National Financial Accounts Bulletin by Institutional Sector – Third Quarter 2025

Below is a summary of the financial accounts by institutional sector and financial instrument. For further details, please refer to the Technical Bulletin (only in Spanish).

Financial Flows for the third quarter of 2025

1. By institutional sector

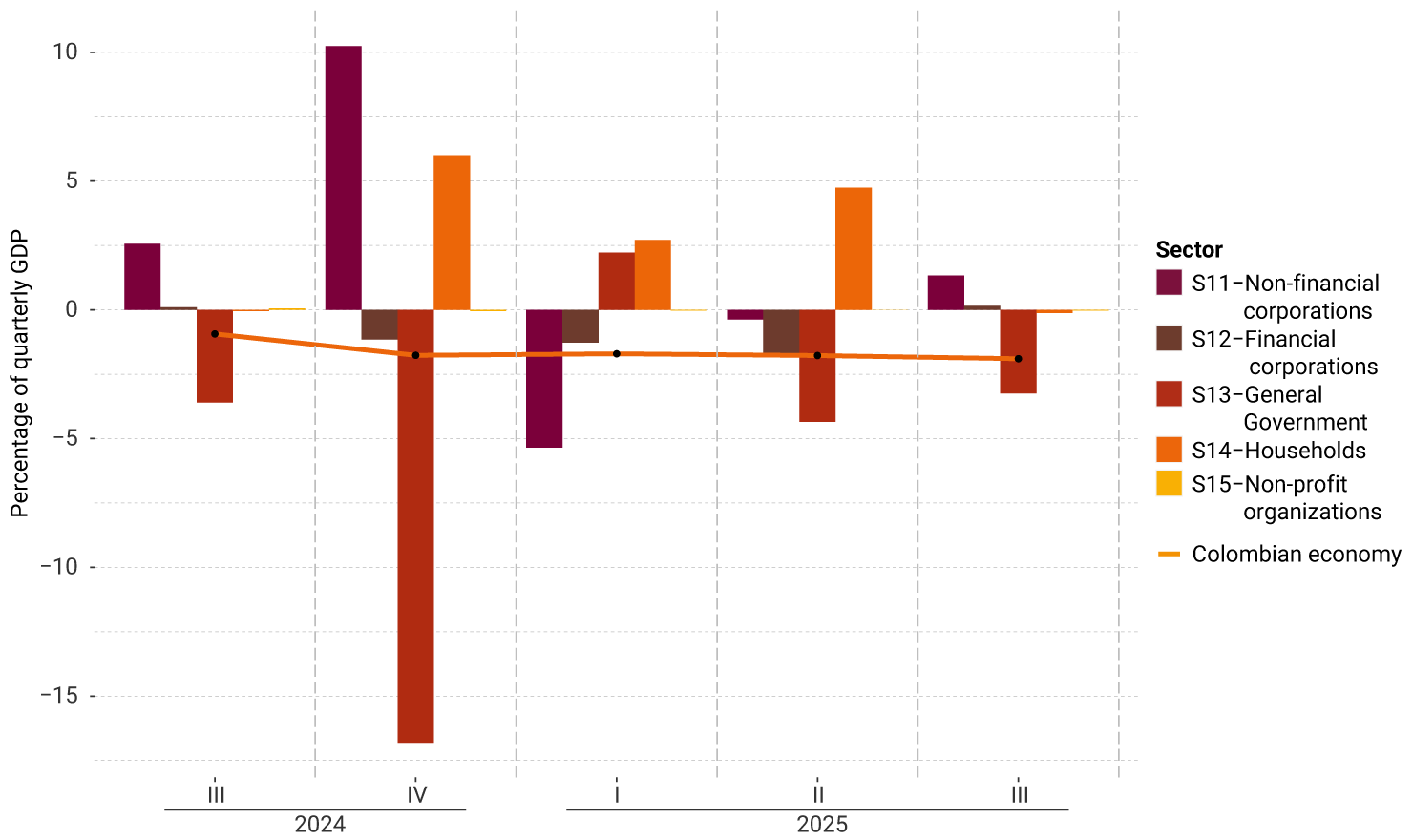

According to the financial accounts calculated by Banco de la República (the Central Bank of Colombia), in the third quarter of 2025, the current account deficit of the Colombian economy reached 1.9% of quarterly Gross Domestic Product (GDP), compared to 0.9% in the same period of 2024. This is primarily explained by the deficits of the General National Government (-3.2%) and households (-0.1%). The institutional sectors that partially offset the deficit were non-financial corporations (1.3%) and financial corporations (0.2%).

