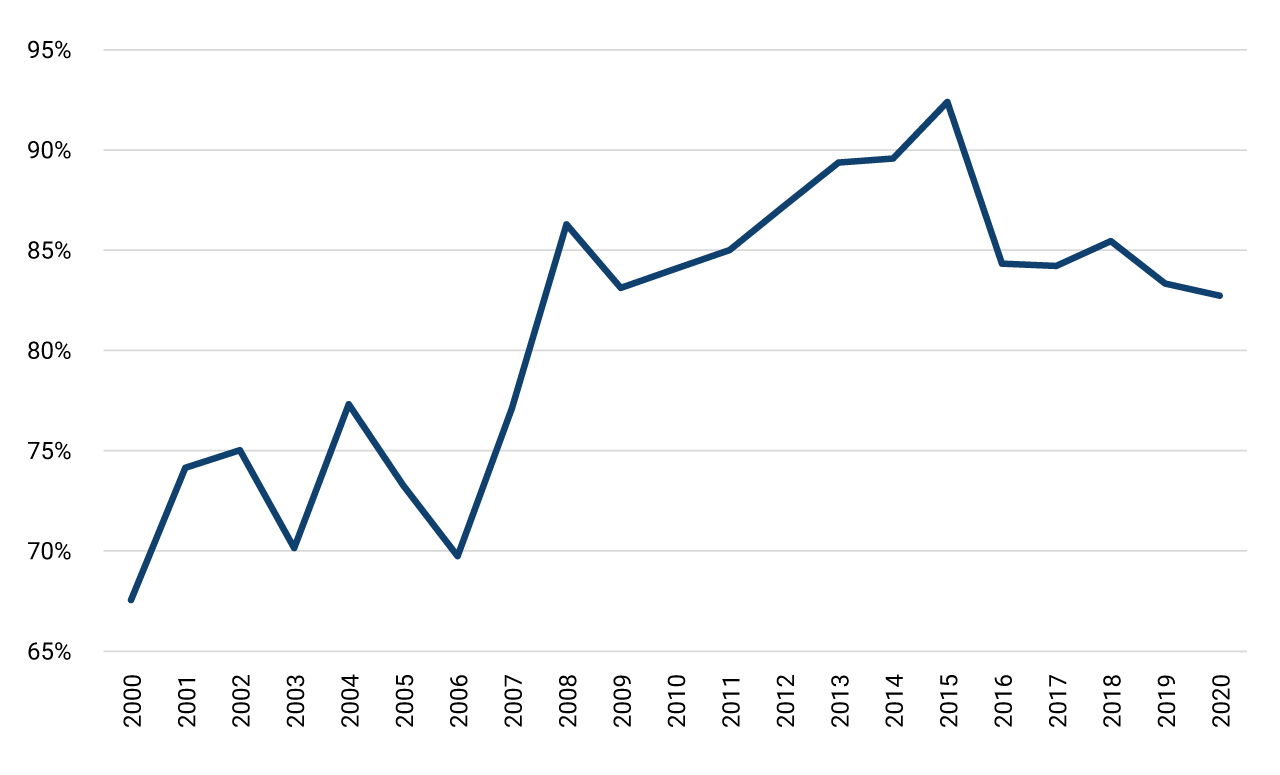

In 2019 and 2020, Banco de la República (the Central Bank of Colombia) showed historically high profits, which amounted to 7.1 trillion and 7.5 trillion Colombian pesos, respectively. This was mainly due to the extraordinary yields of foreign reserves (FRs), which totaled 7.6 trillion and 6.6 trillion Colombian pesos in each of these years, as a result of the appreciation of bonds due to the fall in foreign interest rates. FRs accounted for more than half of Banco de la República’s (Banrep) assets, and their share increased significantly after 2007. Thus, FRs came to represent, on average, 85.3% of total assets in the 2007 - 2020 period (Graph 1).

Graph 1. FRs Share in Banrep’s Assets.

