Documentos de trabajo

|

Dos rasgos característicos de muchas economías desarrolladas y en desarrollo de los últimos dos decenios han sido la gran expansión de sus agregados monetarios, por encima del aumento de su ingreso nominal, y la reducción de sus tasas de inflación.

|

|

Una reducción del impuesto sobre la renta de las empresas en Colombia aumentaría el crecimiento económico, pero generaría efectos redistributivos no deseados: ampliaría la brecha de la distribución de los ingresos de los hogares y afectaría negativamente el bienestar de aquellos con restricciones...

|

|

We study the network of Colombian sovereign securities settlements. With data from the settlement market infrastructure we study financial institutions’ transactions from three different trading and registering individual networks that we combine into a multi-layer network.

|

|

Network analysis has been applied to identify systemically important financial institutions after the 2008 financial crisis. Such applications have stressed the importance of centrality within the too-connected-to-fail concept.

|

|

In the present paper we remark that the absence of an intrinsic or fundamental value represents a problem for the stability of the bitcoin’s price as an asset. In addition, we consider some financial stability concerns that derive from the hypothesis that the bitcoin will survive as an asset...

|

|

Despite various payment innovations, today, cash is still heavily used to pay for low-value purchases. This paper develops a simulation model to test whether standard implications of the theory on cash management and payment choices can explain the use of payment instruments by transaction size.

|

|

Defining whether a financial institution is systemically important (or not) is challenging due to (i) the inevitability of combining complex importance criteria such as institutions’ size, connectedness and substitutability; (ii) the ambiguity of what an appropriate threshold for those criteria may...

|

|

The most recent financial crisis unveiled that liquidity risk is far more important and intricate than regulation have conceived. The shift from bank-based to market-based financial systems and from Deferred Net Systems to liquidity-demanding Real-Time Gross Settlement of payments explains some of...

|

|

An interacting network coupling financial institutions’ multiplex (i.e. multi-layer) and financial market infrastructures’ single-layer networks gives an accurate picture of a financial system’s true connective architecture. We examine and compare the main properties of Colombian multiplex and...

|

|

Evidence suggests that the Colombian interbank funds market is an inhomogeneous and hierarchical network in which a few financial institutions fulfill the role of “super-spreaders” of central bank liquidity among market participants. Results concur with evidence from other interbank markets and...

|

|

We examine how liquidity is exchanged in different types of Colombian money market networks (i.e. secured, unsecured, and central bank’s repo networks). Our examination first measures and analyzes the centralization of money market networks. Afterwards, based on a simple network optimization...

|

|

This document presents an enhanced and condensed version of preceding proposals for identifying systemically important financial institutions in Colombia. Three systemic importance metrics are implemented: (i) money market net exposures network hub centrality; (ii) large-value payment system...

|

|

Scale-free (inhomogeneous) connective structures with modular (highly clustered) hierarchies are ubiquitous in real–world networks. Evidence from the main Colombian payment and settlement systems verifies that local financial networks have self-organized into a modular scale-free architecture that...

|

|

A core goal of regulators and financial authorities is to understand how market prices convey information on the financial health of its participants. From this viewpoint we build an Early-Warning Indicators System (EWIS) that allows for identifying those financial institutions perceived as risky...

|

|

Economic activity nowcasting (i.e. making current-period estimates) is convenient because most traditional measures of economic activity come with substantial lags. We aim at nowcasting ISE, a short-term economic activity indicator in Colombia. Inputs are ISE’s lags and a dataset of payments made...

|

|

Large value payment flows can be disrupted by several types of failures such as operational incidents, problems experienced by the administrator of the payments settlement system, outages in the communications networks and the inability of a participant to submit payments due to insufficient...

|

|

We implement a modified version of DebtRank, a measure of systemic impact inspired in feedback centrality, to recursively measure the contagion effects caused by the default of a selected financial institution. In our case contagion is a liquidity issue, measured as the decrease in financial...

|

|

Under the view that the market is a weighted and directed network (Barabási, 2003), this document is a first attempt to model the Colombian money market within a spatial econometrics framework. By estimating two standard spatial econometric models, we study the cost of collateralized borrowing (i.e...

|

|

The most recent episode of market turmoil exposed the limitations resulting from the traditional focus on too-big-to-fail institutions within an increasingly systemic-crisis-prone financial system, and encouraged the appearance of the too-connected-to-fail (TCTF) concept. The TCTF concept...

|

Borradores de Economía - Uncertainty in the money supply mechanism and interbank markets in ColombiaWe set a dynamic stochastic model for the interbank daily market forfunds in Colombia. The framework features exogenous reserve requirements and requirement period, competitive trading among heterogeneouscommercial banks, daily open market operations held by the Central Bank(auctions and window...

|

|

This paper presents a methodology to estimate the intraday liquidity that systemically important entities (SIE) need to fulfill all its obligations in a timely fashion, when a simulated failure-to-pay from its main liquidity supplier by discretionary concepts of payment occurs. Using the Bank of...

|

|

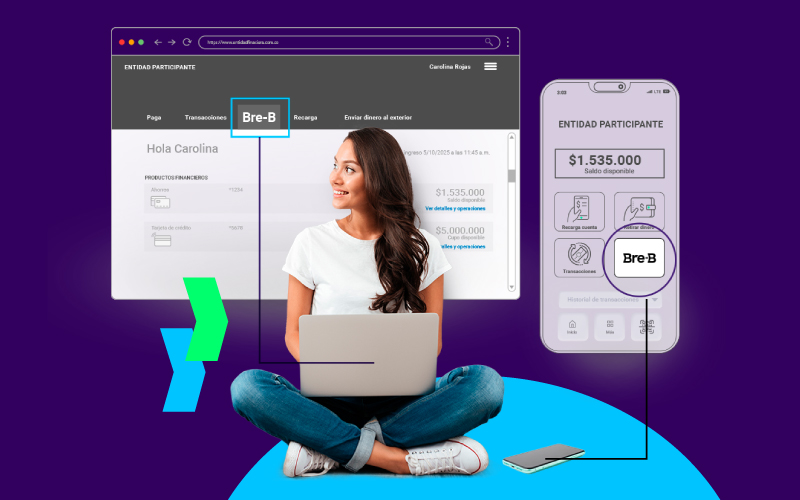

EnfoqueEste trabajo identifica los retos en la adopción de servicios de pagos inmediatos en Colombia para transacciones entre personas y negocios.

|

|

EnfoqueEste trabajo busca identificar qué explica la demanda de efectivo. Se utiliza la aproximación de Drehman et al. (2002) y Amromin y Chakravorti (2009), donde se hace una distinción entre la demanda por efectivo de altas denominaciones y de baja denominaciones. Se consideran determinantes...

|

|

EnfoqueEste estudio emplea modelos de Cópulas con Correlaciones Condicionales Dinámicas (DCC-Copula) para analizar las correlaciones entre los tipos de cambio de siete economías desarrolladas y diecisiete economías emergentes. A partir de estos resultados, y utilizando modelos de datos de panel...

|

|

Para 2017 se encontró que la mayor parte de las importaciones fueron destinadas al consumo intermedio, en especial para los sectores manufactureros y de comercio, y que estos sectores, por lo tanto, pueden ser los más afectados ante cambios en las medidas no arancelarias y en el valor de las...

|