia) submits a report to the Honorable Congress of Colombia, informing about the performance of the economy and its outlook. This report is submitted twice a year, in March and July, within ten business days following the start date of the sessions of the Congress.

In the first months of 2025, annual inflation halted the downward trend observed in the previous year, remaining between 5.1% and 5.3%. In June, inflation declined to 4.8% showing a slow convergence towards the 3.0% target. In this context, the Colombian economy grew by 2.7% in the first quarter. Employment increased, especially in rural areas and municipal capitals, reducing the unemployment rates. Net foreign reserves totaled USD 65,163 million as of June, and Banco de la República's (the Central Bank of Colombia) profit was COP 7,751 billion. In this scenario, the Board of Directors of the Bank maintained a prudent monetary policy stance and gradually reduced the interest rate to 9.25% to protect stability and drive inflation towards its target.

Macroeconomic Environment

- In 2025, the international economic environment has been significantly affected by the announcements from the US government to increase tariffs on its imports, including those from Colombia. This has generated economic uncertainty, trade disruptions, and has affected investment decisions globally.

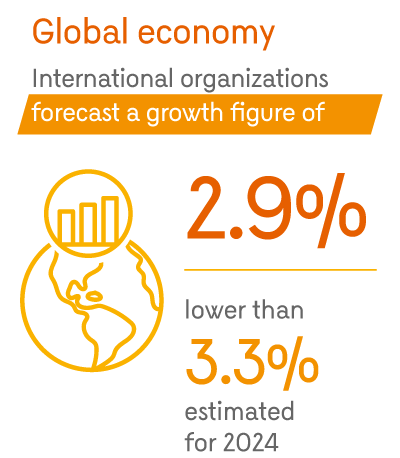

- Amid uncertainty and geopolitical tensions, global economy showed signs of deceleration in the first quarter of 2025. International organizations forecast a growth figure of 2.9% for 2025, lower than the 3.3% estimated for 2024, especially affecting the United States, Mexico, and Canada.

- So far in 2025, global inflation has persisted, with high service price levels and some increases in the prices of goods, despite restrictive monetary policies still in place in advanced economies. In Latin America, dynamics have been mixed: Colombia, Chile, and Peru have shown moderation compared to the end of 2024, while Brazil and Mexico exhibit increases and their outlook remains above their targets.

- External financial markets have experienced high volatility. In contrast to usual patterns, there have been upward pressures on US government bonds rates and a weakened dollar vis-a-vis the currencies of both developed and emerging countries, driven by fiscal and trade concerns, as well as expectations of a slowdown in the US economy.

- As of May 2025, emerging economies received net foreign portfolio investment inflows similar to those observed in the same period of 2024. However, the Organization for Economic Cooperation and Development (OECD) warns of changes in demand for risky assets and a deleveraging in financial markets, which could lead to potential capital outflows from vulnerable economies.

Economic Activity in Colombia

- The Colombian economy continued its recovery path in the first quarter of 2025, with an annual expansion of 2.7%, driven by the strengthening of domestic demand, which grew by 4.7% annually, highlighted by a 4.4% annual growth in private consumption.

- Household consumption was favored by the increase in the minimum wage, higher remittances and tourism, and high coffee prices, with notable growth in durable consumption (14.3% annually) and semi-durable consumption (9.1% annually), while public consumption grew by only 1.9% annually.

- Fixed capital investment remained stagnant due to a decline in housing and other building construction, which was not offset by growth in investment in machinery and equipment.

- In the first quarter of the year, imports rose by 12.4% annually, while exports increased by 0.7%, resulting in a negative impact of net external demand on the variation in Gross Domestic Product (GDP).

- Tertiary activities led the economic expansion, with dynamism in artistic and entertainment services, accompanied by good dynamism in primary sectors such as agriculture related to coffee and livestock.

- The latest available information suggests that the economy continued to grow at a solid pace during the second quarter. The Economic Tracking Indicator (ISE in Spanish) showed an annual growth of 2.7% in May 2025, higher than the technical staff’s forecast (2.3%) and higher than the one recorded in April (2.5%).

Employment

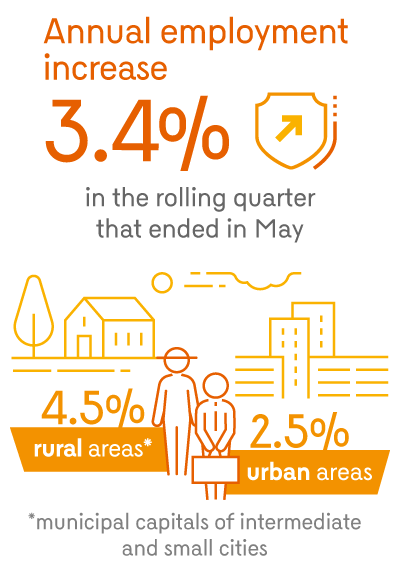

- In the context of a recovering economic activity, employment continued to grow throughout 2025.

