In an article titled “Job Displacement, Credit and Crime in Colombia” published in the international academic journal American Economic Review: Insights by senior economists Carlos Medina and Christian Posso from Banco de la República (the Central Bank of Colombia) estimates the effects of unexpected job loss on the probability of participating in criminal activities. It also studies the role of consumer credit as an instrument to mitigate the effects of job loss by offering the possibility of satisfying consumption needs and contributing to deter criminal activities. The analysis is based on data from Medellín, one of Colombia's cities with the highest formality rates, a high presence of organized crime, and high homicide rates related to disputes between local groups, drug cartels, criminal gangs, and paramilitaries. Between 2006 and 2015, 12% of young men in Medellín were arrested at some point.

The authors focus on mass layoffs as these are often surprising to individuals and can lead to a response in criminal behavior. According to 2010 data, employees of firms that experienced a mass layoff experienced a drastic drop of more than 20% in revenues compared to 2009, followed by a remarkable recovery a year later, although still at levels between 4% and 10% below those recorded prior to the event. The drop in revenues is slightly higher for women and younger employees.

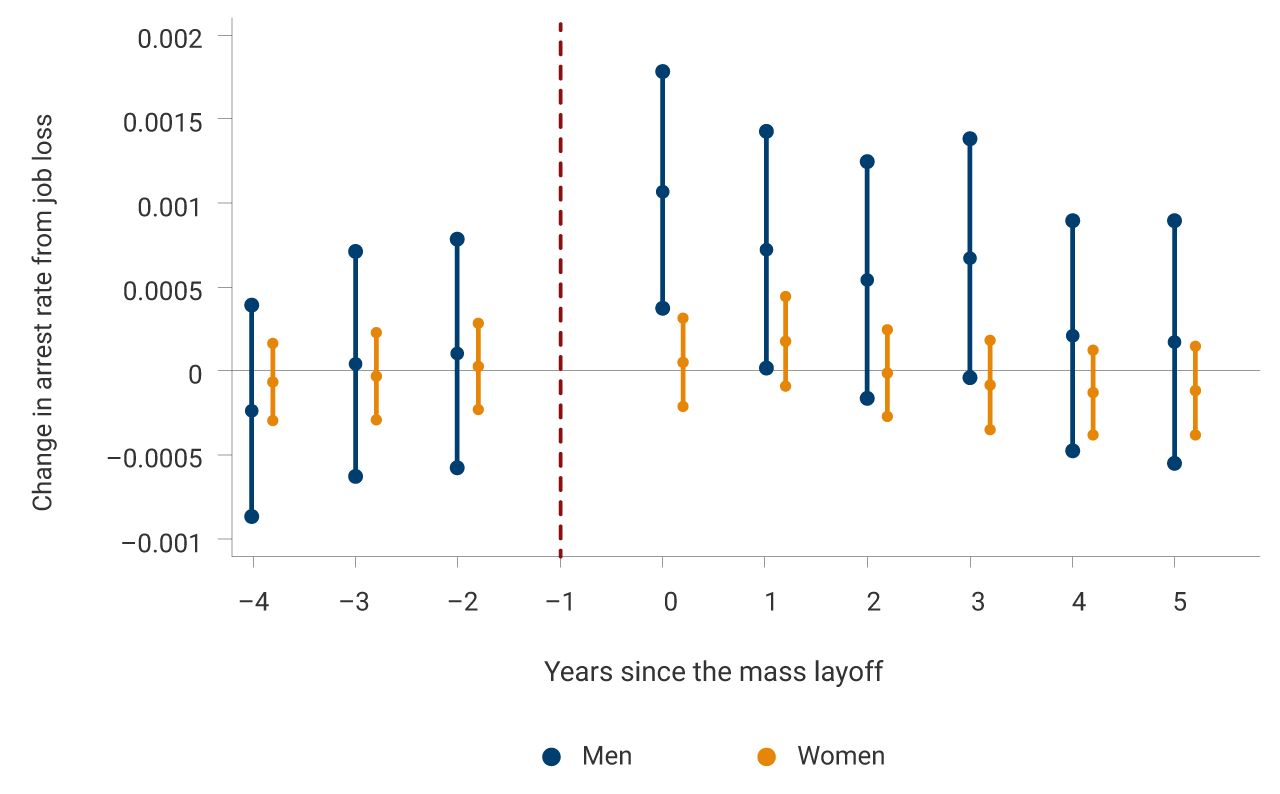

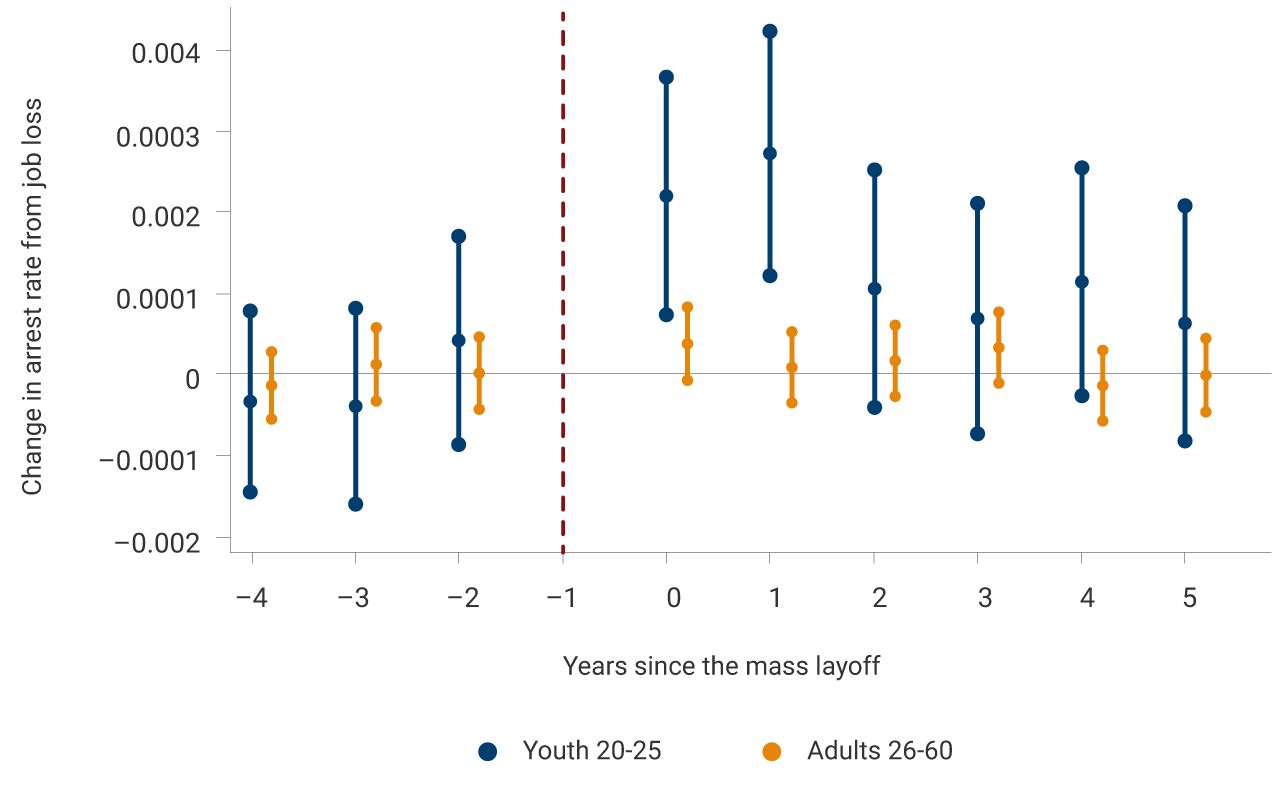

In addition to a sharp loss of revenue in the year of the mass layoff and up to 5 years later, the authors find a sharp increase in the probability of arrest in the year of the mass layoff. This effect is exacerbated in the following years. Graph 1 exhibits the estimated and normalized impact of the layoff on the probability of arrest, distinguishing by gender and age. The increase in the arrest rate observed in the graph is equivalent to a 47% increase in 2010 and 35% one year later, relative to the 0.16% arrest rate in 2009. The increase in the arrest rate is mainly explained by male employees and young people between the ages of 20 and 25. The concentration of effects in the younger population is consistent with the high crime rates observed among young men in Medellín. The most salient effects by type of crime are found in property crime, suggesting a link to the need channel.