2000-2020

Source: Banco de la República

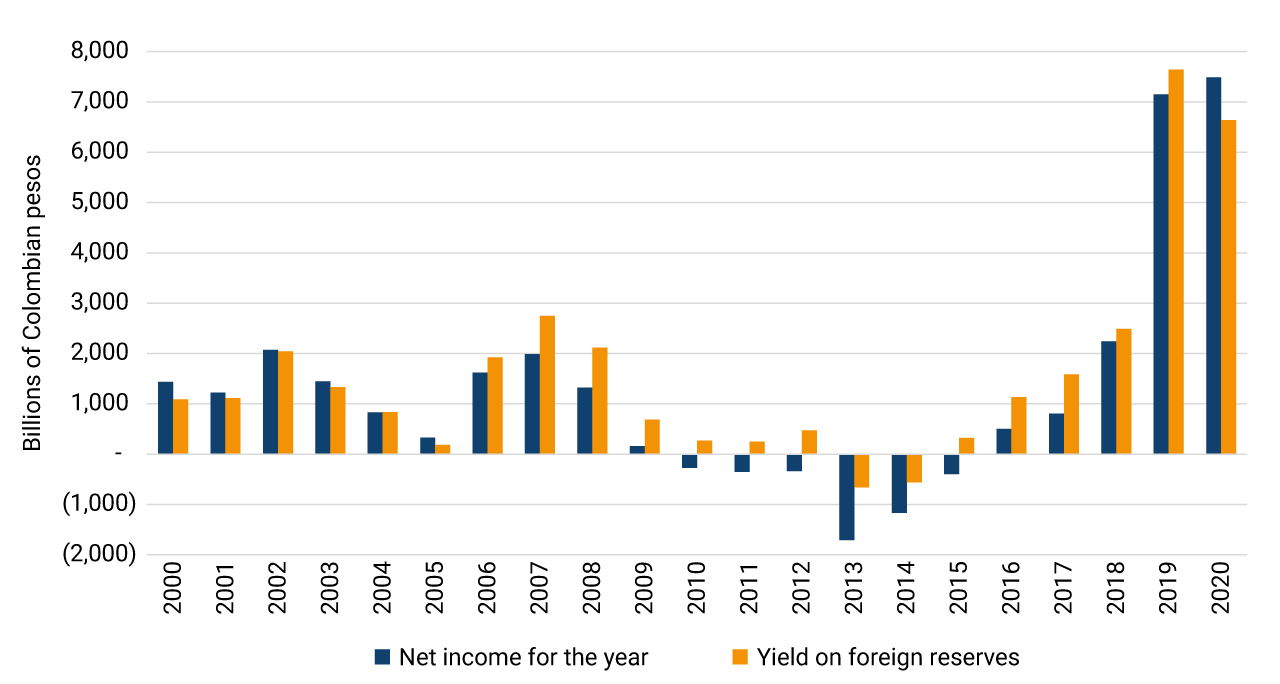

Since FRs are Banrep's most important asset, their yields represent the largest source of income, so profits are strongly correlated with FRs' yields in each period. Indeed, as shown in Graph 2, in periods when reserve yields increase, Banrep's earnings also increase.

Graph 2. Banrep’s Net Income for the Year and FRs Yield

2000-2020

Source: Banco de la República

In Banrep's financial statements, FRs are mostly recorded at market prices. This implies that the change in the balance of FRs has three components:

- Net purchases of foreign currency by Banrep in the market.

- Changes in their value in pesos as a result of exchange-rate fluctuations vis-a-vis the currencies in which they are invested. While most FRs are invested in dollars (US government bonds), the FRs portfolio also includes investments in other currencies, such as the euro, yen, renminbi, Australian dollar, and Canadian dollar, among others. Therefore, changes in the value of reserves in pesos may occur as a result of changes in the exchange rate vis-a-vis the US dollar and these other currencies. These variations are recorded in Banrep's equity without impacting its Income Statement (P&L).