- Employment in the national aggregate grew by 3.4% in the rolling quarter that ended in May, with the creation of 788,000 new jobs, driven by dynamism in municipal capitals of intermediate and small cities (other than the twenty-three main cities) and in rural areas (4.5%), which was higher than in urban areas (2.5%).

- As of May 2025, the non-salaried segment recorded a significant increase (5.1% annually), reaching 12.5 million employed people, while salaried employment rose by only 1.6%. The informality rate increased again, reaching 56.1% in May.

- The labor force participation rate (TGP in Spanish) remained around 66% in the twenty-three main cities but fell to around 62% in other municipalities and in rural area. The lower increase in labor supply in an environment of employment growth implied reductions in the unemployment rate.

- The national unemployment rate for the rolling quarter that ended in May fell by 1.6 percentage points (pp) to 8.9%, one of the lowest levels seen in 25 years. In the twenty-three cities, it was 9.1%, while in other municipalities and rural areas it was 8.8%.

- The unemployment rate for women fell to 11.5%, and for men to 7.0%, reducing the gender gap to 4.5 pp in May.

Inflation

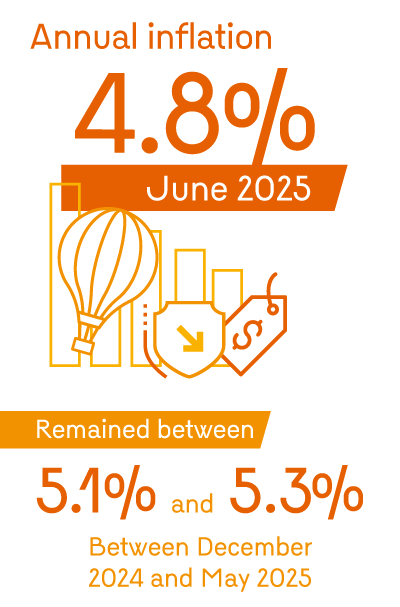

- Between December 2024 and May 2025, annual inflation remained between 5.1% and 5.3%, interrupting the downward trend of 2024 due to upward pressures on food prices and inertia in the inflation of some goods and services.

- In June, annual inflation declined to 4.8%, thanks to a moderation in the inflation of food and regulated items, to a lesser extent in services, and to a lower annual depreciation of the exchange rate.

- Core inflation (excluding food and regulated items) fell to 4.8% in June. This figure is lower than the one observed at the end of 2024 (5.2%) and the one recorded a year ago (6.0%). This decline is due to the sub-basket of services, which was led by the performance of rents, although annual adjustments remain high. Prices of goods, on the other hand, maintain annual variations below 2.0%, with limited exchange-rate pressures.

- The annual variation in food prices rose from 3.3% in December 2024 to 4.3% in June, mainly due to an increase in processed foods, which faced stronger shocks in the international prices of certain agricultural raw materials, as well as higher transportation fees, among others. In contrast, the annual variation in perishable foods declined, although less than expected.

- The annual variation in regulated items went from 7.3% to 5.5% between December 2024 and June, thanks to lower tariff increases in electricity services due to higher hydraulic generation and lower annual adjustments in fuels and regulated education. However, increases persisted in domestic gas and regulated transportation fees.

- Convergence of inflation to the target continues to face significant risks due to the uncertain global trade and financial outlook, along with the effects of the domestic fiscal imbalance that could put upward pressure on local prices.

- Geopolitical conflicts could lead to unforeseen increases in oil prices, which would increase both external and internal transportation costs, as well as items such as electricity and gas.

Monetary Policy

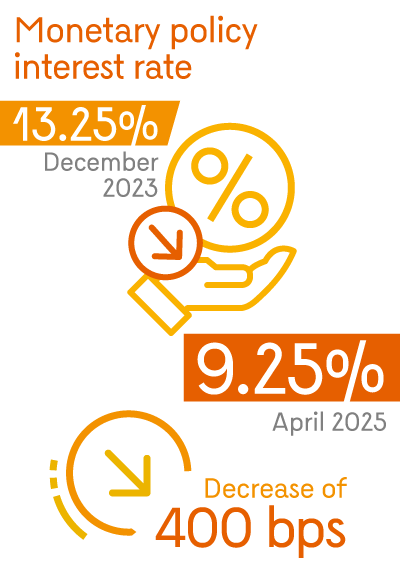

- The Board of Directors of Banco de la República (BDBR) reduced the policy rate from 13.25% at the end of 2023 to 9.5% at the end of 2024 and made a single 25-basis-point cut in April 2025, bringing it to 9.25% at the end of the first semester.

- This cautious stance responds to inflation declining more slowly than expected, remaining far from the target and above the figures observed in its Latin American peers and in many other emerging economies.

- The BDBR considers that uncertainty due to higher tariffs and global financial volatility could affect inflation and economic activity. It also warns of inflationary risks derived from the fiscal deficit this year and in the following years.

- The BDBR highlights that maintaining prudent decisions ensures that monetary policy is sustainable and avoids the need to reverse cuts, protecting the Central Bank's credibility and consistency with the inflation target.