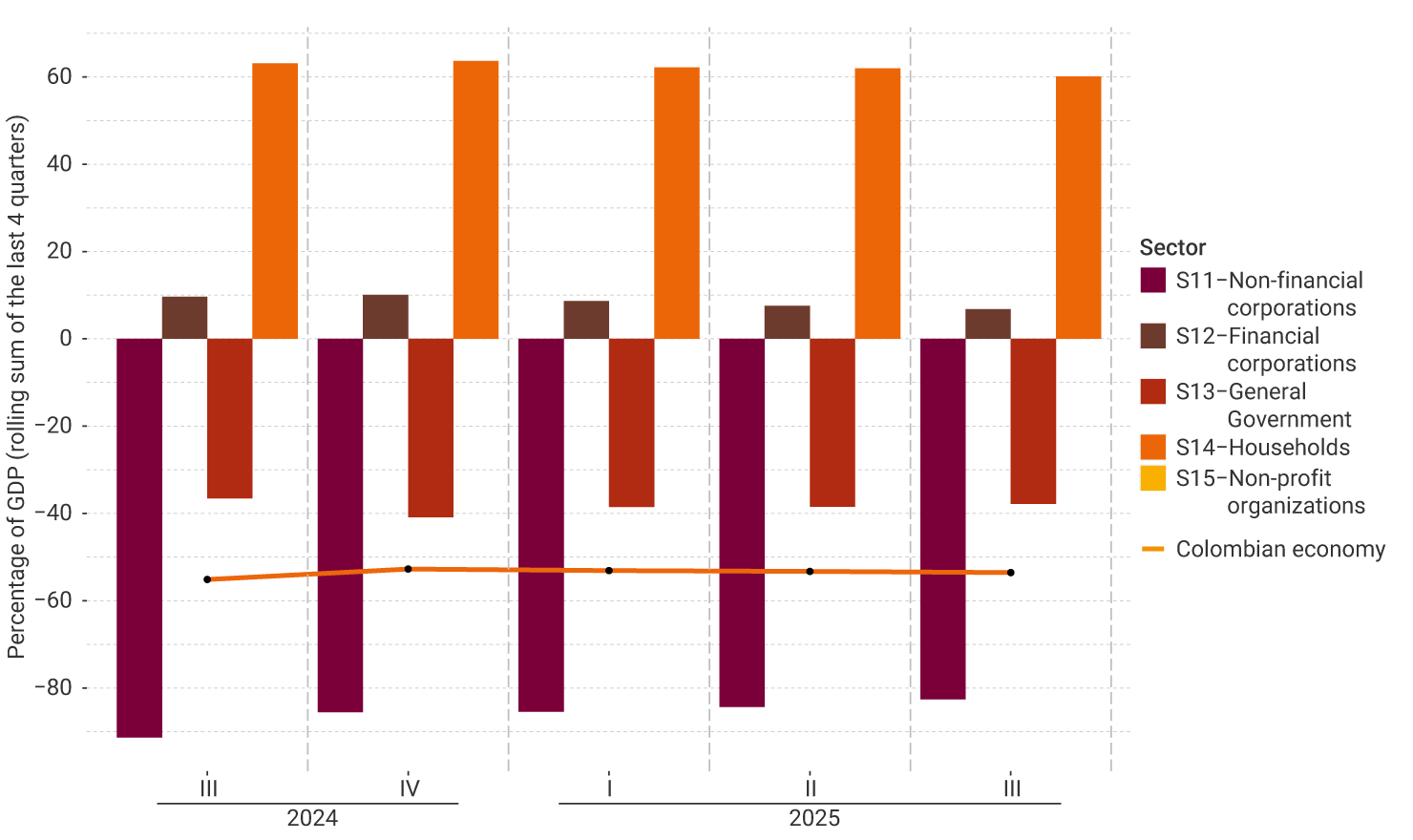

Graph 1. Current Account Deficit of the Colombian Economy and Savings and Investment Balances by Institutional Sector, Q3 2024 – Q3 2025

