Labor Market Reports - Employment Growth led by Rural Areas and Labor Participation Dynamics

The Labor Market Report (RML in Spanish) series is a quarterly publication by the Labor Market Analysis Group (GAMLA, in Spanish) of Banco de la República (the Central Bank of Colombia), a group created in 2017. Opinions and possible errors are the author’s sole responsibility, and its contents do not compromise Banco de la República nor its Board of Directors.

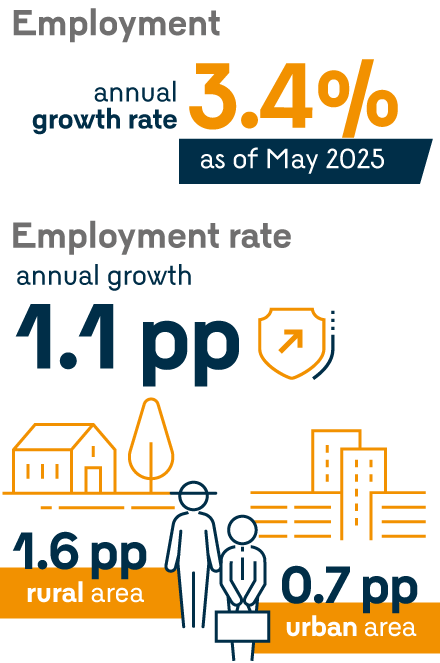

According to the official Colombian Household Survey (GEIH by its acronym in Spanish), national employment grew by 3.4% annually in May, driven by stronger expansion in small municipalities and rural areas (4.5%), while urban employment grew at a moderate annual 2.5% rate. The economic sectors that contributed most to the annual employment dynamics were commerce and accommodation, transportation and communications, and the agricultural sector.

- National employment grew by 3.4% annually, driven by greater growth in other municipalities and rural areas (4.5%), while urban employment grew at a moderate rate of 2.5% annually.

- As a result, the national employment to population ratio (EPR) grew by 1.1 percentage points (pp) annually, driven by a 1.6 pp increase in the rural EPR, while the urban EPR increased at a moderate rate of 0.7 pp.

- By occupational status, in line with the higher dynamism in the rural sector, the best performing sector is non-salaried employment, which grew at an annual rate of 5.1%, mainly explained by self-employment (2.6%).

- Salaried employment grew at a more moderate rate of 1.6%.

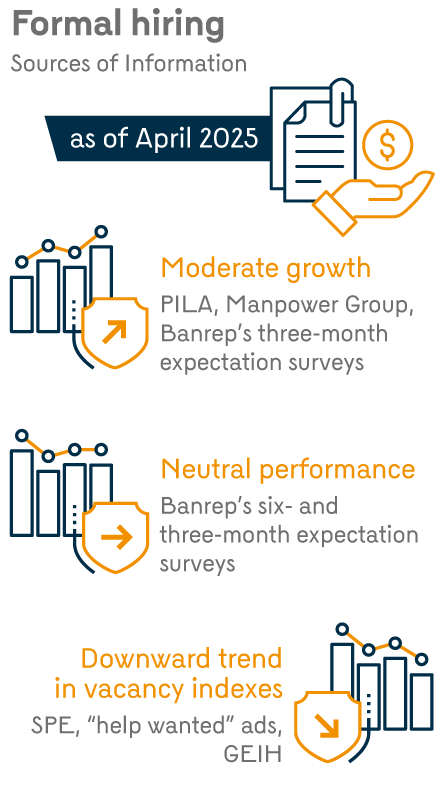

- In line with the slower growth of salaried employment, other formal information sources, such as contributions of salaried workers in the social security administrative records (PILA by its acronym in Spanish), show moderate growth in formal hiring as of April.

- Other formal labor demand indicators, such as the vacancy indexes of the Public Employment Service (SPE in Spanish), the “help wanted” ads index, and GEIH index continue their downward trend, converging to pre-pandemic levels.

- Similarly, Banco de la República’s (the Central of Colombia) six- and twelve-month expectation surveys are neutral, while Manpower Group's short-term (three-month) surveys, although still positive, remain at moderate levels.

