The Adjustment of the Colombian Economy and the Dynamics of the External Sector - Report By the Governor of the Central Bank of Colombia

| Download full report | Dynamic Version | Versión dinámica |

| EXECUTIVE SUMMARY |

|

The fall in the price of oil since the middle of 2014 generated significant macroeconomic imbalances and reduced the long-term growth of the Colombian economy. The scope and duration of these effects can be explained by the multiple links of the oil activity with the other economic sectors of the country, and by the nature of the shock, i.e., not anticipated, of considerable magnitude, and persistent in time. The oil shock resulted in a sharp deterioration in the terms of trade that contracted the country’s external revenues and those of neighboring economies, and generated a widening of the current account deficit. Similarly, it reduced government resources, inducing an increase in the fiscal deficit. With these imbalances, the shock shifted economic production to a lower level, given its negative impact on aggregate demand and on the production system. This, together with the lower accumulation of capital that took place since mid-2015, affected the potential growth of the economy, which is estimated to have fallen from 4.5% on a yearly basis to a current range between 3.0% and 3.5%. |

| 1. Exports of Goods | Exports of Goods | Exports of Services | Annex |

|

|

|

|

|

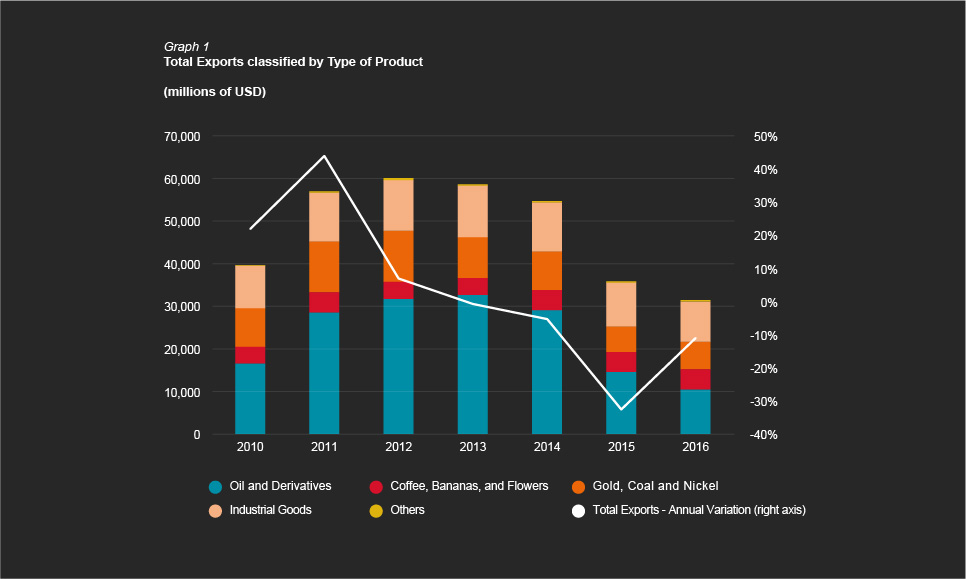

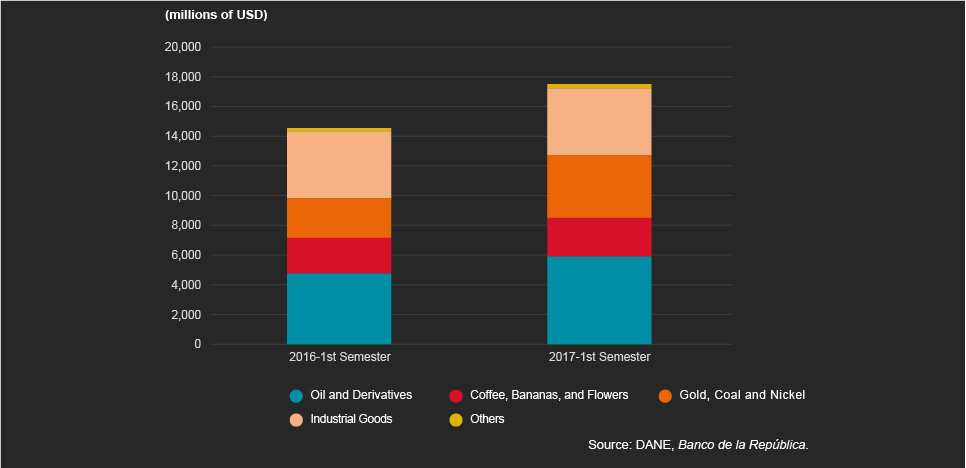

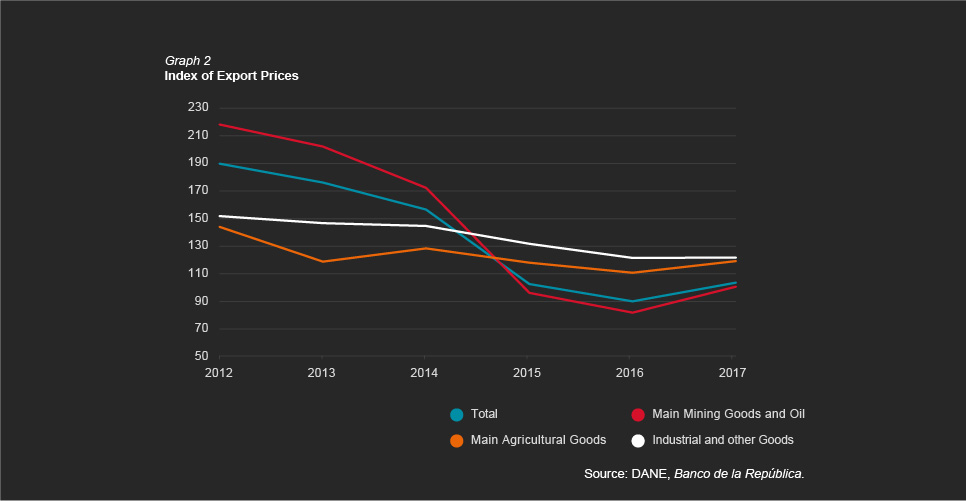

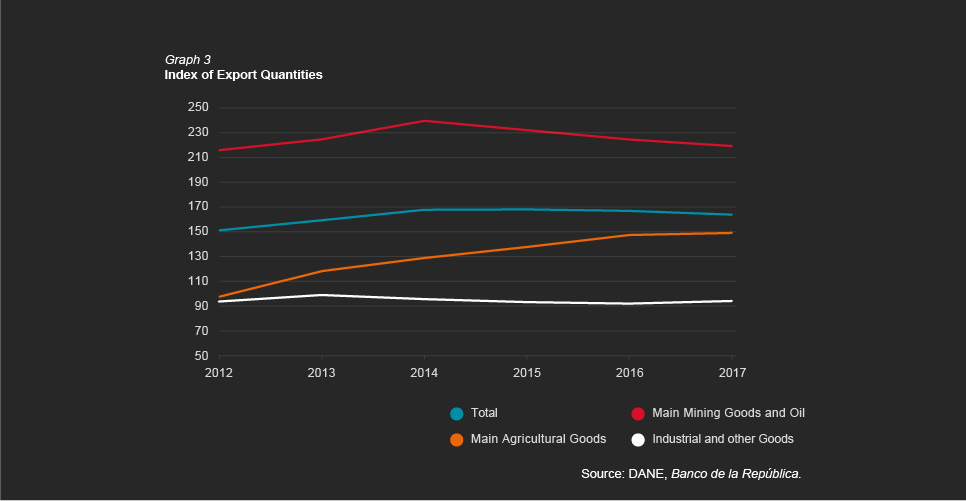

Natural resources, gold, and ferronickel play a central role in Colombian exports; therefore, it is still essential to take advantage of the country's mining potential, and to exploit strategic resources that can be inserted in the global value chains of goods with high technological content. In the first half of 2017, external sales of oil and its derivatives increased at an annual rate of 24.2% (Graph 1), due to the recovery of their international prices (Graph 2), as a response to a rebalancing of the global oil market that managed to offset the reduction in the quantities released. Additionally, the export value of coal increased 55% due to better international prices and greater quantities sold. As a result, during the first half of 2017, total exports exhibited a significant recovery, increasing at an annual rate of 20% (USD $2,963 m).

