Monetary Policy Report - January 2023

The Monetary Policy Report presents the Bank's technical staff's analysis of the economy and the inflationary situation and its medium and long-term outlook. Based on it, it makes a recommendation to the Board of Directors on the monetary policy stance. This report is published on the second business day following the Board of Directors' meetings in January, April, July, and October.

The document, which is used for the technical staff´s monetary policy recommendation, will be published on the working day after the meeting of the BDBR in January, April, July, and October.

1. Macroeconomic Summary

In December, headline inflation (13.1%) and the average of the core inflation measures (10.3%) continued to trend upward, posting higher rates than those estimated by the Central Bank's technical staff and surpassing the market average. Inflation expectations for all terms exceeded the 3.0% target. In that month, every major group in the Consumer Price Index (CPI) registered higher-than-estimated increases, and the diffusion indicators continued to show generalized price hikes. Accumulated exchange rate pressures on prices, indexation to high inflation rates, and several food supply shocks would explain, in part, the acceleration in inflation. All of this is in a context of significant surplus demand, a tight labor market, and inflation expectations at different terms that exceed the 3.0% target. Compared to the October edition of the Monetary Policy Report, the forecast path for headline and core inflation (excluding food and regulated items: EFR) increased (Graphs 1.1 and 1.2), reflecting heightened accumulated exchange rate pressures, price indexation to a higher inflation rate (CPI and the producer price index: PPI), and the rise in labor costs attributed to a larger-than-estimated adjustment in the minimum wage. Nevertheless, headline inflation is expected to begin to ease by early 2023, although from a higher level than had been estimated in October. This would be supported initially by the slowdown forecast for the food CPI due to a high base of comparison, the end anticipated for the shocks that have affected the prices of these products, and the estimated improvement in external and domestic supply in this sector. In turn, the deterioration in real household income because of high inflation and the end of the effects of pent-up demand, plus tighter external and domestic financial conditions would contribute to diluting surplus demand in 2023 and reducing inflation. By the end of 2023, both headline and core (EFR) inflation would reach 8.7% and would be 3.5% and 3.8%, respectively, by December 2024. These forecasts are subject to a great deal of uncertainty, especially concerning the future behavior of international financial conditions, the evolution of the exchange rate, the pace of adjustment in domestic demand, the extent of indexation of nominal contracts, and the decisions taken regarding the domestic price of fuel and electricity.

