Control, Oversight, and Surveillance Agencies

In order to achieve its objectives and perform its constitutional functions, Banco de la República (the Central Bank of Colombia) has a control framework based on the permanent strengthening of the Internal Control System and the promotion of a control culture, in addition to the control, supervision, and oversight performed by different agencies over its management.

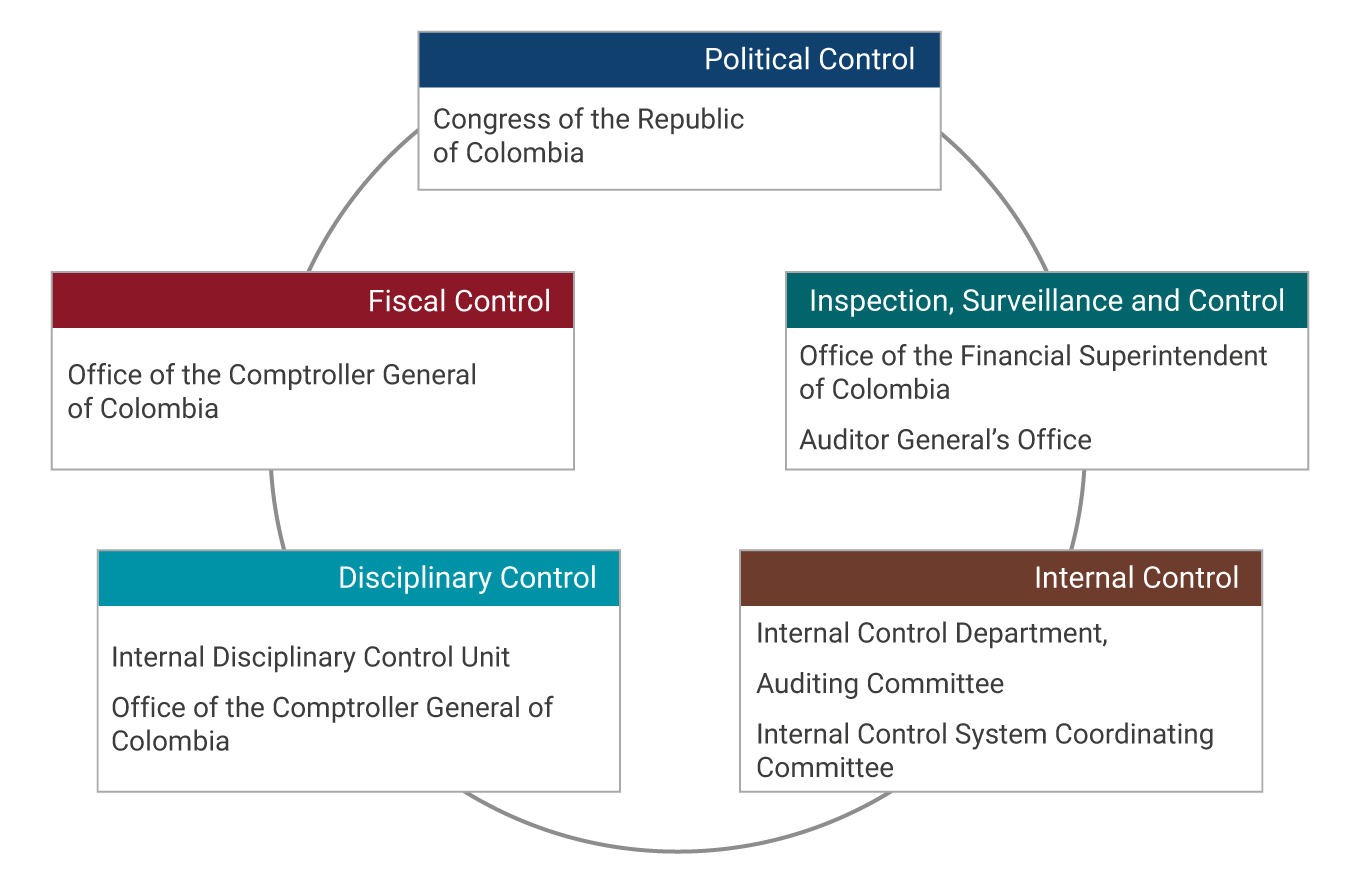

1. Control fronts

In order to verify the status of the Bank's Internal Control System and with the purpose of contributing to its strengthening and continuous improvement, several agencies exercise control over the institution's management on various fronts:

The following is a detail of the control fronts, the agencies that perform these functions, and the regulations that govern their actions before the Bank.

