Labor Market Reports - Improved Performance of Salaried Employment and Analysis of the Colombian Labor Market in the Latin American Context

The Labor Market Report (RML in Spanish) series is a quarterly publication by the Labor Market Analysis Group (GAMLA, in Spanish) of Banco de la República (the Central Bank of Colombia), a group created in 2017. Opinions and possible errors are the author’s sole responsibility, and its contents do not compromise Banco de la República nor its Board of Directors.

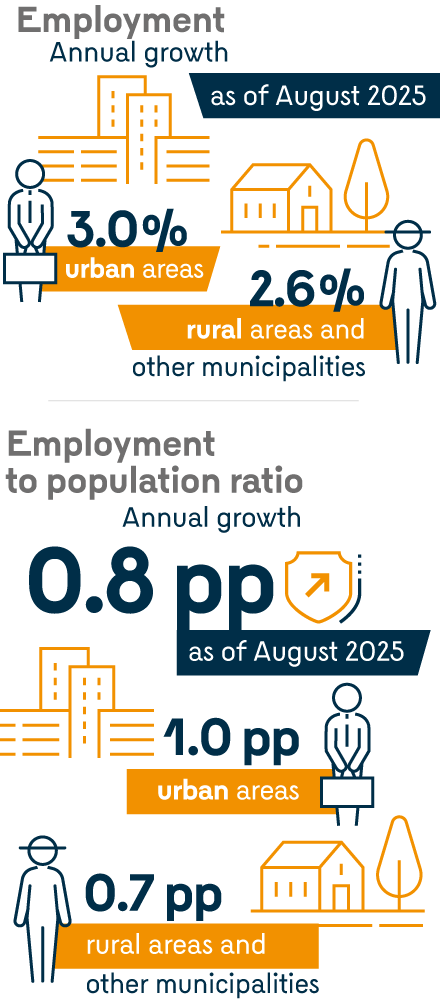

According to the Official Colombian Household Survey (GEIH by its acronym in Spanish), as of August 2025, national employment continued to grow. This employment dynamics is mainly explained by improved performance in urban areas (annual growth of 3.0%), followed by other municipalities and rural areas (annual growth of 2.6%). By type of employment, it is observed that, during the last quarter, the segment of salaried workers was more dynamic than the non-salaried segment. By economic sectors, the main contributors to employment growth were manufacturing, commerce, and accommodation.

According to the Official Colombian Household Survey (GEIH), as of August 2025, national employment continued to grow.

- This employment dynamics is mainly explained by improved performance in urban areas (annual growth of 3.0%), followed by small municipalities and rural areas (annual growth of 2.6%).

- This resulted in an annual increase in the national and urban employment to population ratio (EPR) of 0.8 percentage points (pp) and 1.0 pp, respectively, while the EPR of other municipalities and rural areas grew by 0.7 pp.

- By type of employment, it is observed that during the last quarter the salaried segment was more dynamic than the non-salaried segment, with annual growth rates of 4.3% and 1.4%, respectively.

- By economic sector, the main contributors to employment growth were manufacturing, commerce, and accommodation, in contrast with the lower dynamism observed in the primary sector.

- Consistent with the stronger performance of salaried employment, other sources of information on salaried and formal employment, such as administrative records from the social security system, showed a positive variation as of July. This has led to an annual correction in the informality rate (IR) of -0.8 pp, standing at 55.3% in the national aggregate as of August.

- Other sources of labor demand, such as vacancy indexes from the Public Employment Service (SPE in Spanish), “job wanted” ads, and the GEIH new hires, showed improvements in the last quarter. Meanwhile, the balance of short- and medium-term hiring expectations also remains positive.

- On the labor supply side, the overall labor force participation rate (TGP in Spanish) remained relatively stable, at 64.1% and 65.9% for the national aggregate and the urban domain, respectively.

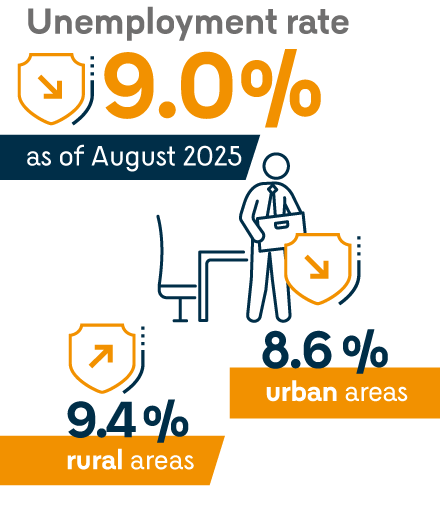

- Stability in labor force participation and employment growth have allowed the unemployment rate (UR) to continue declining, standing at 9.0% and 8.6% as of August for the national and urban domains, respectively.

- On the other hand, the weaker dynamics observed in small municipalities and rural areas are reflected in a moderate increase in the UR in that domain during the last quarter, reaching 9.4%.

- Finally, the combination of higher labor demand, reflected in vacancy indexes, and lower unemployment rates continues to suggest a tight labor market, positioned in the upper-left segment of the Beveridge curve (BC).

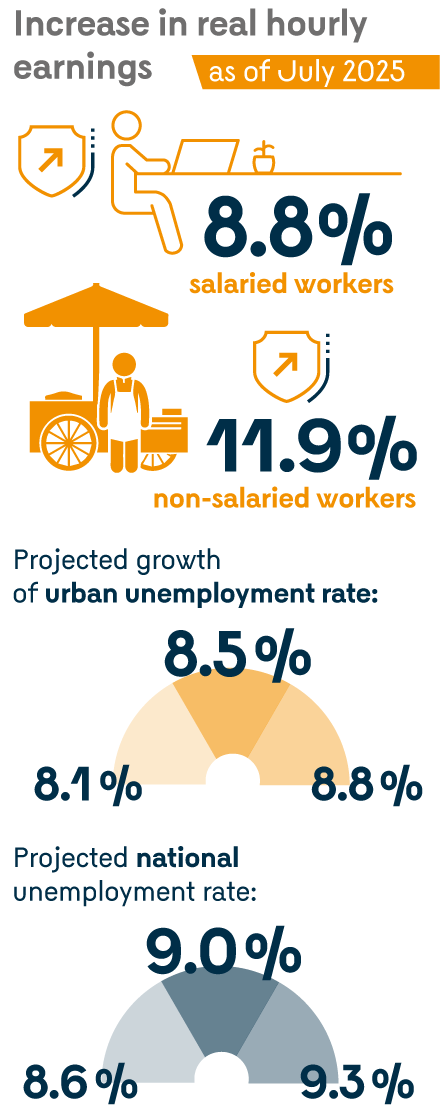

- This is consistent with the dynamics of real hourly earnings, which as of July continued to grow by 8.8% for salaried workers and 11.9% for non-salaried workers.

- In line with this and considering the growth forecasts by the Central Bank’s Monetary Policy and Economic Information Office (SGPMIE in Spanish), as reported in the October 2025 Monetary Policy Report (MPR), the average urban unemployment rate is expected to range between 8.1% and 8.8%, with 8.5% as the most likely value.

- In turn, the UR in the national aggregate is projected to range between 8.6% and 9.3%, with 9.0% as the most likely value.

- Additionally, given the forecast for the non-accelerating inflation rate of unemployment (NAIRU) at 10.2%, a more negative gap (-1.7 pp) is estimated compared to the one projected in the previous report. These forecasts indicate the persistence of inflationary pressures stemming from the labor market in the near future.