Source: Banco de la República - Cuentas Financieras

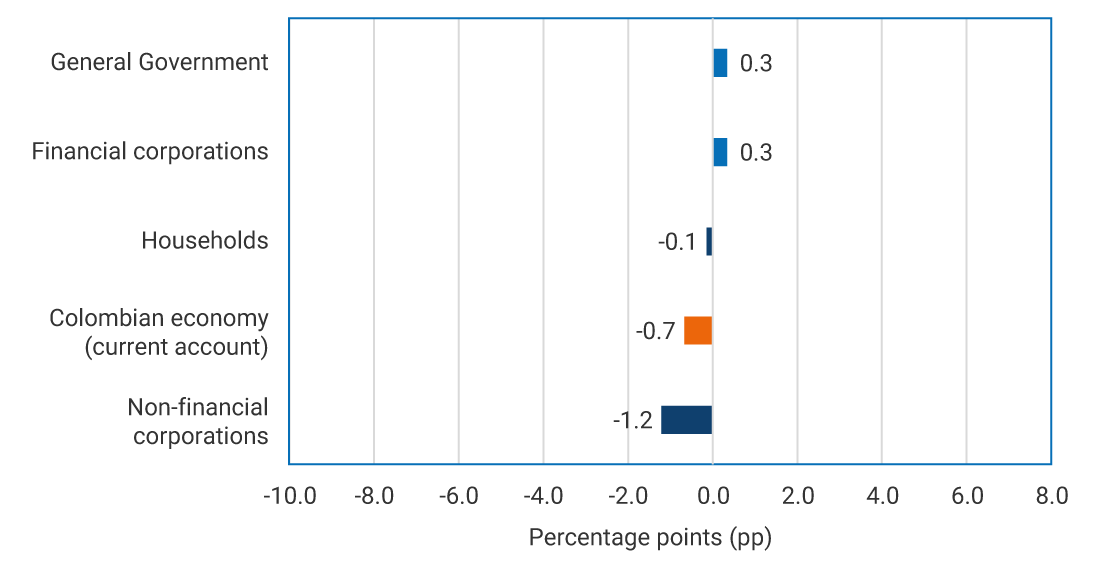

Compared to the third quarter of 2024, the economy’s consolidated external financing needs increased by 1.0 percentage points (pp), as reflected in the internal and external financing flows of institutional sectors. Therefore, the increase in the economy’s financing was explained by changes in the financing capacity of non-financial corporations (-1.2 pp) and financial corporations (0.3 pp), as well as by changes in the financing needs of the General National Government (-0.3 pp) and households (0.1 pp).

Graph 2. Explanation of the Change in the Colombian Economy’s Saving-Investment Balance by Institutional Sectors, Q3 2024 – Q3 2025

