Financial Infrastructure and Payment Instruments Report 2025

In 2024, Colombia’s financial infrastructure provided its services adequately, supporting the normal operation of the payment system and financial market transactions, and contributing to the preservation of financial stability.

Financial Infrastructure in Colombia

Payment Infrastructure in Financial Markets

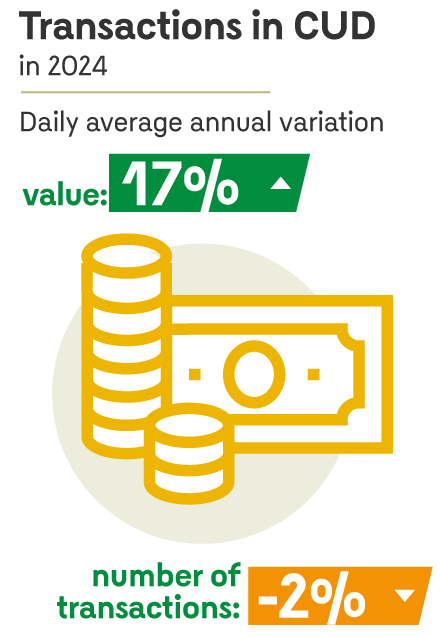

- In 2024, Banco de la República’s (the Central Bank of Colombia) large-value payment system (Deposit Accounts System, CUD by its Spanish acronym) exhibited greater dynamism. The average daily value of settled transactions increased by 17% vis-a-vis the previous year, despite a slight 2.0% decline in the volume of transactions. This outcome reflected shifts in money market liquidity conditions, which stimulated the sell/buy back transactions market and raised the usage of the Bank's liquidity absorption facility.

- Consistent with developments in the CUD, both the Central Counterparty Risk of Colombia (CRCC) and the fixed-income securities settled through the Central Securities Depository (DCV) also registered increased dynamism. Transactions cleared by the CRCC grew by 15% driven by expansion in fixed-income and equity segments, along with greater use of products linked to the Representative Market Exchange Rate (TRM), including futures, NDFs, and options. By contrast, activity in the DCV decreased slightly, reflecting reduced services provided to Banco de la República (open market operations and liquidity supply to the large-value payment system), despite higher volumes of spot and fixed-income sell/buy back transactions.

- La The recent modification of reserve requirements by the Central Bank reduced balances in the large-value payment system, without impairing its safe and efficient functioning.

- Cyber risk remains a key challenge, requiring Financial Market Infrastructures (FMIs) to strengthen governance, anticipate emerging threats, and continuously enhance their response capabilities.

Retail-Value Payment Infrastructures

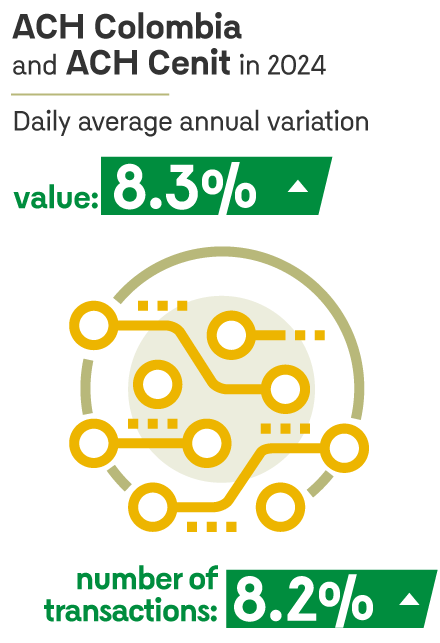

- In 2024, Colombia’s Automated Clearing Houses (ACH Colombia and ACH Cenit) recorded an 8.3% annual increase in transaction value and an 8.2% rise in transaction volume.

- Retail-value payment systems responsible for clearing and settling debit and credit card payments expanded by 7.9% in value and 15.1% in volume.

Payment Instruments

- Wire transfers remained the most representative payment instrument in the retail market. They are characterized by a large number of low-value transactions initiated by individuals, alongside a smaller volume of high-value transfers by companies.

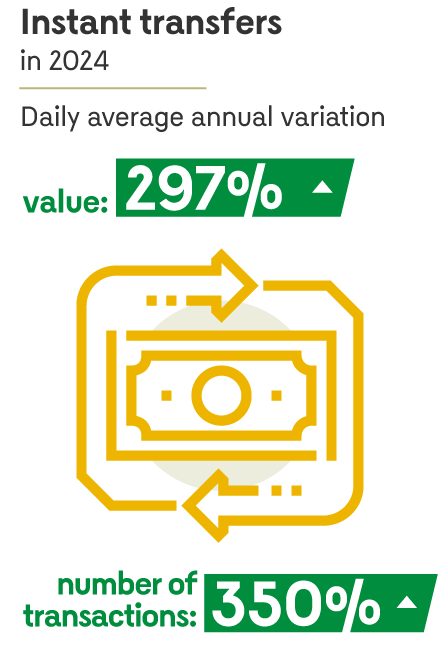

- Instant transfers continued their rapid expansion, marked by the immediate availability of funds to recipients. Compared to the previous year, transaction numbers increased by nearly 350%, while transaction values grew by 297%.

- Although cash as a means of payment has increased recently, its use as a payment instrument has declined steadily over the past decade. Nonetheless, cash remains the predominant method for everyday transactions.

- Cash is most frequently used by individuals with lower educational attainment, those engaged in domestic work, elderly adults, and lower-income groups.

Trends and Innovations in Payments

- The adoption of emerging technologies, such as tokenization, offers new opportunities for financial market infrastructures but also introduces risks and operational challenges.

- Colombia’s fintech ecosystem has rapidly expanded and diversified, reshaping the provision of financial services and creating both opportunities and challenges for the traditional financial sector.

- International regulatory approaches to digital assets are increasingly moving toward their integration within the perimeter of traditional financial regulation, aiming to mitigate risks while fostering innovation.

Boxes

Box 1: Bank Reserves and their Relationship to the Large-Value Payment System

Box 2: Access Channel Performance in the Payment Process: Trends in Digital and In-Person Use

In Focus

In Focus 2: Current Status of International Digital Asset Regulation