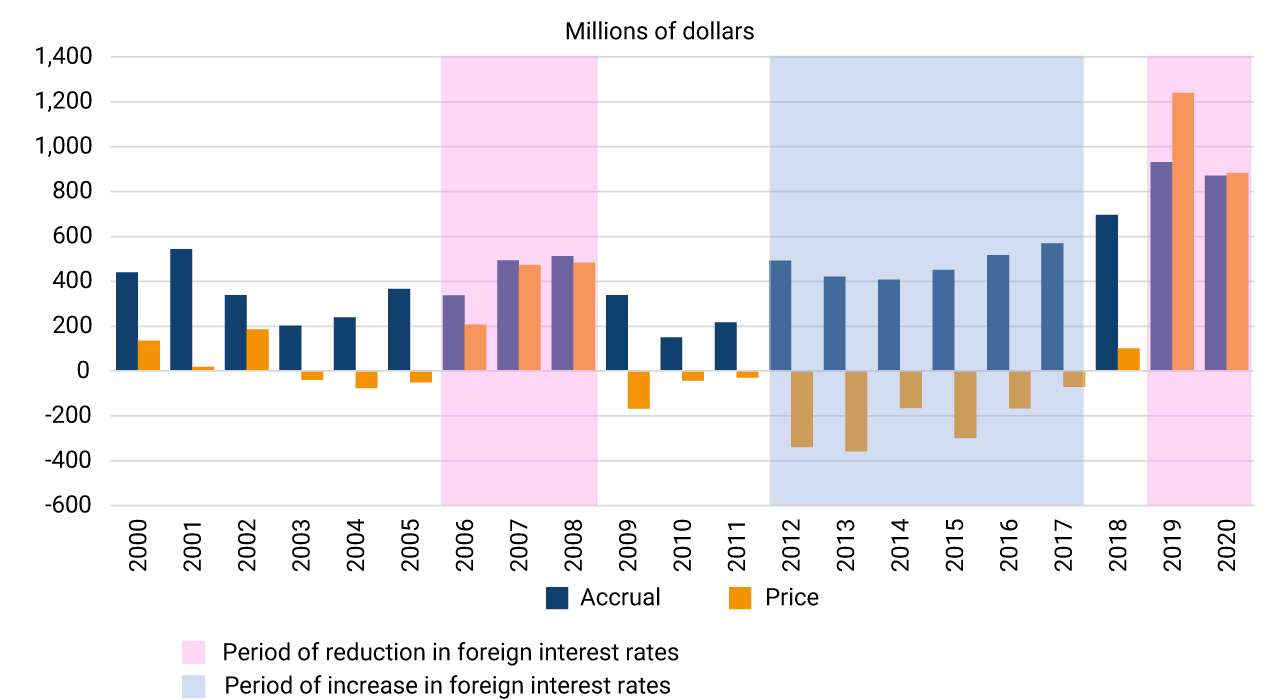

- Changes in their value in foreign currency, which are derived from the interest they create (accrual effect) and from changes in the present value of the securities in which they are invested (price effect). The accrual effect is greater when the interest rates of each security are higher. On the other hand, the price effect fluctuates in the opposite direction to movements in market interest rates. When the market interest rate increases, the value of the securities decreases. If the market interest rate decreases, these securities increase in value.

Graph 3 exhibits that in the periods 2006-2008 and 2019-2020 (pink shadow), there was a significant positive price effect on FRs due to reductions in foreign interest rates (red bar). In contrast, in the 2012-2017 period (blue shadow), the increase in foreign interest rates, particularly those of US government bonds, caused a devaluation of reserves that affected reserve yields.

