In September last year, a blog was published announcing the quarterly publication of the National Accounts by Institutional Sector (CNSI in Spanish), which include the national accounts by the National Administrative Department of Statistics (DANE in Spanish) and the financial accounts by Banco de la República (the Central Bank of Colombia). This set of accounts and their remarkable periodicity was described as a great progress in the Colombian statistical system, allowing for the monitoring of the real and financial economic balance sheets of the various economic agents and their interrelationships.

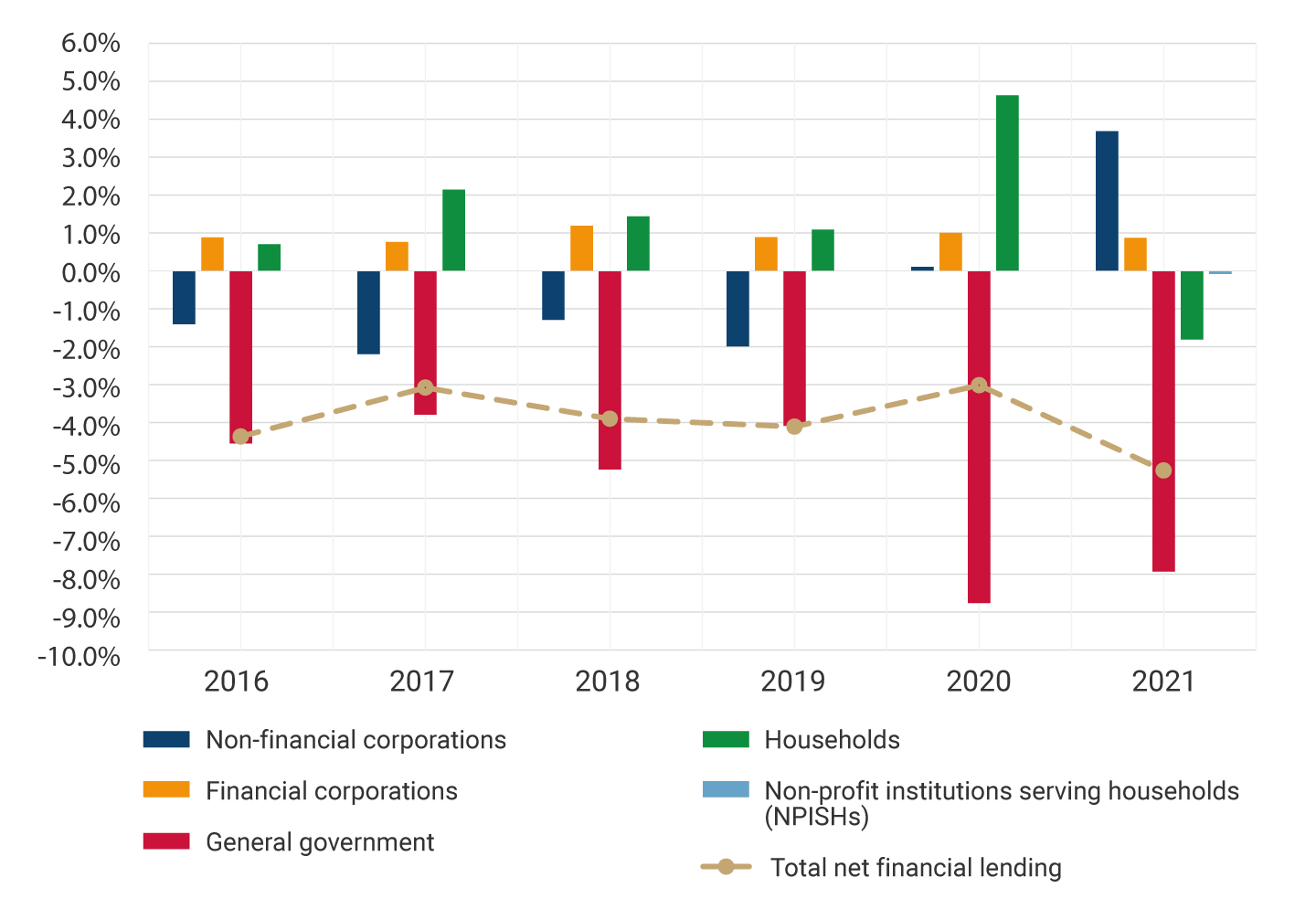

That blog showed that, as a result of the Covid-19 pandemic in 2020, households had a substantial increase in their savings levels due to the sharp reduction of their current consumption, forced, among other factors, by the confinement, in a context in which their disposable income was sustained thanks to the increase in transfers coming mainly from the general government 1 and the income from foreign remittances, which were important that year. This behavior, combined with the surplus of financial institutions, more than offset the significant expansion of the general government deficit resulting from the sharp fall in tax revenues and extraordinary expenses to deal with the emergency. As a result, the balance of the economy’s financial flows as a whole (called total net financial lending ) was less negative than in previous years (Graph 1).

Graph 1. Annual financial balances as a percentage of nominal GDP

Source: Banco de la República, Financial Accounts

The post pandemic economic recovery produced substantial changes in macroeconomic balances in 2021, as shown in Graph 1. At the aggregate level, the economy showed a significantly more negative financial balance, as shown by the total net financial lending, which reached -5.3% of GDP, the highest in the graph series. The real counterpart to this result was one of the highest current account deficits in recent years, which in macroeconomic terms means a significant shortfall in savings compared to the economy’s investment. This greater imbalance was largely induced by the dramatic shift in households’ balance sheet, which went from positive net financial positions of 4.6% of GDP in 2020 to net borrowing of 1.8% of GDP in 2021. In addition, the reactivation of household aggregate expenditure and the progressive decline in transfers in 2021 explains the households’ negative net balance, which was financed through loans, other accounts payable, and the reduction of their deposits, which in practice meant a dissaving on its resources.

