Introduction

In its most recent financial report for 2023 (only available in Spanish), Banco de la República (the Central Bank of Colombia or Banrep) reported historical profits of 9.2 trillion of Colombian pesos, mainly due to the yield of the international reserves (IR) . In order to understand the origin of these high results, it should be considered that international reserves represented 78% of Banrep's total assets in 20231. It should also be noted that variations in Colombian pesos in the balance of the international reserves arising from changes in the exchange rate of the peso compared to the currencies in which they are invested have no impact on Banrep's Income Statement (P&L).

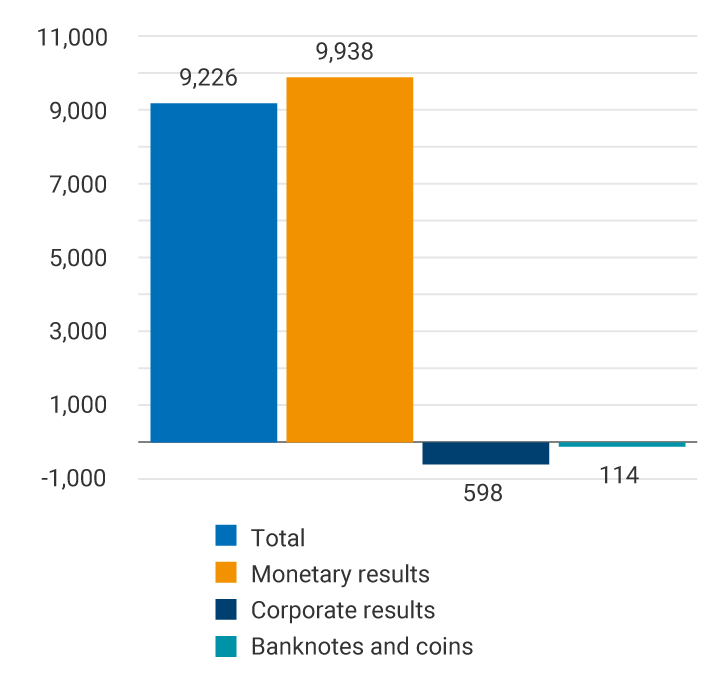

Banco de la República's P&L can be broken down into monetary, issuing bank, and corporate results. The monetary results include, among others, the net income from monetary, foreign exchange, and credit activities and from the international reserves management. Issuing bank results i correspond to the difference between the face value of coins put into circulation minus the expenses for issuing and putting into circulation monetary species. Corporate results are derived from the Bank's administrative management, including income from commissions and cultural activities and the personnel and operating expenses, among others. Unlike private sector companies, which seek to maximize profits, the policy decisions made by the Bank are aimed at fulfilling the objectives assigned to it by the Constitution and the Law.