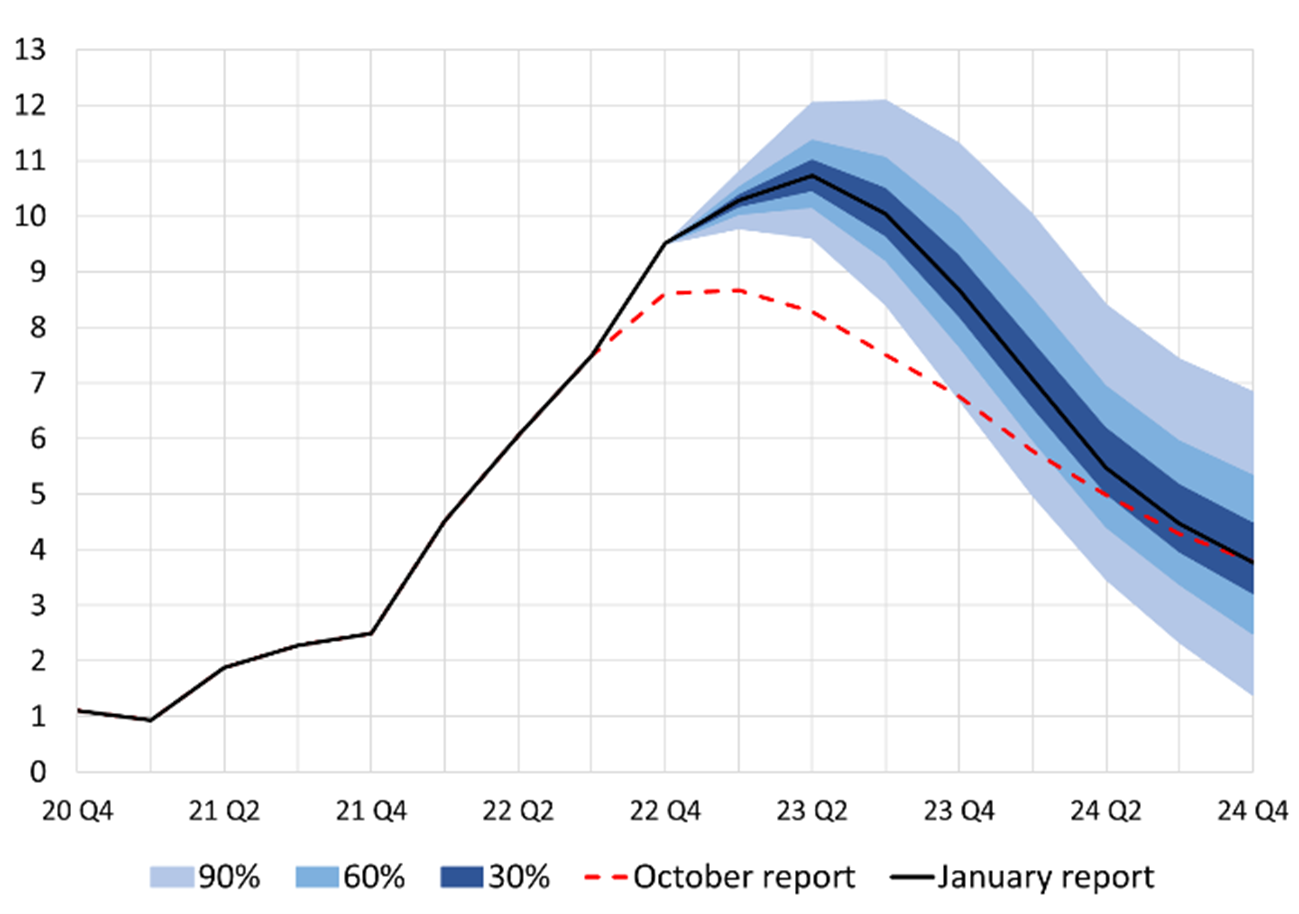

Graph 1.1

Consumer Price Index a/b/

(annual change; end-of-period)

(percentage)

a/ This graph presents the forecast probability distribution on an eight-quarter time horizon. Density characterizes the prospective balance of risks with areas of 30%, 60%, and 90% probability surrounding the central forecast (mode), through a combination of densities from the Patacon and the 4GM monetary policy models.

a/ This graph presents the forecast probability distribution on an eight-quarter time horizon. Density characterizes the prospective balance of risks with areas of 30%, 60%, and 90% probability surrounding the central forecast (mode), through a combination of densities from the Patacon and the 4GM monetary policy models.

b/ The probability distribution corresponds to the forecast exercise from the January report.

Source: DANE – calculations and projections by Banco de la República.