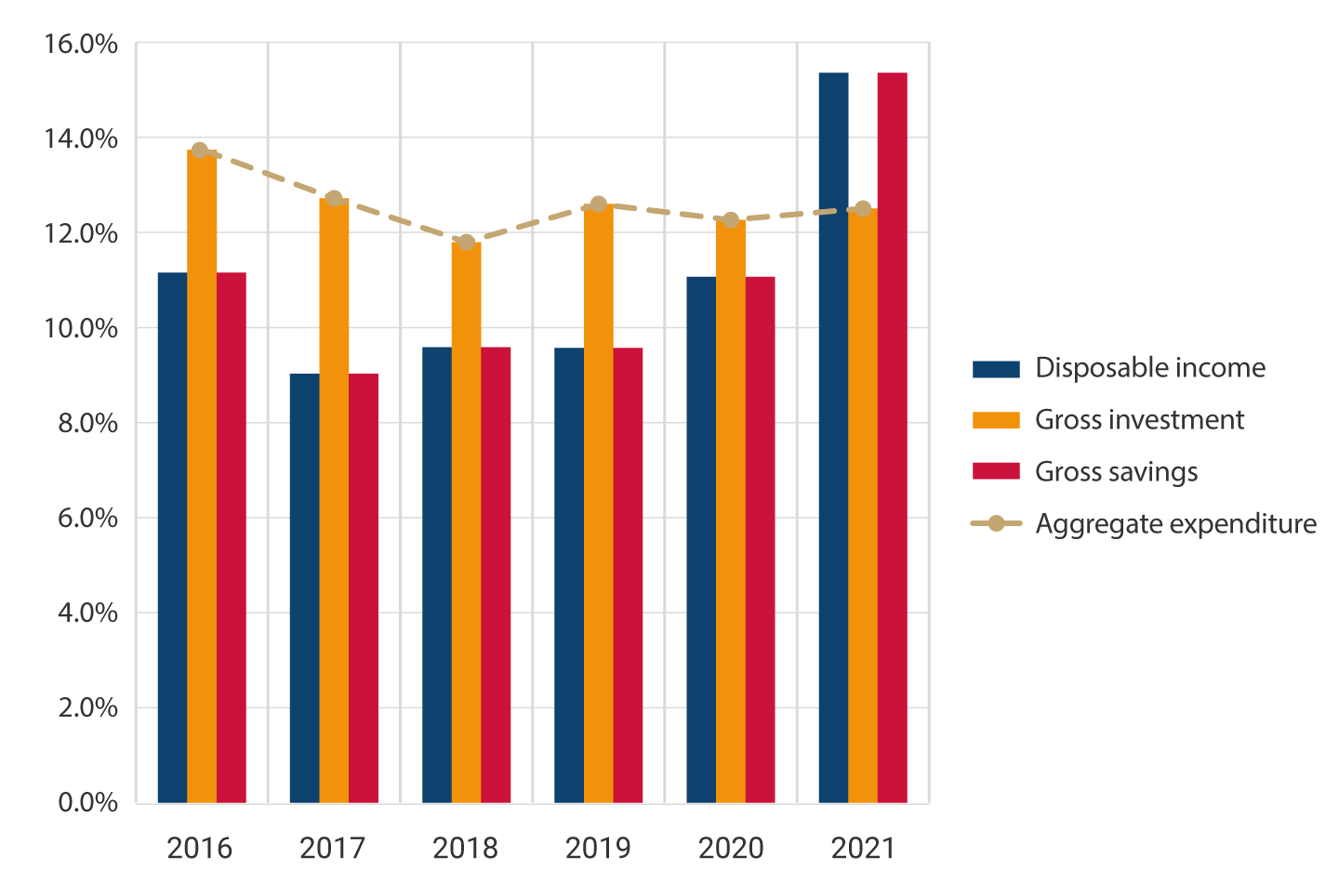

As shown in Graph 1, the negative financial balance of households was partially offset by the expansion of the positive net financial balance of non-financial corporations, which basically comprises companies. This result is explained by the substantial increase in the share of non-financial corporations’ disposable income in GDP during 2021, thanks to the economic recovery and the increase in sales (Graph 2). Nevertheless, the share of gross investment in GDP of these corporations remained relatively constant, as did their aggregate expenditure. As a result, the gross savings of non-financial corporations increased, resulting in a significant accumulation of money and deposits, equity, and accounts receivable on the balance sheets of these institutions.

Graph 2. non-financial corporations’ balance by component

(% of nominal GDP)