Source: Banco de la República - Cuentas Financieras

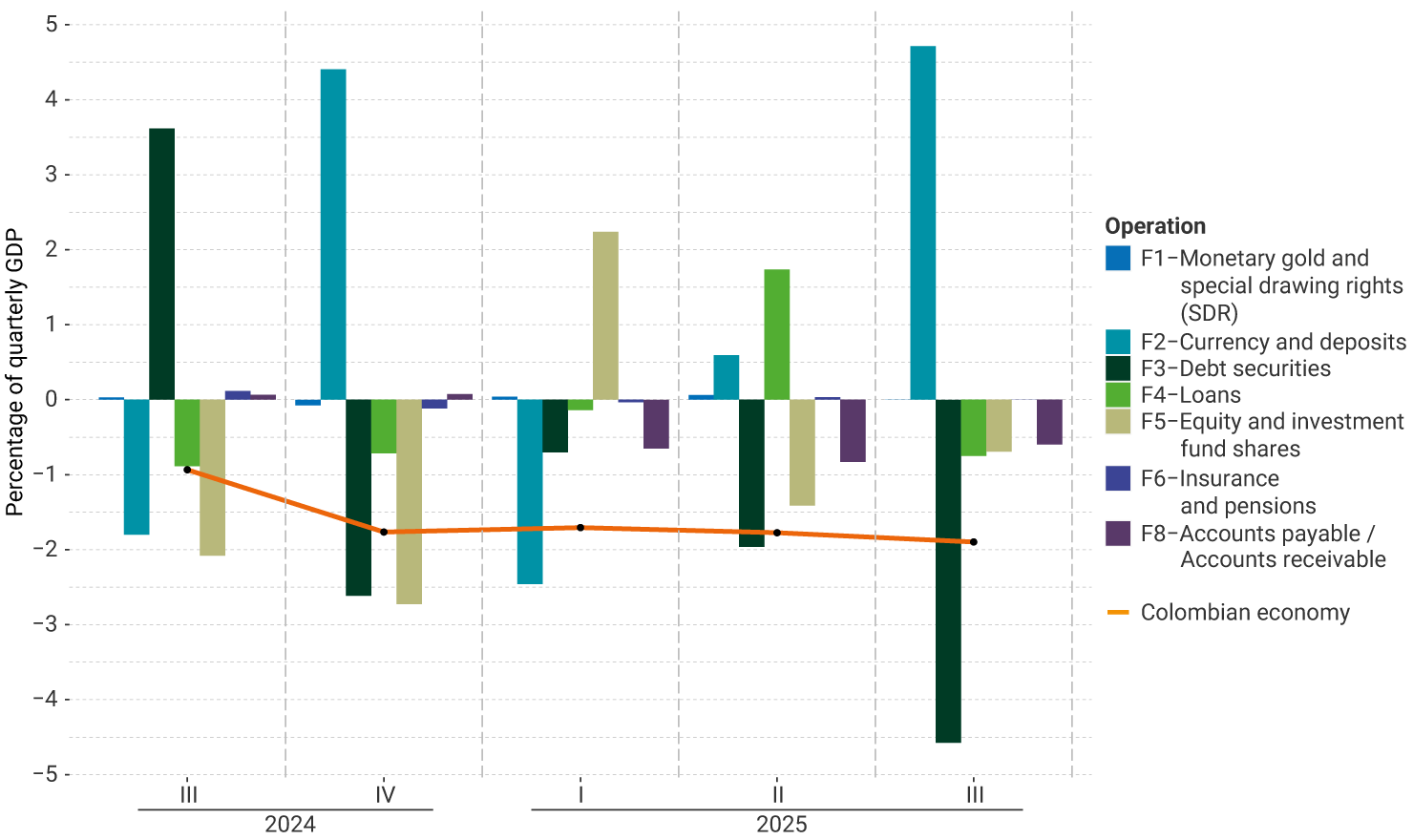

2. By financial instrument / net external financing

The negative quarterly saving-investment balance of the Colombian economy was covered by net external financing flows equivalent to 1.9% of quarterly GDP. Net inflows of financial resources from the rest of the world were primarily channeled through the net issuance of debt securities to the rest of the world (4.5%), the receipt of equity investments from abroad (1.5%), and higher external borrowing through accounts payable (0.9%). This was partially offset by deposit outflows [EPRF1.1][CCJS1.2][PE1.3]to the rest of the world, totaling 4.7% of quarterly GDP.

Graph 3. Net External Financing of Colombia’s Saving-Investment Balance by Financial Instrument, Q3 2024 – Q3 2025

