Monetary Policy Report - January 2026

The Monetary Policy Report presents the Bank's technical staff's analysis of the economy and the inflationary situation and its medium and long-term outlook. Based on it, it makes a recommendation to the Board of Directors on the monetary policy stance. This report is published on the second business day following the Board of Directors' meetings in January, April, July, and October.

During 2025, annual headline inflation (5.1%) stopped decreasing and remained above the 3% target, staying at a similar level to the end of 2024 (5.2%). The Colombian economy continued to grow, driven by vigorous consumption, in an environment of rising fiscal stimulus, higher household income, and low unemployment. Inflation expectations among businesses, analysts, and financial markets increased significantly across all time horizons and moved further away from the 3% target after the decision to significantly raise the minimum wage. In this context—characterized by excess demand and rising inflation expected for 2026—the Board of Directors of Banco de la República decided to adjust its monetary policy stance to ensure that inflation returns to its convergence toward the 3% target by 2027. This reaffirms Banco de la República’s commitment to its constitutional mandate of preserving the purchasing power of the currency and achieving the maximum sustainable levels of output and employment.

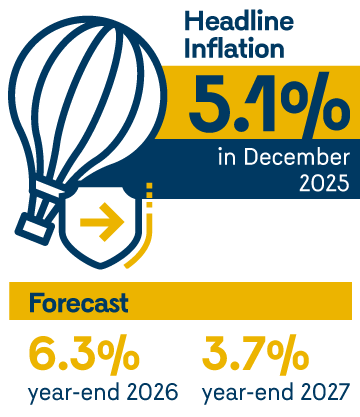

In 2025, inflation stopped declining and remained above the 3% target. It is expected to rise to 6.3% in 2026 and then fall to 3.7% by December 2027, within a context of excess demand, solid economic growth, high employment levels, and increased labor costs in 2026.

- Inflation remained relatively stable in 2025, standing at 5.1% in December—close to 2024 levels and above the 3% target. Core inflation, which excludes volatile components such as food and regulated items, rose to 5.0% by the end of the year.

- The high level of inflation in 2025 was driven by several factors: a strong domestic economy growing above its productive capacity; price adjustments guided by 2024 inflation, which exceeded the 3% target; cost pressures from wage increases above inflation plus productivity, and from the reduction in working hours; increases in the prices of certain food items; and upward pressures on natural gas prices early in the year.

- These factors helped offset other elements such as lower international commodity prices, a stronger exchange rate that reduced imported goods prices, abundant supply of perishable foods, and low adjustments in fuel prices and some public service fees.

- During 2026 inflation is expected to rise mainly due to the substantial increase in the minimum wage and strong consumption, both public and private, despite exchange rate behavior. By 2027 inflation is projected to decline again and approach the 3% target, mainly supported by monetary policy decisions.

- Uncertainty surrounding future price behavior remains high, with risks mostly tilted to the upside. These are especially due to the historically large minimum wage increase and the size of its impact on prices, uncertainty regarding the future path of the exchange rate due to external and domestic factors, and difficulties projecting prices of certain regulated goods and services, among others.

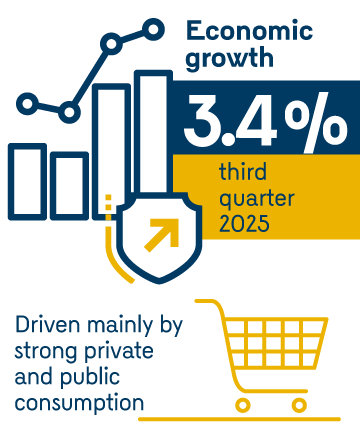

In 2025, economic activity likely accelerated, driven mainly by strong private and public consumption within a context of dynamic household disposable income, growing fiscal deficit, and high employment levels. The economy enters 2026 with strong domestic demand, which puts upward pressure on both inflation and the current account deficit.

- During the third quarter of 2025, the economy grew 3.4%, mainly driven by strong private and public consumption.

- Household consumption continued to increase sharply, with notable growth in durable goods consumption. This performance was supported by higher household disposable income, boosted by strong inflows of remittances from Colombians abroad, spending by foreign tourists in Colombia, sustained good income from coffee sector, high employment levels, and improved consumer confidence.

- Investment also increased during the third quarter of 2025. Machinery and equipment component, especially transportation equipment and capital goods for agriculture, was the main contributor. Infrastructure projects performed well, while housing investment continued to show weak performance.

- With data through November, employment continued growing, especially in rural areas. The unemployment rate remained at historically low levels. However, informal employment rose, reaching 55.8%, driven by recent increases in non-salaried employment.

- The economy is expected to continue growing in 2026, although at a slightly slower pace. Consumption will likely remain dynamic, supported by a persistent fiscal deficit, strong remittance inflows, favorable momentum in foreign tourism, still high coffee prices, and, at least in the short term, higher real wages.

- In 2027, the economy is expected to continue adjusting within a context of a less dynamic external income and the accumulated effects of monetary policy, consistent with inflation returning to its target.

- These projections remain highly uncertain due to international political and trade tensions and domestic risks related to the fiscal situation.

The Board of Directors reaffirms its commitment to bringing inflation back to the 3% target and achieving the maximum sustainable levels of output and employment, in line with its constitutional mandate. The expected increase in inflation in 2026 requires raising the policy interest rate to ensure that inflation returns to a downward path.

- Inflation stopped decreasing in 2025, remained above the 3% target, and is expected to rise in 2026, with significant upside risks.

- Inflation expectations among economic agents increased significantly and now exceed the 3% target, in an environment where strong cost pressures are anticipated from the large increase in the minimum wage.

- At the end of 2025, the economy remained very dynamic, exhibiting excess spending reflected in a higher external trade deficit (the difference between imports and exports), along with historically high employment levels.

- In this context, the Board of Directors of Banco de la República raised the monetary policy rate by 100 basis points in its January 2026 meeting, bringing it to 10.25%.

- The Board’s decision is meant to ensure that inflation returns to a downward path toward the target. Future decisions will depend on the evolution of inflation and expectations, economic activity dynamics, and the balance of domestic and external risks.

Monetary Policy Presentation (only in Spanish)

Box Index

Box 1. Posibles efectos macroeconómicos del aumento del salario mínimo (only in Spanish)

Ávila-Montealegre, Óscar Iván; Grajales-Olarte, Ánderson; Ramos-Veloza, Mario Andrés; Ospina-Tejeiro, Juan José

Box 2. Incorporación del mercado laboral en el modelo 4GM (only in Spanish)

Naranjo-Saldarriaga, Sara; Pulido-Pescador, José David; Ramos-Veloza, Mario Andrés