Monetary Policy Report - July 2025

The Monetary Policy Report presents the Bank's technical staff's analysis of the economy and the inflationary situation and its medium and long-term outlook. Based on it, it makes a recommendation to the Board of Directors on the monetary policy stance. This report is published on the second business day following the Board of Directors' meetings in January, April, July, and October.

In June, inflation decreased after several months of stability, but it remains significantly above the 3% target. Economic activity continues to show dynamism, driven by household consumption. Employment has also remained strong, and the unemployment rate is low. The uncertainty of the international context has reduced, but risks associated with trade and geopolitical conflicts remain. In this context, the Board of Directors maintains a cautious approach to monetary policy, consistent with the aim of guiding inflation toward the 3% target over the next two years and with supporting the gradual recovery of economic growth.

Inflation increased more than the Bank anticipated during the second quarter of the year. However, with a cautious monetary policy and no significant increases in labor costs, prices are projected to rise at a slower pace, closer to the 3% target, in 2026 and 2027.

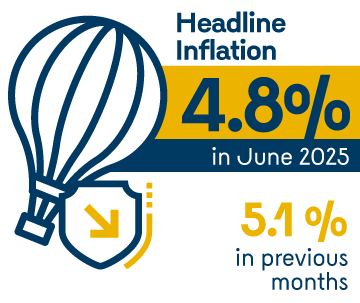

- After remaining stable at 5.1% in previous months, inflation decreased in June to 4.8%.

- The accumulated effects of monetary policy, the recent reduction in electricity tariffs, a lower exchange rate, and an increased food supply contributed to the reduction in inflation.

- However, the reduction in inflation was less than anticipated three months ago due to higher-than-expected increases in food prices, service basket prices, and international prices of some goods.

- With prudent monetary policy and no significant increases in labor costs, inflation is expected to continue decreasing gradually and reach the 3% target over the next two years.

- However, some persistent risks could slow the reduction in inflation, including substantial increases in labor costs, significant increases in gas tariffs, and the future evolution of the exchange rate, all within a context of deteriorating local public finances and high international uncertainty.

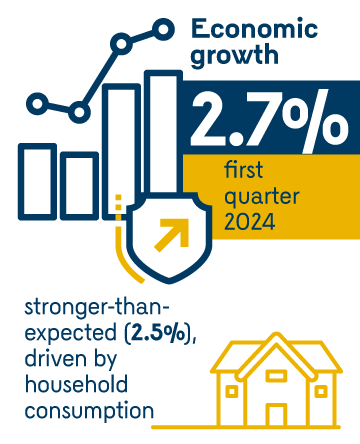

Economic activity continues to gain traction, driven by the strong increase in household consumption, good employment performance, and a lower expected impact of global trade and geopolitical conflicts.

- In the first quarter of 2025, economic growth was 2.7%, stronger-than-expected (2.5%), mainly driven by household consumption. This momentum was partially offset by a weakened investment in construction and a decline in mining and oil activities.

- The good performance of household consumption occurred in a context marked by robust remittance inflows, higher incomes from coffee activities, reduced household financial burdens, and a significant increase in the minimum wage. The strength of consumption was reflected in a significant increase in imports.

- Employment has grown, especially in rural areas and self-employment. The unemployment rate remained at historically low levels.

- The Colombian economy is expected to continue gaining dynamism, in a context of high prices for some exported products, such as coffee, strong foreign tourism, a gradual recovery of credit, and lower negative impacts from trade and geopolitical conflicts.

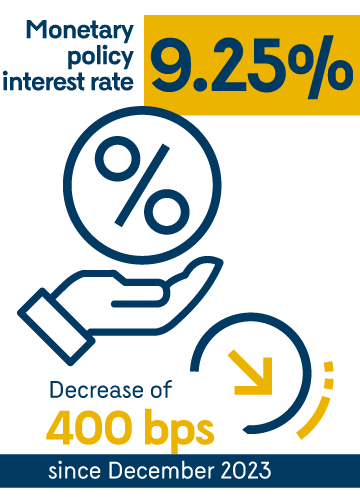

The Board of Directors of Banco de la República (JDBR continues to adopt a cautious approach to monetary policy, consistent with the aim of guiding inflation toward the 3% target over the next two years and supporting a sustainable recovery in economic activity.

- In June and July, the Board of Directors kept the monetary policy interest rate unchanged at 9.25%.

- Although inflation has decreased, it is projected to fall more slowly than anticipated and face significant upward risks going forward. At the same time, economic growth is expected to continue consolidating gradually.

- In this context, a cautious monetary policy is considered appropriate for inflation to continue decreasing and reach 3% over the next two years.

Monetary Policy Presentation (only in Spanish)

Presentation of the Monetary Policy Report by Hernando Vargas, Deputy Technical Governor of Banco de la República

Box Index

Box 1. Adjusting long-term growth forecasting models to address Colombia’s demographic shifts

Ospina-Tejeiro, Juan José; Pulido-Pescador, José David