Source: Banco de la República - Cuentas Financieras

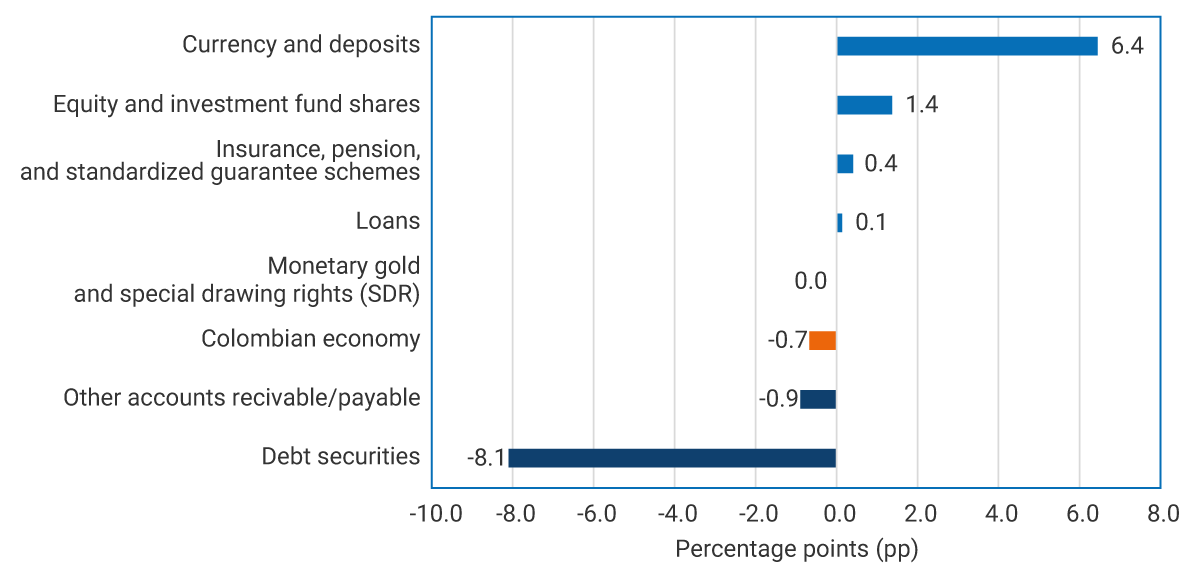

Compared to the third quarter of 2024, the 1.0 pp increase in external financing inflows was primarily driven by higher investments by the rest of the world in debt securities (8.1 pp) and an increase in accounts payable to the rest of the world (0.7 pp). This was partially offset by the change in deposit outlfows (6.4 pp), during which the Colombian economy transitioned from being a recipient to a lender, alongside a decline in equity investments (1.4 pp).

Graph 4. Explanation of the Change in the Financing Needs of the Colombian Economy by Financial Instrument, Q3 2024 – Q3 2025

Source: Banco de la República - Cuentas Financieras

Financial Account Balances for the third quarter of 2025

1. Net financial position by institutional sector

Al final del tercer trimestre del 2025, la economía colombiana registró una posición deudora neta con el resto del mundo equivalente al At the end of the third quarter of 2025, the Colombian economy recorded a net debtor position with the rest of the world equivalent to -53.6% of annual GDP. This was explained by the net debtor position of non-financial corporations (-82.6%) and the General National Government (-37.8%). This was partially offset by the net creditor positions of households (59.9%) and financial corporations (6.8%).

Compared to the third quarter of 2024, there was a 1.6 pp reduction in the economy’s external debtor position, explained by the reduction in the net debtor position of non-financial corporations (8.7 pp). These changes were partially offset by declines in net creditor positions of households (3.0 pp) and financial corporations (2.9 pp), and by the increase in the net debtor position of the General National Government (1.2 pp).

Graph 5. Colombia’s Net Financial Position by Institutional Sector, Q3 2024 – Q3 2025 (percentage of annual nominal GDP*)

* Corresponds to the rolling sum of quarterly GDP for the last 4 periods.