Graph 3. Accrual Effect and Price Effect on FRs Portfolio Yields

Source: Banco de la República

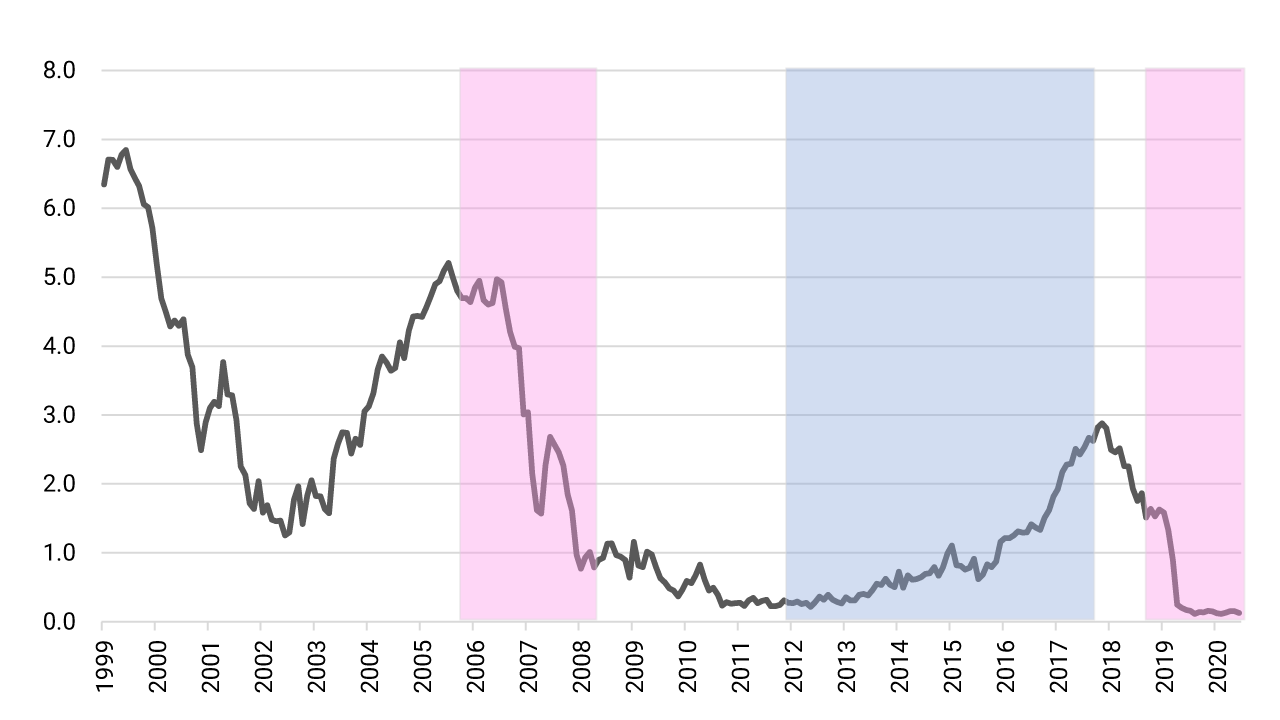

The performance of foreign interest rates is shown in Graph 4. To simplify, only US government bond rates representing more than 80% of the FRs portfolio are considered here. The same shaded areas of Graph 3 are included in this graph to highlight how changes in rates affect the yield of foreign reserves, particularly through their price effect. It is observed that in the 2019-2020 period there was a sharp fall in interest rates, which explains the significant appreciation of securities that took place in that same period.

Graph 4. Foreign Interest Rates

(Information for U.S. 2-year term bonds)

Source: Bloomberg

The situation forecast for 2021 and 2022 differs significantly from the previous two years. As foreign interest rates are at levels close to zero, there is no outlook for further reductions that could be reflected in FRs’ portfolio valuations and result in a high level of Banrep’s profits through the price effect. On the contrary, it is to be expected that the FRs’ portfolio bonds will be devalued when the performance of these foreign rates increases, as was, in fact, the case in the first quarter of this year. In turn, low foreign interest rates will result in low FR yields due to the accrual effect.

Therefore, it is estimated that between 2021 and 2022 Banrep will generate low profits, or even losses, due to the low FRs yields, which, as mentioned above, represent Banrep's main source of income. The performance of FRs corresponds to the main factor explaining the Bank's P&L final result.