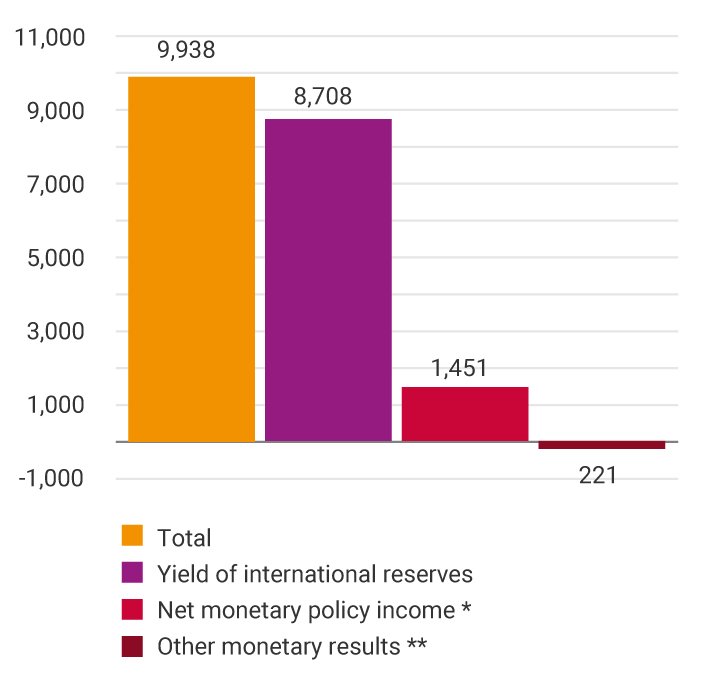

As shown in Graph 1, in 2023, profits are explained by monetary results, whose net income amounted to 9.9 trillion of Colombian pesos (Panel A). Among these, the main component was the yield of international reserves recorded in the P&L for 8.7 trillion of Colombian pesos (Panel B).

Graph 1: Profits of Banco de la República and their Breakdown in 2023

Panel A: Total profits

Billions of Colombian pesos

Panel B: Monetary results

Billions of Colombian pesos

* It is defined as the difference between income from interest and yields of the securities portfolio held by Banrep and from expansionary repo transactions minus the expenses for the remuneration of deposits of the Colombian Government and contractionary in the Bank.

** Corresponds to the net result from foreign exchange differences minus the commitment fee of the flexible credit with the International Monetary Fund (IMF) and the administration and management expenses of funds abroad, mainly.

Source: Banco de la República

Yield of the International Reserves

Given the relevance of international reserves in the Bank's results, it is essential to understand that their yield is mainly linked to the behavior of external interest rates. It is important to note that a change in such rates impacts their profitability on foreign currency in two ways: i) it affects the accrual of interest and yields as the investment portfolio is renewed through the acquisition of securities earning the new interest rates (accrual effect), and ii) it changes the market value of the securities acquired before the change in rates, creating immediate appreciation or depreciation of such portfolio (price effect). When external interest rates increase, an immediate effect on the asset is generated by the devaluation of the international reserves portfolio that affects the Bank’s results, which is offset over time with the interest accrual at higher rates2.

Thus, the external interest rate cycle is an essential element in understanding the evolution of the international reserves yield and, consequently, of the Bank's profits. As presented in Graph 2, Panel A, this cycle was characterized by a downward dynamic in 2019 and 2020 that brought rates to low levels due to the economic policy actions to address the pandemic. The reductions in external rates implied valuations that, together with the interest generated, resulted in high levels in the Bank's profits (Graph 2, Panel B)3. External interest rates remained low for most of 2021. However, they increased from the end of that year, especially during 2022, in response to expectations of monetary policy tightening in most advanced economies. Under these conditions, the international reserves yield was negative in both years due to the portfolio devaluations, which the interest earned4 could not offset.

Grapgh 2. Sovereign Bonds Rates and International Reserves Yields in the P&L

Panel A: Two-year Sovereign Bonds Yield Rates

Percentage

Source: Bloomberg

Panel B: Total Results and International Reserves Yield Recorded in the P&L

Billions of Colombian pesos

Source: Banco de la República

The interest rate increase cycle by the main central banks continued until the first half of 2023, which kept high rates in the main foreign markets and, consequently, increased the international reserves yield due to the interest accrual effect. In addition, in 2023, significant portfolio appreciations were observed at the end of the year, in line with expectations of external interest rates reductions due to monetary policy easing in the main advanced economies in 2024.

1 On average, this participation was 84% in the last ten years.

2 See Blog of 14 July 2021: Utilidades del Banco de la República y el rendimiento de las reservas internacionales.

3 In nominal terms, between 1994 and 2018, the highest level of profits was observed in 2018, when these amounted to 2.2 trillion of Colombian pesos.

4 The total yield of international reserves in 2022 was negative and amounted to -2 trillion of Colombian pesos. Due to the change in the accounting treatment of international reserves as of 2022 (Decree 2443 of 12 December 2022), the yield of these reserves recorded in the P&L for this same year was -332 billion of Colombian pesos. For more details on the treatment of foreign reserves, see Shaded section 3, "Cambio en el tratamiento contable de las reservas internacionales" (Change in Accounting Treatment of international Reserves in English) of the Report to the Congress of March 2023.