The Colombian peso has exhibited a volatile behavior and a significant depreciation in recent months. In view of this trend, the question arises as to whether an intervention by Banco de la República (the Central Bank of Colombia) in the foreign exchange market to stabilize the currency would be desirable.

During 2022 and especially since June, the Colombian peso has been volatile and has showed a significant depreciation. This behavior is explained by external and domestic factors. Among the external ones, the global trend towards dollar appreciation as a result of interest rate increases by the United States Federal Reserve (FED) has played an important role. Domestic factors include uncertainty regarding local economic policy in a context of large external and public deficits.

Faced with a trend such as the one observed in recent months, in which the depreciation of the Colombian peso has been greater than that experienced by other economies in the region and several emerging countries, the question arises as to whether an intervention by Banco de la República in the foreign exchange market to try to stabilize the currency would be desirable, or whether it would be preferable to maintain a high degree of exchange rate flexibility.

Answering this question requires clarity on three key aspects of the foreign exchange market. The first is to understand the reasons why the Colombian peso has depreciated relatively more than the currencies of other emerging economies, which have also been affected by the strengthening of the dollar, but to a lesser extent. The second aspect is to understand the benefits of exchange rate flexibility to absorb external shocks and allow monetary policy to operate correctly. Finally, it is necessary to discuss the effectiveness of foreign exchange intervention in containing and/or reversing the Colombian peso’s depreciation trend in the long term, and the dilemmas that this policy creates.

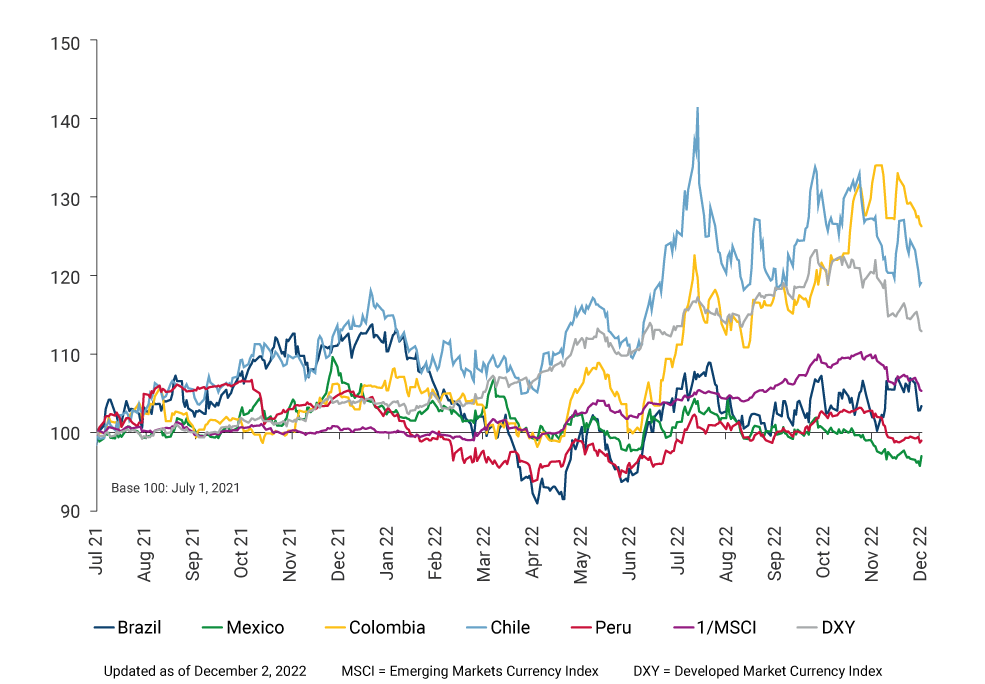

Regarding the first item, Figure 1 shows the evolution of the exchange rate of the Colombian peso vis-a-vis the dollar compared to the currencies of countries in the region and those of emerging and developed economies. As may be observed, the marked depreciation trend since June has placed the Colombian peso as the most depreciated currency in the comparison sample in recent months. This behavior goes beyond the global appreciation of the US dollar, which has also affected other economies, and is due to idiosyncratic factors specific to the Colombian economy. These factors are probably related to the uncertainty about economic policy in the context of large external and public deficits and are the ones that increase the country's vulnerability to external shocks. The weakening trend of the Colombian peso has been reversing since the middle of November due to the expected moderation of the FED’s monetary policy and the approval of the tax reform, among other factors.

Figure 1. Exchange Rate Behavior of Latin American, Other Emerging and Developed Countries

As for exchange rate flexibility, after more than two decades of experience, it has been proven that it is a desirable system for the Colombian economy for multiple reasons. On the one hand, exchange rate flexibility softens the impact of movements in the terms of trade, whose effects on economic activity and employment are cushioned by the subsequent nominal appreciation or depreciation. On the other hand, by avoiding a conflict of objectives, exchange rate flexibility confers greater autonomy to monetary policy, allowing it to gain credibility and carry out a countercyclical policy. In addition, to the extent that it induces agents to internalize and limit their exposure to currency risk, exchange rate flexibility discourages the emergence of currency mismatches that represent a risk to the country's financial stability. Likewise, the volatility that accompanies exchange rate flexibility provides incentives for the development of the hedging strategy and sends timely signals on the state of the economy that promote its real and financial adjustment in the face of external shocks. Exchange rate flexibility also moderates capital outflows in times of high external and internal uncertainty.

Finally, the abundant research done at Banco de la República on the effectiveness of foreign exchange intervention has shown that its ability to affect the level of the exchange rate is uncertain and, when detected, it has a short duration. Thus, a foreign exchange intervention is unlikely to contribute significantly to alleviate exchange rate and inflationary pressures that may occur in circumstances such as those observed in recent months. In contrast, intervention would imply the sacrifice of foreign reserves, which contribute to maintaining confidence in the country in international markets.

In other episodes of strong illiquidity and deficient functioning of the foreign exchange market such as the one observed in 2020 during the first months of the pandemic, Banco de la República intervened with derivative instruments that did not imply loss of foreign reserves and contributed to restore the adequate operation of the market. However, the foreign exchange dollar markets and the hedging strategy have functioned adequately in recent times, therefore, an intervention of this type has not been considered necessary.

For all these reasons, there have been no net benefits from intervening in the foreign exchange market to moderate Colombian peso depreciation or exchange rate volatility.