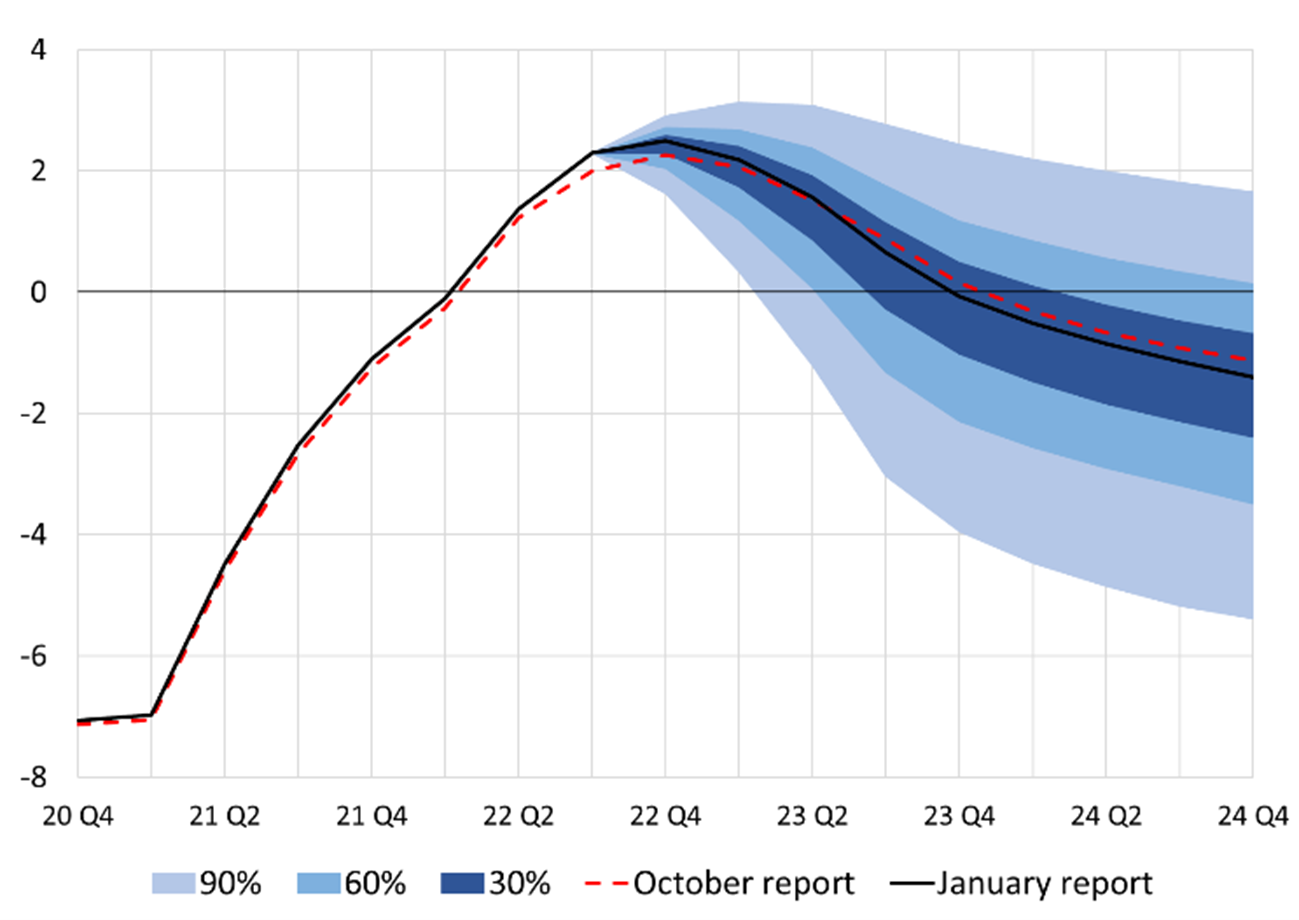

Graph 1.2

CPI excluding food and regulated items a/b/

(annual change; end-of-period)

(percentage)

a/ This graph presents the forecast probability distribution on an eight-quarter time horizon. Density characterizes the prospective balance of risks with areas of 30%, 60%, and 90% probability surrounding the central forecast (mode), through a combination of densities from the Patacon and the 4GM monetary policy models.

b/ The probability distribution corresponds to the forecast exercise from the January report.

Source: DANE – calculations and projections by Banco de la República.

In the third quarter, economic activity surprised again on the upside and the growth projection for 2022 rose to 8.0% (previously 7.9%). However, it declined to 0.2% for 2023 (previously 0.5%). With this, surplus demand continues to be significant and is still expected to weaken during the current year. Annual economic growth in the third quarter (7.1 % SCA)1 was higher than estimated in October (6.4 % SCA), given stronger domestic demand specifically because of higher-than-expected investment. Private consumption fell from the high level witnessed a quarter earlier and net exports registered a more negative contribution than anticipated. For the fourth quarter, economic activity indicators suggest that gross domestic product (GDP) would have remained high and at a level similar to that observed in the third quarter, with an annual variation of 4.1%. Domestic demand would have slowed in annual terms, although at levels that would have remained above those for output, mainly because of considerable private consumption. Investment would have declined slightly to a value like the average observed in 2019. The real trade deficit would have decreased due to a drop in imports that was more pronounced than the estimated decline in exports. On the forecast horizon, consumption is expected to decline from current elevated levels, partly because of tighter domestic financial conditions and a deterioration in real income due to high inflation. Investment would also weaken and return to levels below those seen before the pandemic. In real terms, the trade deficit would narrow due to a lower momentum projection for domestic demand and higher cumulative real depreciation. In sum, economic growth for all of 2022, 2023, and 2024 would stand at 8.0%, 0.2% and 1.0%, respectively (Graph 1.3). Surplus demand remains high (as measured by the output gap) and is expected to decline in 2023 and could turn negative in 2024 (Graph 1.4). Although the macroeconomic forecast includes a marked slowdown in the economy, an even greater adjustment in domestic absorption cannot be ruled out due to the cumulative effects of tighter external and domestic financial conditions, among other reasons. These estimates continue to be subject to a high degree of uncertainty, which is associated with factors such as global political tensions, changes in international interest rates and their effects on external demand, global risk aversion, the effects of the approved tax reform, the possible impact of reforms announced for this year (pension, health, and labor reforms, among others), and future measures regarding hydrocarbon production.

Graph 1.3

Gross Domestic Product, four quarter accumulation a/b/c/

(annual change)

(percentage)

a/ Seasonally adjusted and corrected for calendar effects.

a/ Seasonally adjusted and corrected for calendar effects.

b/ This graph presents the forecast probability distribution on an eight-quarter time horizon. Density characterizes the prospective balance of risks with areas of 30%, 60%, and 90% probability surrounding the central forecast (mode), through a combination of densities from the Patacon and the 4GM monetary policy models.

c/ The probability distribution corresponds to the forecast exercise from the January report.