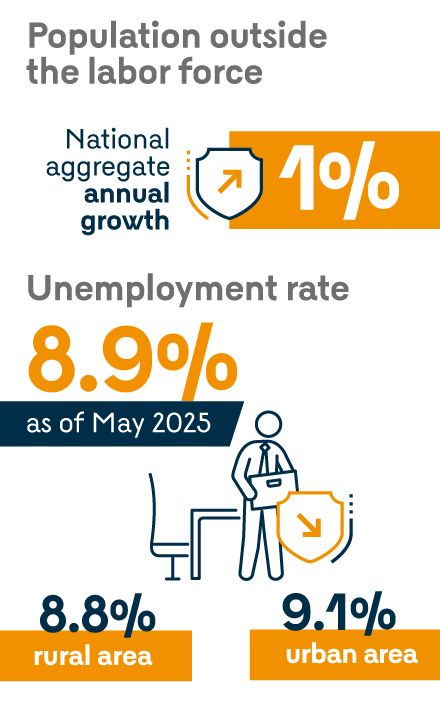

- The population outside the labor force showed an annual 1.0% growth in the national aggregate, explained by a 2.3% increase in urban areas.

- As a result, the labor force participation rate (LFPR) for the national aggregate remained stable (0.1 pp), while the urban LFPR fell by 0.3 pp annually.

- This has allowed the unemployment rate (UR) to continue falling despite slower urban employment growth. Thus, as of May, the urban UR fell by 1.5 pp annually, reaching 9.1%.

- Similarly, the national and rural UR fell by slightly more than 1.6 pp and stood at historically low levels of 8.9% and 8.8%, respectively.

- Despite the convergence of unemployment rates across regions, some capital cities exhibit significantly higher-than-average unemployment rates, such as Quibdó (30%), Riohacha (15.3%), and Ibagué (13.1%). In turn, the cities with the lowest unemployment rates are Bucaramanga (7.7%), Villavicencio (7.9%), and Medellín (8.0%).

- Despite the slowdown in labor demand evidenced by vacancy indexes, the continued decline in the unemployment rate shows that the labor market remains tight.

- This is reflected in the Beveridge curve (BC), which plots the relationship between the vacancy index and the unemployment rate.

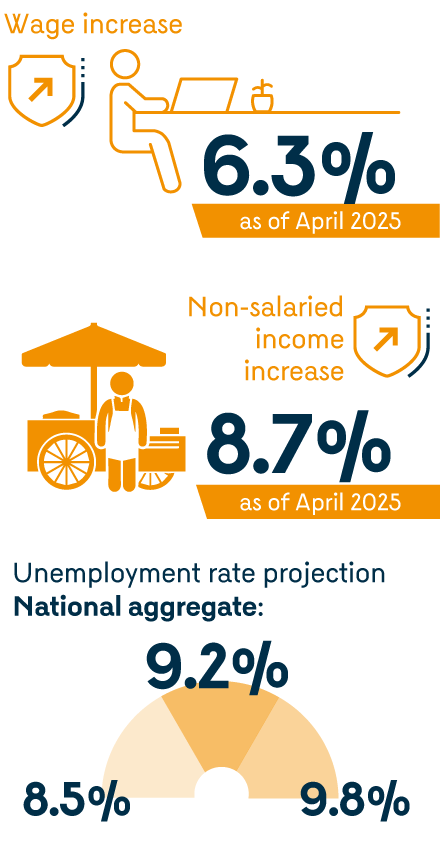

- This is in line with the increase in wages, which recorded a real growth of 6.3% as of April, and with the real income growth of non-salaried workers of 8.7%, the latter largely explained by higher labor income observed in the agricultural sector.

- In line with this and considering growth forecasts by Banrep's Monetary Policy and Economic Information Office (SGPMIE in Spanish), as stated in the Monetary Policy Report (MPR, July 2025), the urban UR is expected to average between 8.5% and 9.8%, with 9.1% as the most likely value.

- In turn, the UR of the national aggregate would stand between 8.5% and 9.8%, with 9.2% as the most likely value.

- Given the forecasted non-accelerating unemployment rate (Nairu) of 10.2%, the UR gap is estimated at -1.1 pp, which would be similar to that of the previous Report, indicating that inflationary pressures from the labor market will persist in the near future.

Históricos del Reporte de Mercado Laboral (disponible desde abril de 2017)

2020

2019