|

|

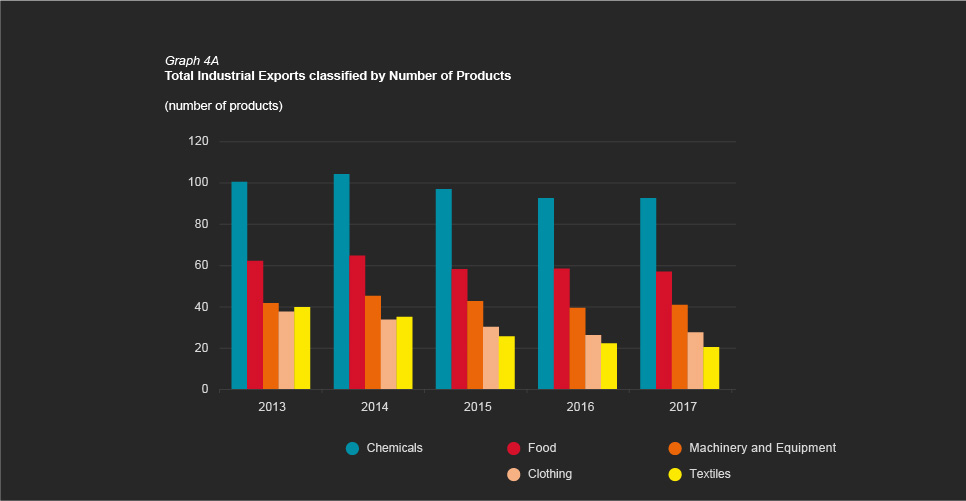

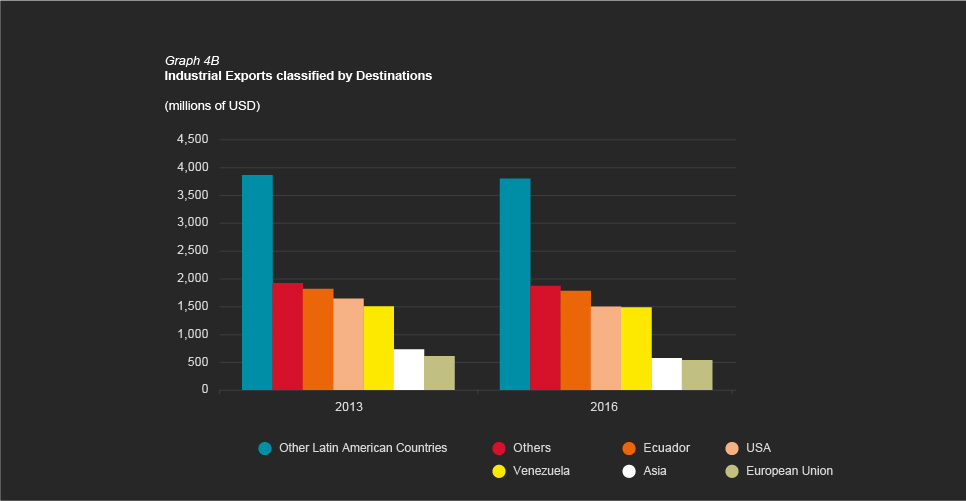

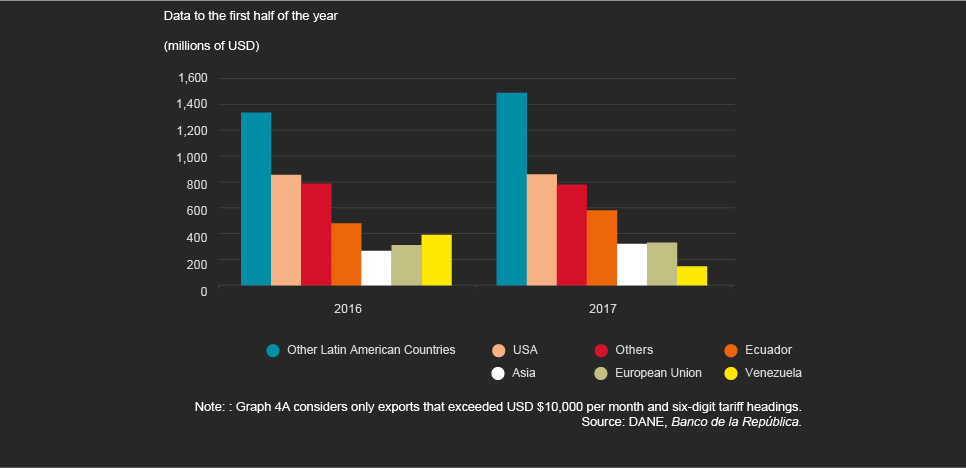

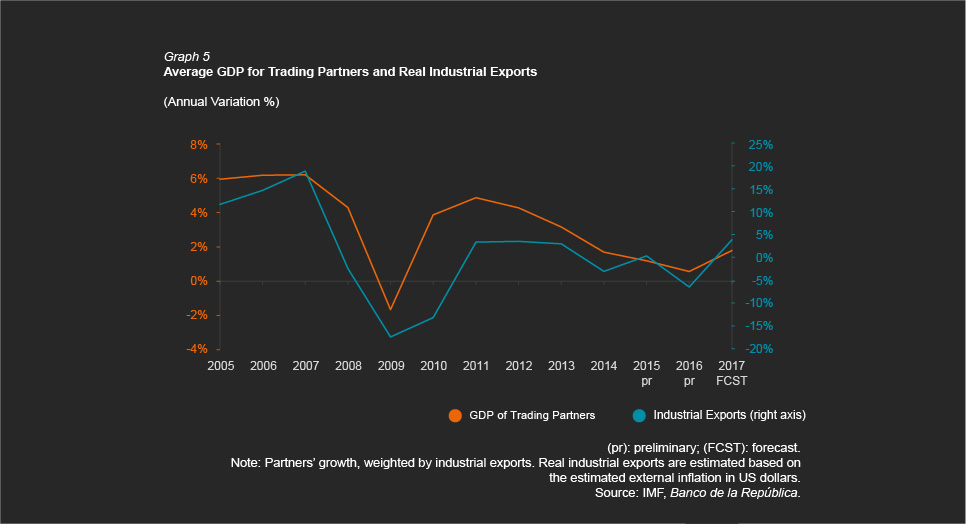

Several factors are associated with the poor export performance of manufactured goods in recent years. On the one hand, the weakening of external demand, measured as the economic growth of the country's trading partners. After the crisis in 2009, the average GDP of Colombia’s partners increased by nearly 5.0% in 2011, and later began to show a decreasing trend, which continued until 2016, when it reached 0.5%. This behavior was explained both by the low growth of developed countries (mainly the United States and European countries), as well as by the economic slowdown of our Latin American partners, particularly Venezuela (Graph 5), several of which are buyers of Colombian manufacturing exports. As long as external demand recovers, industrial exports should record a higher growth in 2017 and 2018. |

|

Another factor that prevents a better performance of industrial exports is the high cost of doing business in Colombia. Non-tariff barriers have increased gradually over the past two decades, and tariffs (mainly on agriculture) are excessively high, increasing the cost of imported inputs and capital goods, and causing domestic production and the export supply to become more expensive. Between 1999 and 2012, the cost of transporting goods to Colombia once they are embarked in a foreign port ranged between 35% and 52% of their FOB value, reaching 36% in 2012. Close to 70% of this total cost originated in non-tariff barriers (internal transport, port operation, and prior procedures, among others), and the remaining amount is caused by international transportation costs and high tariffs in Colombia.