Source: Banco de la República.

Graph 1.4

Output gap a/b/c/ - Predictive Densities

(four-quarter accumulation)

(percentage)

a/ The historical output gap estimate is calculated as the difference between observed GDP (four-quarter accumulation) and potential GDP (trend; four-quarter accumulation) based on the 4GM model.

b/ This graph presents the forecast probability distribution on an eight-quarter time horizon. Density characterizes the prospective balance of risks with areas of 30%, 60%, and 90% probability surrounding the central forecast (mode), through a combination of densities from the Patacon and the 4GM monetary policy models.

c/ The probability distribution corresponds to the forecast exercise from the January report.

Source: Banco de la República

In 2022, the current account deficit would have been high (6.3 % of GDP), but it would be corrected significantly in 2023 (to 3.9 % of GDP) given the expected slowdown in domestic demand. Despite favorable terms of trade, the high external imbalance that would occur during 2022 would be largely due to domestic demand growth, cost pressures associated with high freight rates, higher external debt service payments, and good performance in terms of the profits of foreign companies.2 By 2023, the adjustment in domestic demand would be reflected in a smaller current account deficit especially due to fewer imports, a global moderation in prices and cost pressures, and a reduction in profits remitted abroad by companies with foreign direct investment (FDI) focused on the local market. Despite this anticipated correction in the external imbalance, its level as a percentage of GDP would remain high in the context of tight financial conditions.

In the world's main economies, inflation forecasts and expectations point to a reduction by 2023, but at levels that still exceed their central banks' targets. The path anticipated for the Federal Reserve (Fed) interest rate increased and the forecast for global growth continues to be moderate. In the fourth quarter of 2022, logistics costs and international prices for some foods, oil and energy declined from elevated levels, bringing downward pressure to bear on global inflation. Meanwhile, the higher cost of financing, the loss of real income due to high levels of global inflation, and the persistence of the war in Ukraine, among other factors, have contributed to the reduction in global economic growth forecasts. In the United States, inflation turned out to be lower than estimated and the members of the Federal Open Market Committee (FOMC) reduced the growth forecast for 2023. Nevertheless, the actual level of inflation in that country, its forecasts, and expectations exceed the target. Also, the labor market remains tight, and fiscal policy is still expansionary. In this environment, the Fed raised the expected path for policy interest rates and, with this, the market average estimates higher levels for 2023 than those forecast in October. In the region's emerging economies, country risk premia declined during the quarter and the currencies of those countries appreciated against the US dollar. Considering all the above, for the current year, the Central Bank's technical staff increased the path estimated for the Fed's interest rate, reduced the forecast for growth in the country's external demand, lowered the expected path of oil prices, and kept the country’s risk premium assumption high, but at somewhat lower levels than those anticipated in the previous Monetary Policy Report. Moreover, accumulated inflationary pressures originating from the behavior of the exchange rate would continue to be important.

External financial conditions facing the economy have improved recently and could be associated with a more favorable international context for the Colombian economy. So far this year, there has been a reduction in long-term bond interest rates in the markets of developed countries and an increase in the prices of risky assets, such as stocks. This would be associated with a faster-than-expected reduction in inflation in the United States and Europe, which would allow for a less restrictive course for monetary policy in those regions. In this context, the risks of a global recession have been reduced and the global appetite for risk has increased. Consequently, the risk premium continues to decline, the Colombian peso has appreciated significantly, and TES interest rates have decreased. Should this trend consolidate, exchange rate inflationary pressures could be less than what was incorporated into the macroeconomic forecast. Uncertainty about external forecasts and their impact on the country remains high, given the unpredictable course of the war in Ukraine, geopolitical tensions, local uncertainty, and the extensive financing needs of the Colombian government and the economy.

High inflation with forecasts and expectations above 3.0%, coupled with surplus demand and a tight labor market are compatible with a contractionary stance on monetary policy that is conducive to the macroeconomic adjustment needed to mitigate the risk of de-anchoring inflation expectations and to ensure that inflation converges to the target. Compared to the forecasts in the October edition of the Monetary Policy Report, domestic demand has been more dynamic, with a higher observed level of output exceeding the productive capacity of the economy. In this context of surplus demand, headline and core inflation continued to trend upward and posted surprising increases. Observed and expected international interest rates increased, the country’s risk premia lessened (but remains at high levels), and accumulated exchange rate pressures are still significant. The technical staff's inflation forecast for 2023 increased and inflation expectations remain well above 3.0%. All in all, the risk of inflation expectations becoming unanchored persists, which would accentuate the generalized indexation process and push inflation even further away from the target. This macroeconomic context requires consolidating a contractionary monetary policy stance that aims to meet the inflation target within the forecast horizon and bring the economy's output to levels closer to its potential.

