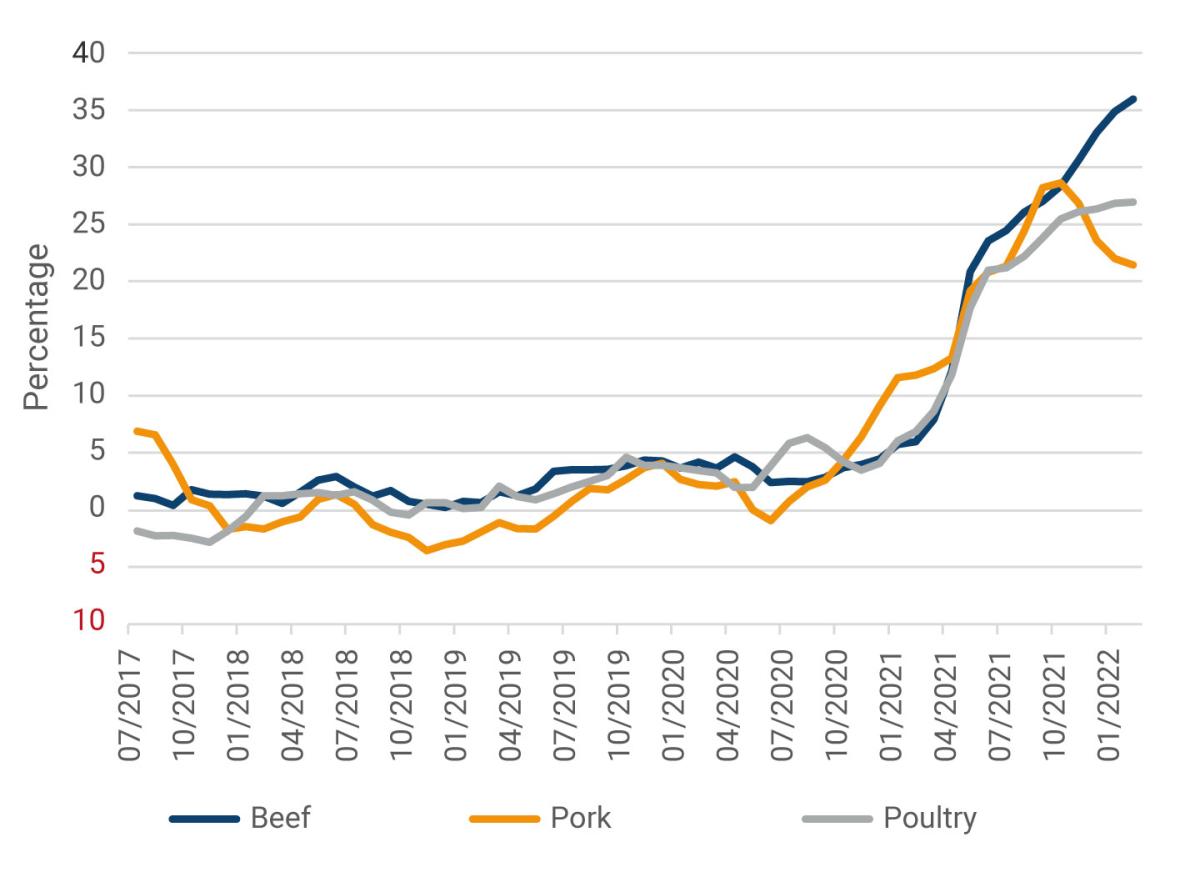

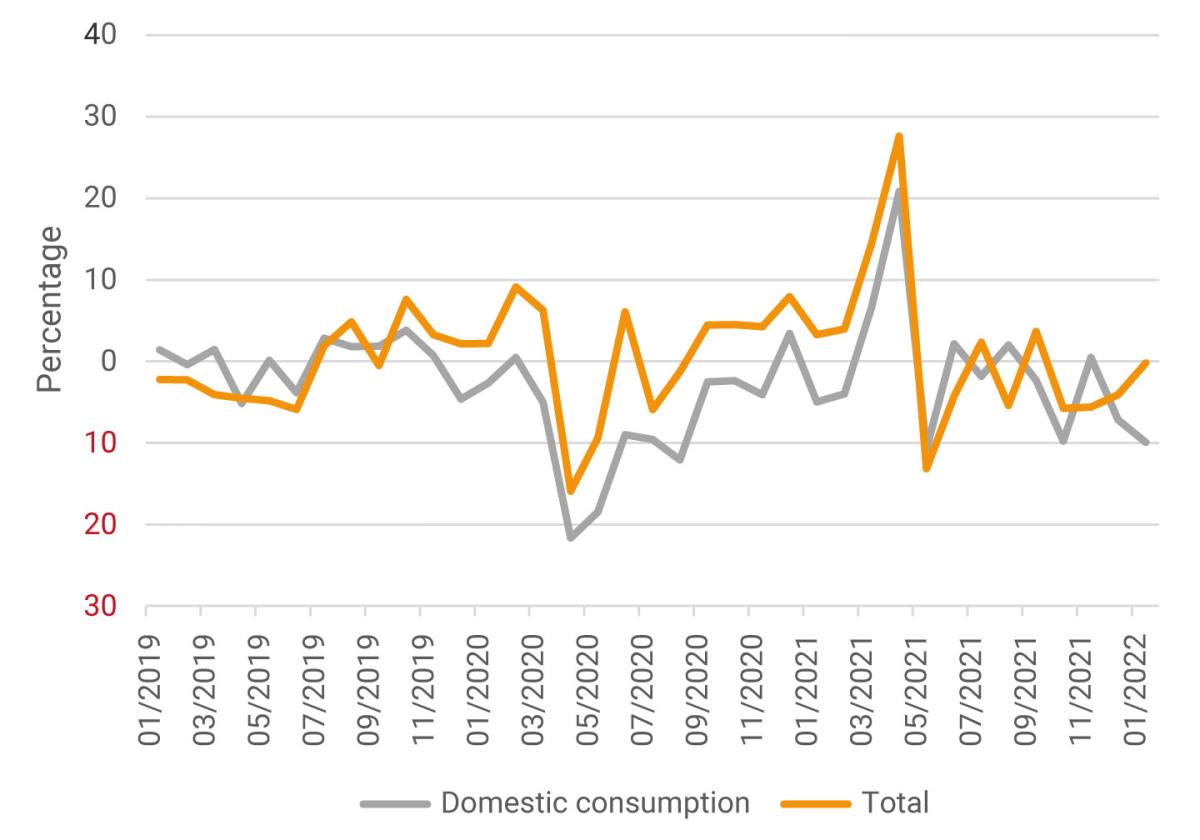

In 2021, the price of beef grew about 31% and, as of February 2022, has seen an additional growth of more than 4.0%. As can be seen from Graph 1, this increase coincided with similar increases in chicken and pork prices up to October 2021 in contrast to the relative stability seen since 2017. Meanwhile, and as can be seen in Graph 2, beef production and consumption remained relatively constant during 2021 after a drop during the first months of the pandemic. The substantial increase in prices with relatively stable levels of production and consumption suggests that the domestic market suffered negative supply shocks and positive demand shocks simultaneously.

Graph 1. Annual Changes in Meat Price Index

Note: The total meat CPI based on December 2018 includes beef, poultry, and pork prices.

Source: Authors' calculations based on information from DANE-CPI.

Graph 2. Annual Change in Total Head of Cattle and Cattle for Domestic Consumption

Note: annual change in number of head of cattle removed from inventory each month for slaughter for domestic consumption and export in live cattle and carcasses.

Source: Authors' calculations based on information from Fedegan and DANE.

Among the factors that negatively affected beef supply was the increase in the prices for imported supplies such as mineral salts that complement cattle feed based mainly on forage. However, this effect was much lower than the one suffered by the chicken and pork industry that depends directly on imported food, and where prices increased to a similar extent.