1.1 Political Control

As per the Political Constitution of Colombia and Act 31 of 1992, Banco de la República (the Central Bank of Colombia) must submit to the Congress of the Republic of Colombia, twice a year, a report on the execution of monetary, foreign exchange, and credit policies. This report should include its general guidelines, the assessment of results from the previous period, and the objectives, purposes, and goals for the following period and in the medium term. It also reports on the management of foreign reserves and on the Bank's financial situation and its outlook.

- Web addresses: https://www.senado.gov.co and https://www.camara.gov.co

- Phone numbers: +57 (601) 382-3000 and +57 (601) 382-4000

- Address: Calle 11 # 5-60, Bogotá D.C.

- E-mail address: atencionciudadanacongreso@senado.gov.co

1.2 Inspection, Surveillance and Control: Financial Superintendency of Colombia (Inspection and Surveillance) and General Auditing (Control)

Pursuant to the Political Constitution of Colombia, the President of the Republic of Colombia is responsible for the inspection, oversight, and control of Banco de la República, under the terms established by law. The President delegates the functions of inspection and oversight to the Office of the Financial Superintendent of Colombia and appoints an auditor to exercise the control function, a task entrusted to the Auditor General’s Office of the Bank, which operates with complete independence from the Central Bank´s administration.

- Web address: https://www.superfinanciera.gov.co

- Phone numbers: +57 (601) 594-0200 y +57 (601) 594-0201

- Address: Calle 7 # 4-49, Bogotá D. C.

- E-mail address: super@superfinanciera.gov.co

More information about Auditor General’s Office: https://www.banrep.gov.co/es/banco/gobierno-corporativo/auditoria-gener…

- Address: Carrera 7 #14-78, Bogotá, D. C.

1.3 Fiscal Control: Office of the Comptroller General of Colombia

The Office of the Comptroller General of Colombia performs a control function over the activities in which Banco de la República (the Central Bank of Colombia) acts as fiscal agent of the Government, which are limited to the administration of the national government´s securities and the administration of the nation’s funds.

- Web address: https://www.contraloria.gov.co

- Phone number: +57 (601) 518-7000

- Address: Carrera 69 # 44-35. Bogotá, D. C.

- E-mail address: cgr@contraloria.gov.co

1.4 Disciplinary Control: Internal Disciplinary Control Unit and Office of the Inspector General of Colombia

The Office of the Comptroller General also acts with respect to the conduct of employees in cases of disciplinary offenses.

Since 1996, the Bank has had an Internal Disciplinary Control Unit, which is in charge of preventive and management disciplinary functions, within the framework of the principles of impartiality and transparency, based on constitutional, legal, and regulatory provisions.

In addition, the Inspector General’s Office acts in relation to the conduct of Banco de la República’s employees in cases of disciplinary misconduct.

- Web address: https://www.procuraduria.gov.co

- Phone number: +57 (601) 587-8750

- Address: Carrera 5 # 15-80, Bogotá, D. C.

- Contact us: https://www.procuraduria.gov.co/PQRSDF/Pages/default.aspx

1.5 Internal Control: Internal Control Department (Internal Audit function), Audit Committee, and Institutional Internal Control Coordinating Committee

Pursuant to the functions assigned by Act 87 of 1993, the Internal Control Department (Internal Audit function) independently assesses the Bank's Internal Control System and proposes recommendations to the Bank’s Administration for the improvement of said system.

In addition, the Institutional Internal Control Coordinating Committee is an advisory and decision-making body on the Central Bank’s Internal Control System matters, whose purpose is to recommend the necessary corrective measures or modifications for the fulfillment of the system’s objectives. The Audit Committee is the advisory and support body for the Board of Directors and the Administrative Council in its function of ensuring the adequate preparation, presentation, and disclosure of financial reporting and assessing the operation of the Internal Control System.

2. Internal Control System

It is the set of rules, plans, resources, methods, and verification mechanisms implemented by the Bank to ensure that its activities, processes, and actions are carried out with high levels of quality, timeliness, and transparency in compliance with the regulatory provisions in force and with the institutional objectives. The Internal Control System adopts the Internal Control Standard Model established by the Administrative Department of Public Function.

Internal control is part of all the Bank's management systems and is exercised by each person involved in the operation.

3. Control culture

It is the capability of employees to perform and assess their work detecting deviations, taking corrective actions, and requesting advice when they consider it necessary. Banco de la República (the Central Bank of Colombia) develops training, awareness and releases activities aimed at strengthening this culture, ensuring that the execution of processes, activities, and tasks are carried out with transparency and effectiveness.