Graph 1. Effect of Mass Layoffs on Arrests by Gender and Age Range

Effects on arrests by gender

Effects on arrests by age

The paper exhibits that mass layoffs of adults in the household have spillover effects on other family members, especially younger ones. This suggests that job loss increases criminality beyond what was initially anticipated, as it also affects other family members. A positive effect on family members aged 25-35 is found in the same year that their relative loses their job, while the effect on those under 25 is recorded a year later, potentially suggesting that the example of older ones could be playing a role in younger relatives’ decisions.

The study also finds that access to consumer credit weakens the relationship between job loss and criminality by allowing individuals to smoothen the hardship of unemployment, deterring them from joining criminal activities. In particular, the authors find that the layoff has no significant impact on the population that had access to credit before the event. On the other hand, the estimated impact is positive, significant, and persistent for the population that did not have access to credit before the event.

The authors estimate the extent to which access to credit decreases the effect of mass layoffs on arrests based on the consumer credit expansion observed in 2010 on account of the entry of five new banks in the city, using the distances of their branches to households. It is observed that individuals who had access to consumer credit as a product of that expansion register a reduction in the probability of becoming criminals in the periods subsequent to the credit expansion. The role played by access to consumer credit as a buffer against the adverse effects of job loss suggests that the increase in the arrest rate would be more motivated by necessity than by psychological or emotional reasons. The results highlight that in situations such as those experienced during the COVID-19 pandemic, liquidity support to people who lost their jobs becomes very important as a vehicle to reduce the likelihood that they will engage in criminal activities.