1.2 Monetary Policy Decision

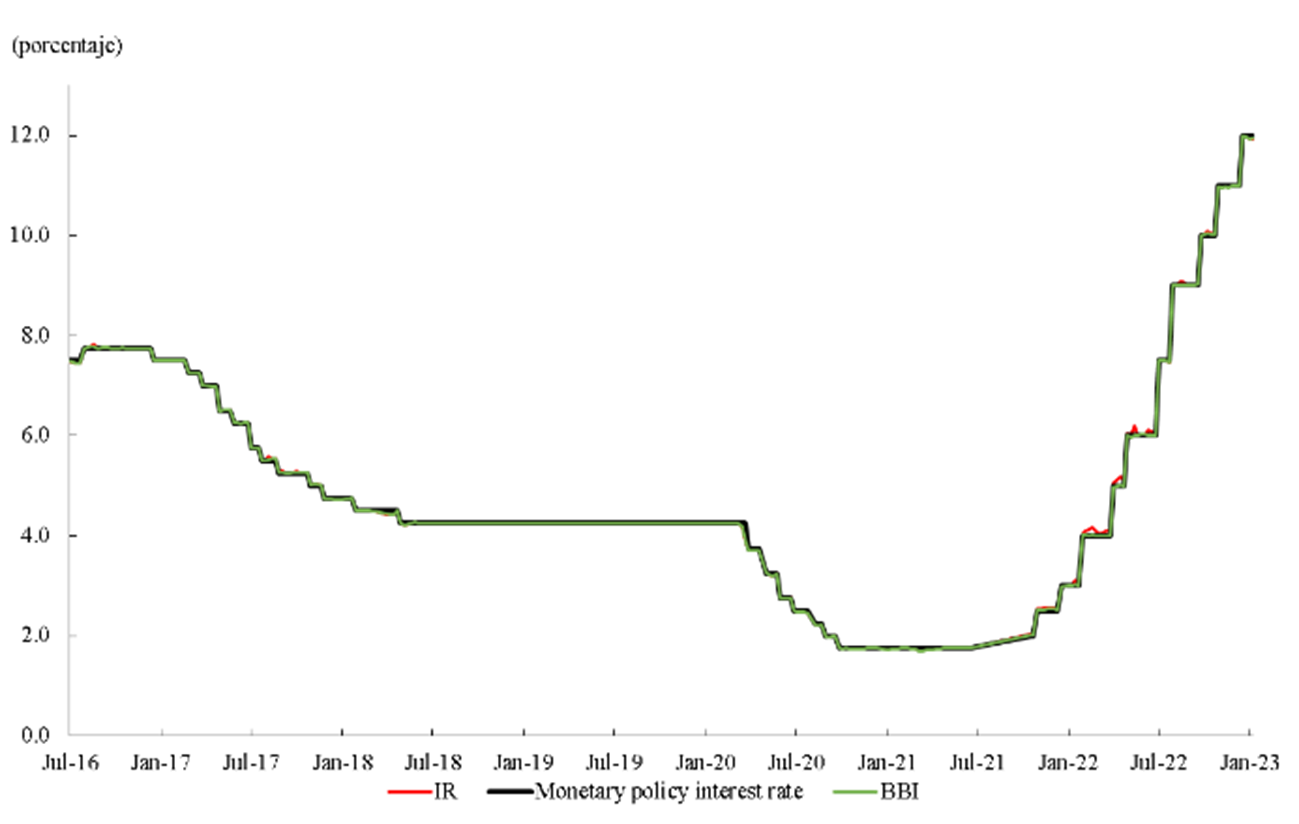

At its meetings in December 2022 and January 2023, Banco de la República’s Board of Directors (BDBR) agreed to continue the process of normalizing monetary policy. In December, the BDBR decided by a majority vote to increase the monetary policy interest rate by 100 basis points (bps) and in its January meeting by 75 bps, bringing it to 12.75% (Graph 1.5).

Graph 1.5

Monetary policy interest rate, interbank rate and BBIa/

(weekly data)

Sources: Financial Superintendent of Colombia and Banco de la República.

a/ IR: interbank rate. BBI: benchmark banking indicator.

1/ Seasonally and calendar adjusted.

2/ In the current account aggregate, the pressures for a higher external deficit come from those companies with FDI that are focused on the domestic market. In contrast, profits in the mining and energy sectors are more than offset by the external revenue they generate through exports.