Source: Banco de la República - Cuentas Financieras

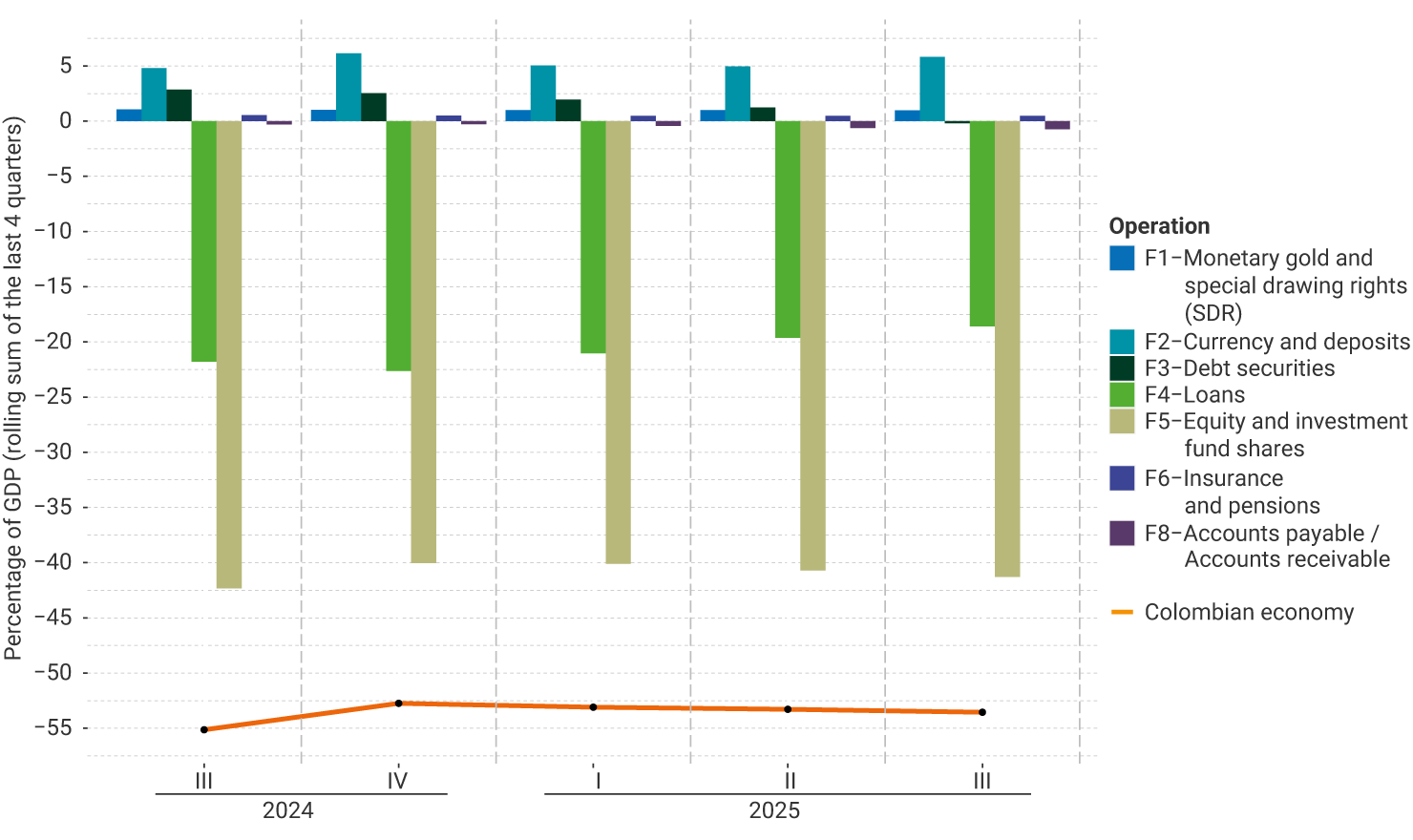

2. Net external position by financial instrument

At the end of the third quarter of 2025, the net debtor position of the Colombian economy with the rest of the world, equivalent to -53.6% of annual GDP, was primarily represented by equity investments (-41.3%) and loans (-18.6%). This was partially offset by Colombians’ foreign holdings of deposits (5.8%) and debt securities (1.2%).

Compared to the third quarter of 2024, the reduction in the economy’s net debtor position of 1.6 pp was mainly due to decreases in net debtor positions in loans (2.3 pp) and equity investments (2.0 pp). This change was partially offset by higher outward investment in debt securities (3.1 pp) and an increase in accounts payable to the rest of the world (0.4 pp).

Graph 6. Net External Financial Position of the Colombian Economy by Financial Instrument, Q3 2024 – Q3 2025 (percentage of annual nominal GDP*)

* Corresponds to the rolling sum of quarterly GDP for the last 4 periods.

Source: Banco de la República - Cuentas Financieras