Monetary Policy Report - January 2025

The Monetary Policy Report presents the Bank's technical staff's analysis of the economy and the inflationary situation and its medium and long-term outlook. Based on it, it makes a recommendation to the Board of Directors on the monetary policy stance. This report is published on the second business day following the Board of Directors' meetings in January, April, July, and October.

While inflation fell significantly in 2024, it continues above the 3% target. However, monetary policy measures and corrections in particular factors that exert upward price pressures have helped direct inflation toward the objective. Economic activity continues to recover and is expected to continue growing. The monetary policy interest rate is compatible with the convergence of inflation to its 3% target and the gradual recovery of economic growth toward more sustainable levels.

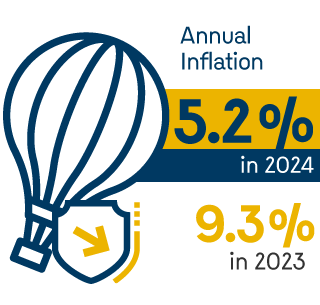

Inflation has fallen significantly, from 9.3% in 2023 to 5.2% in 2024. During this year and into the next, inflation would continue to decline towards the inflation target.

- In the last quarter of 2024, inflation continued its downward path, ending the year at 5.2% with the help of smaller increases in the prices of some regulated goods and services (particularly utilities and fuel prices) and food away from home.

- Despite inflation’s significant decline throughout 2024, including in the last quarter and the positive performance of goods and food, headline inflation ended the year above the target.

- Monetary policy actions and the adjustment in economic activity contributed to inflation’s decline; however, indexation to a high inflation rate in 2023 and labor cost pressures constrained a more marked drop.

- Over the next two years, both headline and core inflation are expected to gradually approach the 3% target.

- The indexation of certain goods and services prices to lower inflation and the cumulative effects of monetary policy decisions would assist in steering inflation closer to the target. Nevertheless, inflationary pressures from the recent minimum wage increase and those resulting from the exchange rate’s behavior in a environment of high global uncertainty, could make the reduction of inflation slower than projected.

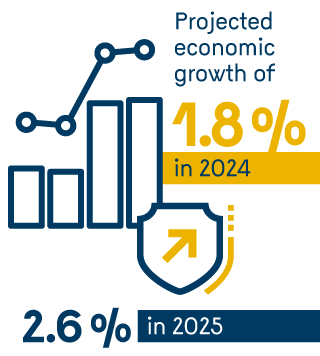

Economic activity continues on a path of gradual recovery, helping inflation remain close to the 3% target and encouraging a stable labor market environment.

- Colombia’s economy continued to strengthen in the second half of 2024, backed by strong household consumption and signs of investment recovery.

- Increased spending on machinery and equipment, civil works construction, and the recovery of inventories would driving the improvement seen in investment. Private consumption (household consumption) has grown, supported by lower interest rates, improved access to credit, and increased disposable income.

- Economic activity is projected to grow 1.8% in 2024 and would continue to accelerate to 2.6% in 2025 and 3.4% in 2026, attributed to a monetary policy that would gradually ease as inflation falls. Consequently, the economy is foreseen to reach a level close to its productive capacity by 2026.

- The unemployment rate has decreased and is at low levels compared to its historical performance, concurrent with growing employment levels. Additionally, improvements in salaried employment have led to additional reductions in the informality ratios.

- Monetary policy interest rate reductions have been reflected in significant decreases in financial market interest rates, contributing to the the gradual recovery of credit.

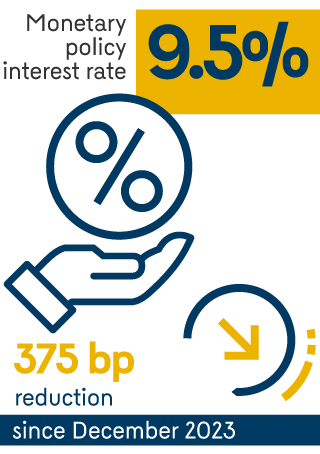

Since the end of 2023, the Board of Directors of Banco de la República has reduced the monetary policy interest rate by 375 basis points to its current level of 9.5%. The latter is compatible with inflation converging to its 3% target over the next two years and the gradual recovery of economic activity to sustainable levels.

- At its December meeting, the Board of Directors of Banco de la República decided by majority vote to lower the monetary policy interest rate by 25 basis points and concurred at its January meeting to maintain the benchmark rate at 9.5%.

- All monetary policy decisions have contributed to reducing annual inflation amid a backdrop of gradual improvements in economic activity and a stable labor market.

- The impact of the minimum wage increase on prices and the exchange rate behavior in an environment of high external and fiscal uncertainty are significant factors guiding inflation’s future trajectory. Consequently, information in this context will help define the future monetary rate decisions that will allow inflation to continue converging toward the 3% target.

- In this sense, monetary policy interest rate decisions continue to support the sustainable recovery of economic growth and maintain the prudence required given the continuing risks surrounding the future behavior of inflation.

Monetary Policy Presentation (only in Spanish)

Box Index

Box 1: Instantaneous infation in Colombia

Caicedo-García, Edgar; Martínez-Rivera, Wilmer Osvaldo; Vallejo-Peña, Juan Camilo; Garavito-Plata, Gabriel Adolfo

Box 2: Estimated effects of the minimum wage on infation in Colombia

Martínez-Cortés, Nicolás; Restrepo-Ángel, Sergio

Box 3: Energy demand as an indicator of industrial activity in Colombia

Cortázar, Diana; Villanueva, Nicolás