|

| 2. Exports of Services and other Current Income | Exports of Goods | Exports of Services | Annex |

|

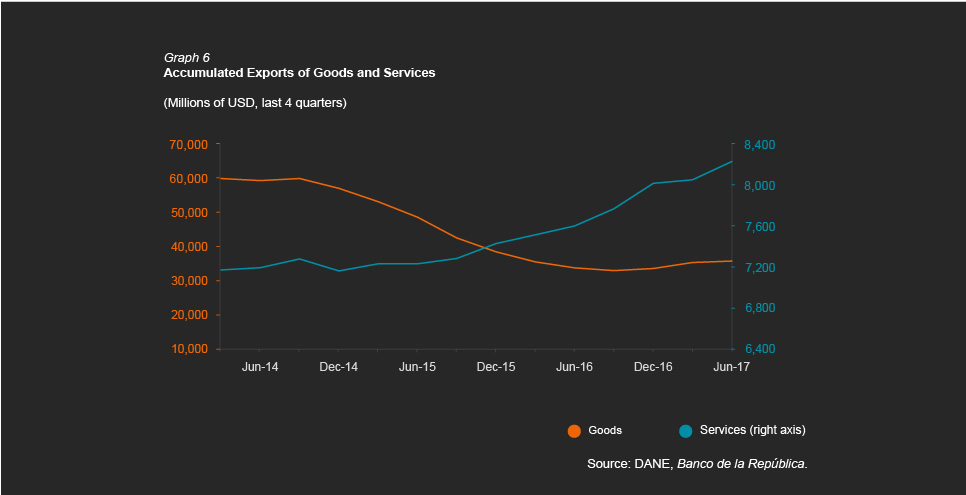

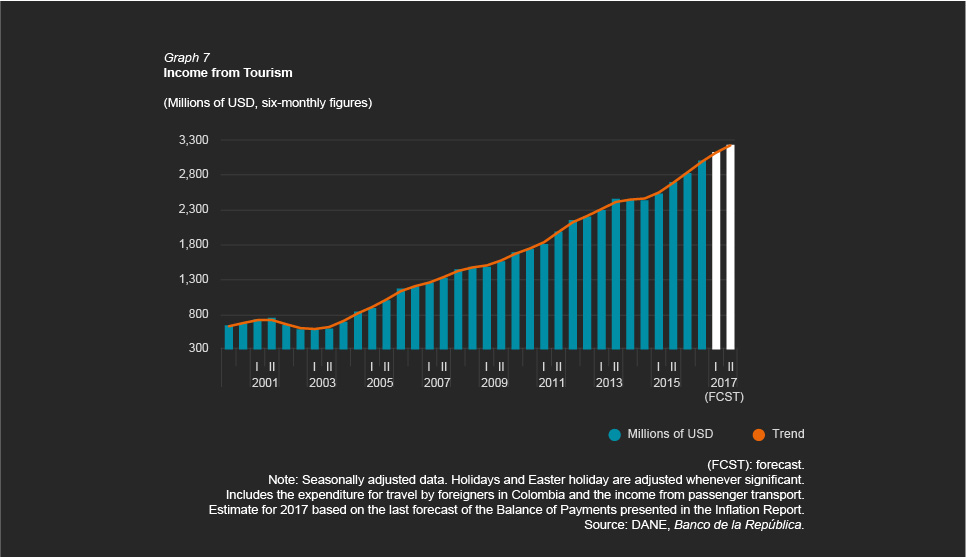

Exports of services have registered a positive variation in recent years (Graph 6), driven mainly by the recovery of the activities linked to tourism and business services. Indeed, between 2013 and 2016, total exports of services increased 14%, moving from USD $7,022 m to USD $8,007 m. These dynamics are largely explained by tourism revenues, which increased 23% in that period and was equivalent to 73% of total services exported in 2016 (vis-à-vis 68% in 2013), exceeding the value of exports of traditional goods such as coal, gold, coffee, and flowers (Graph 7). All of them have benefited from the accumulated depreciation of the peso and a better perception of security conditions in the country.

|

|

These dynamics are expected to continue in 2017 and in the following years. As a matter of fact, in the first half of 2017, revenues from travel increased 4.0% annually, and those from business services 17%. These figures underscore the country's potential as a supplier of services, as well as the need to develop the required infrastructure and logistics, and to improve our human capital (for example, encouraging bilingualism) in the sector. |