Source: DANE, Non-Financial Accounts

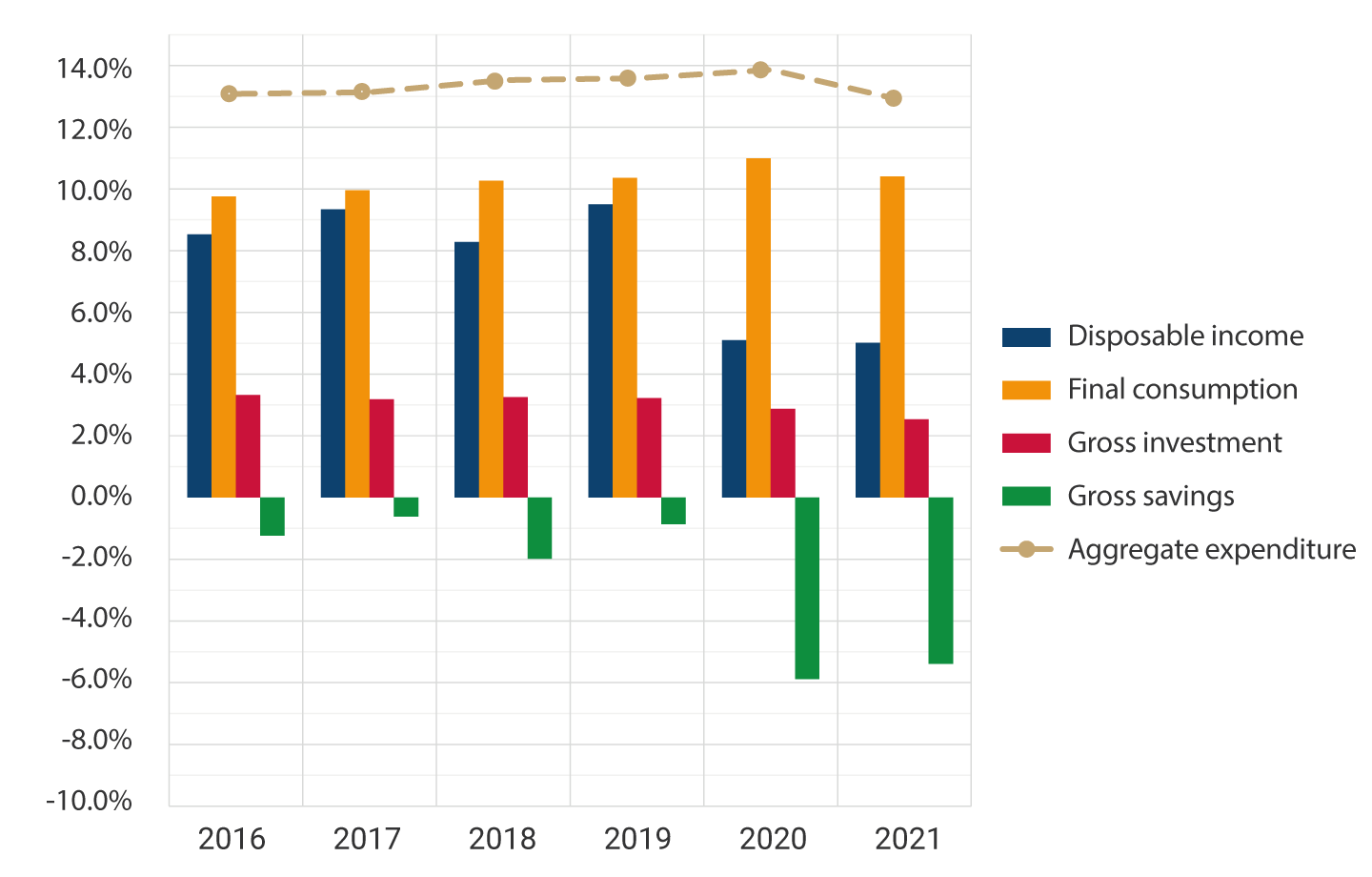

Finally, the financial debtor position of the general government in 2021 showed a slight improvement from a deficit of 8.8% to 7.9% of GDP, which remains a historically high imbalance in terms of fiscal deficit and dissaving (Graph 1). The marginal correction of the public balance sheet is explained by the fact that the shares of consumer and investment expenditure, and consequently their aggregate expenditure, fell slightly, while the share of disposable income remained stable, which was reflected in less negative gross savings of the general government (Graph 3). Therefore, this helped contain public debt flows as a percentage of GDP.

Graph 3: General government balance by component

(% of nominal GDP)

Source: DANE, Non-Financial Accounts

The behavior of the macroeconomic balances of institutional sectors in 2021 looks atypical when viewed in retrospect. Households are usually a source of savings that finance corporate investment. These roles were disrupted last year with households’ dissaving and going into debt, and companies that, thanks to improved incomes, saved and increased their financial assets but did not expand their investment. Sustainable growth would require companies to reinvest actively and households to save. On the other hand, despite its slight improvement in 2021, the general government deficit remains excessively negative, which is reflected in a large external balance deficit, generating upward pressure on risk premiums and a trend toward exchange rate depreciation.

The results of the National Accounts by Institutional Sector (CNSI) for the first quarter of 2022, and the DANE reports of GDP growth for the first two quarters of the year, show that households have continued to deteriorate their financial balance as a result of the strong dynamics of their consumption, which is expanding at a rate of more than 12.0% per year. At the same time, the current account deficit for the first half of the year was at a historically high level of 5.9% of half-yearly GDP, higher at 1,2 percentage points from the same period in 2021 2. Achieving a rebalancing of the economy that ensures high and sustainable growth in the coming years is one of the main challenges currently facing the country’s monetary and fiscal policy.

1 The general government includes the central national government, local governments, and social security.

2 Balance of payments numbers for the first half of 2022 prepared by Banco de la República.