Balance of Payments

- In the first quarter of the year, the current account recorded a deficit of 2.2% of GDP, higher than the 1.9% recorded a year ago, explained by the increase in the goods trade balance deficit and the reduction in the services surplus, although it was partially offset by higher current transfers and a decrease in the factor income deficit.

- External sales of coffee, industrial products, and non-monetary gold increased, while those of coal and oil decreased; imports of goods increased for inputs, capital goods for industry, consumer goods, and fuels. The services surplus declined due to increased imports driven by higher expenditure on travel and cargo transportation, which more than offset the increases in exports thanks to higher revenues from foreign tourists.

- Current transfers strengthened by remittances, which reached USD 3,131 million in the first quarter (USD 410 million more than a year ago) thanks to the good performance of employment in the United States and Spain.

- Lower net factor income outflows were due to reduced interest payments on external debt and higher income from Colombia's investments abroad, although the remittance of profits from firms with foreign direct investment in the financial, business, trade, and manufacturing sectors in the country increased.

- Foreign direct investment was the main source of financing with USD 3,142 million in the first quarter, lower than a year ago.

- The technical staff projects a current account deficit close to 2.5% of GDP by 2025, higher than the 1.7% deficit recorded in 2024. The widening of this imbalance would result from more dynamic domestic demand and the continued moderation of international prices for some mining goods exported by the country. This takes place in an environment of uncertainty regarding external trade policies.

Public Finance

- The General Government’s (GG) deficit stood at 5.8% of GDP in 2024, which represented an increase of 3.1 pp vis-a-vis 2023. This was explained by a deterioration in the balances of the Central National Government (CNG) (2.5 pp), the social security subsector (0.7 pp), and other central level entities (0.2 pp), which was partially offset by a 0.1 pp improvement in the balance of regional and local entities.

- The CNG’s total and primary deficit was 6.7% and 2.4% of GDP, respectively, due to a decline in total revenues of 2.2 pp of GDP, caused by lower income tax collection, external VAT plus tariffs, and dividends paid by Ecopetrol, while spending increased by 0.3 pp due to the General Participation System (GSP), social security (health and pensions), interest and personnel.

- According to the most recent Medium-Term Fiscal Framework, the CNG’s deficit is projected to reach 7.1% of GDP in 2025 due to a higher interest burden and a stable primary deficit of 2.4%, as well as a fiscal deficit of 6.2% for 2026, mainly supported by an annual increase in tax revenues that will largely depend on the approval and implementation of a tax reform.

- The CNG’s net debt would rise from 53.4% of GDP in 2023 to an all-time high of 63.0% in 2026, prompting the Supreme Council for Fiscal Policy (CONFIS in Spanish) to invoke the escape clause of the fiscal rule that allows a temporary deviation from compliance with the fiscal targets set in the fiscal rule between 2025 and 2027. At the end of the escape clause activation period, the total deficit of the CNG is expected to reach 3.1% of GDP in 2028 and 2.8% of GDP on average between 2029 and 2036.

Foreign Reserves

- As of 30 June 2025, net foreign reserves totaled USD 65,163 million (m), which represents a USD 2,682 m increase during 2025.

- So far this year, the return on the reserves excluding the foreign exchange component was 2.90% (USD 1,851 m), driven by higher interest rates, which increased investment income.

- The profitability of reserves was favored by the appreciation of investments due to the decline in short-term interest rates in the main markets where the reserves are invested, and by the appreciation of other reserve currencies against the US dollar.

- According to the IMF methodology to assess the level of reserves to cover balance of payments risks, Colombia maintains an adequate level with a 1.30 ratio in May 2025, indicating that reserves are sufficient to face extreme external scenarios.

Profits of Banco de la República

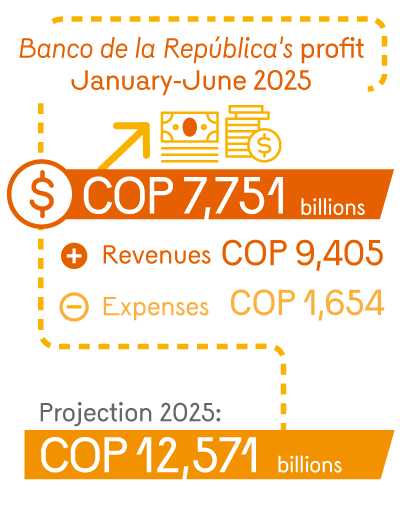

- Banco de la República's profit between January and June 2025 was COP 7,751 b, as a result of revenues for COP 9,405 b and expenses for COP 1,654 b. This profit was COP 3,663 b higher than the one recorded in the same period in 2024.

- Revenues were mainly due to the yield on foreign reserves, which recorded an annual COP 3,029 b increase (80.3%).

- For 2025, a profit of COP 12,571 b is projected, COP 2,530 b higher than the one observed in 2024, explained by the increase in net monetary income that would exceed the increase in net corporate expenses and those of the issuing bank.

Boxes

Box 1. Potential Drivers of Private Consumption

Box 3. Determinants of Sovereign Debt Interest Rates at Different Maturities