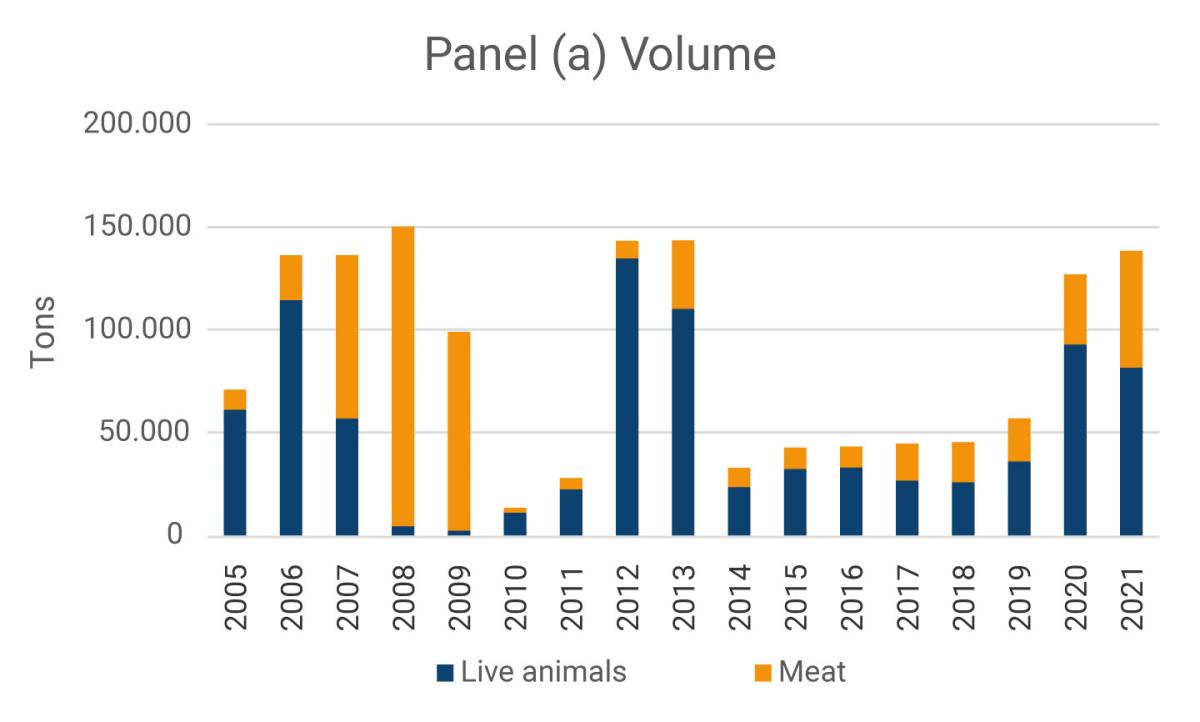

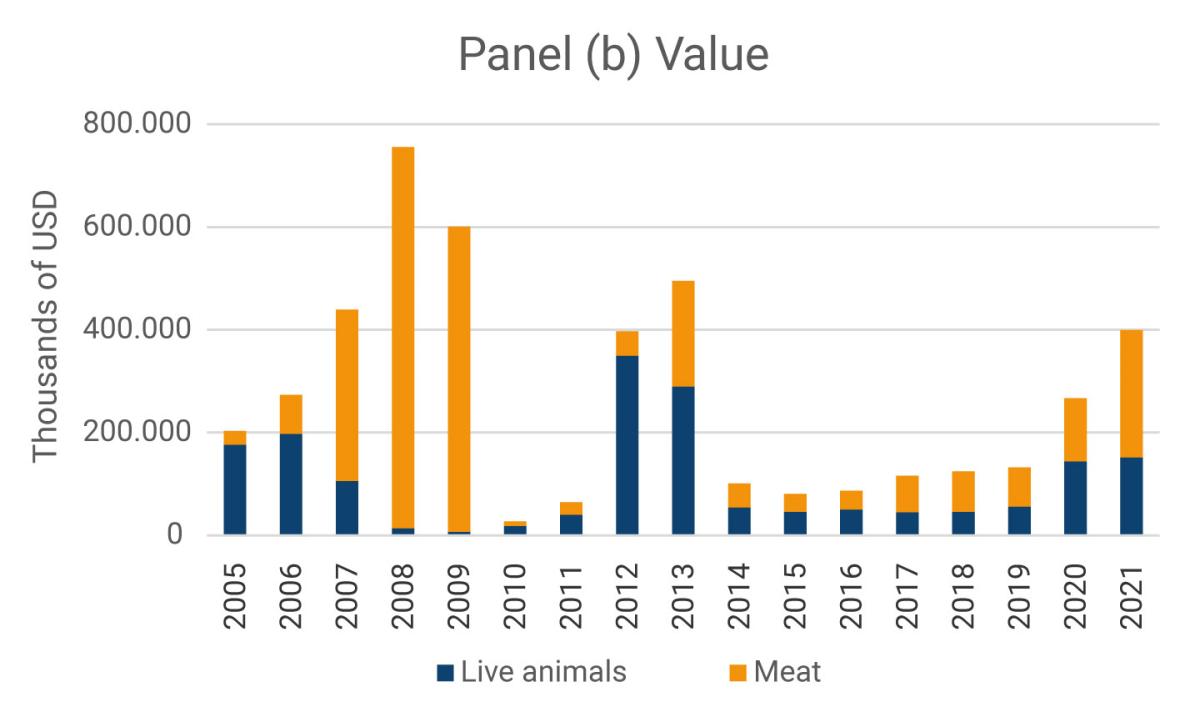

Regarding demand, in 2021 the beef market was impacted by the strong aggregate consumption in the economy, which grew 14.1% and reached values higher than the trend before the pandemic. In addition, export demand has grown significantly since 2020 and is expected to continue to do so in the future following the recovery of Colombia's foot-and-mouth disease-free status in October 2020. As can be seen in Graph 3, the volume exported in 2020 grew at an annual rate of over 100%. During 2021, the growth moderated, but its value had a proportionally higher increase due to the increase in prices.

Graph 3. Exports of live animals and beef

Note: the value corresponds to the CIF value of exports in thousands of dollars.

Source: Authors' calculations based on information from DIAN.

As was discussed in a box in Banco de la República's most recent Monetary Policy Report (see report here), supply shocks that affected pork and chicken production were an additional factor that increased the demand for beef in 2021. The shocks resulted from the increase in the prices for imported food, especially soybeans and corn, as well as the roadblocks during the national strike that affected the productive capacity of that sector in the medium term. Although these shocks did not directly affect beef production, they had an indirect effect on the demand for it due to the increase in the prices for pork and chicken which are substitute goods.

The increase in prices should generate incentives to increase production. However, the supply of beef is relatively inelastic in the short term since there is a lag between the reproduction of heifers and the slaughter of cattle. In addition, the demand shocks described above may have persistent negative effects on supply insofar as they have led to reductions in the inventory of livestock and the reproductive capacity. Although the information from Fedegan for the first vaccination cycle of 2021 showed increases of close to 4% in the cattle inventory, the effect of the shocks described above is expected to persist in the short term.