As part of its efforts to monitor the country's economic activity, Banco de la República conducts monthly surveys among businessmen and representatives of productive sectors in all regions of the country. The results of these qualitative surveys are aggregated into a balance, known as the Regional Economic Pulse (PER), that reflects the annual change in regional and sectoral economic activity.

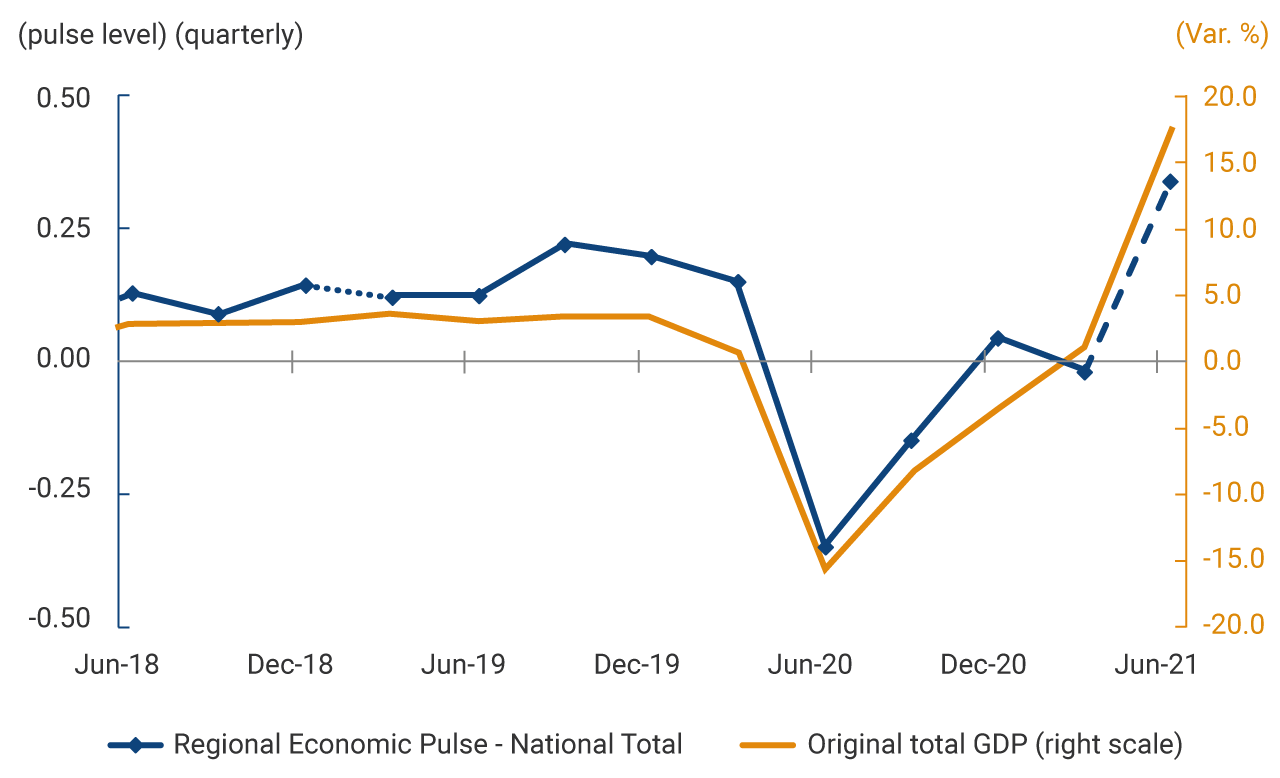

Graph 1 illustrates the changes in the aggregate quarterly PER for all the sectors and regions surveyed. As one can see, the change in the indicator is consistent with the progression in the annual quarterly GDP growth rate calculated by DANE. Specifically, the indicator accurately reflects the substantial decline in economic activity observed during the second quarter of 2020 and its recovery since then.

Graph 1. Pulse (PER) Nacional Total1 and Total GDP Nationwide

1/ Southwest, Antioquia, the coffee region, the Eastern Plains, the Northeast, the Caribbean, the central region and Bogota-Cundinamarca.

Source: Banco de la República, DANE; calculations by Banco de la República.

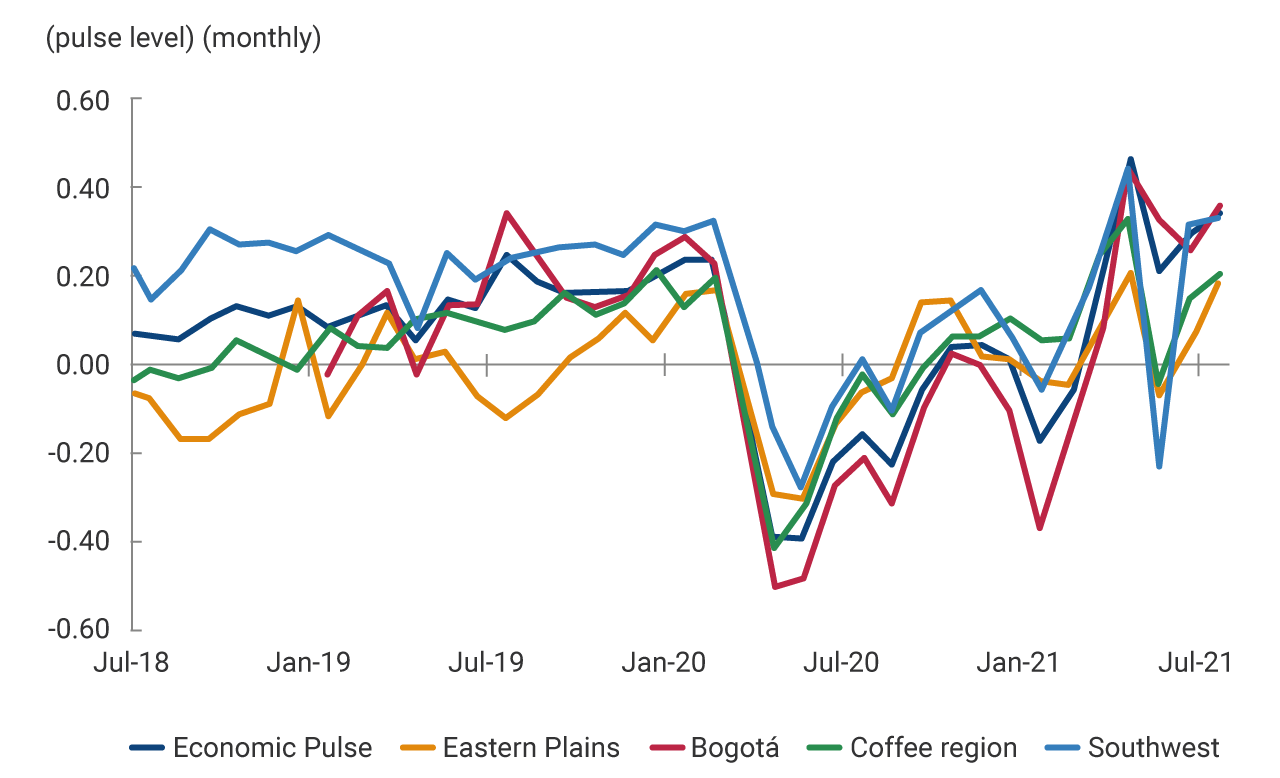

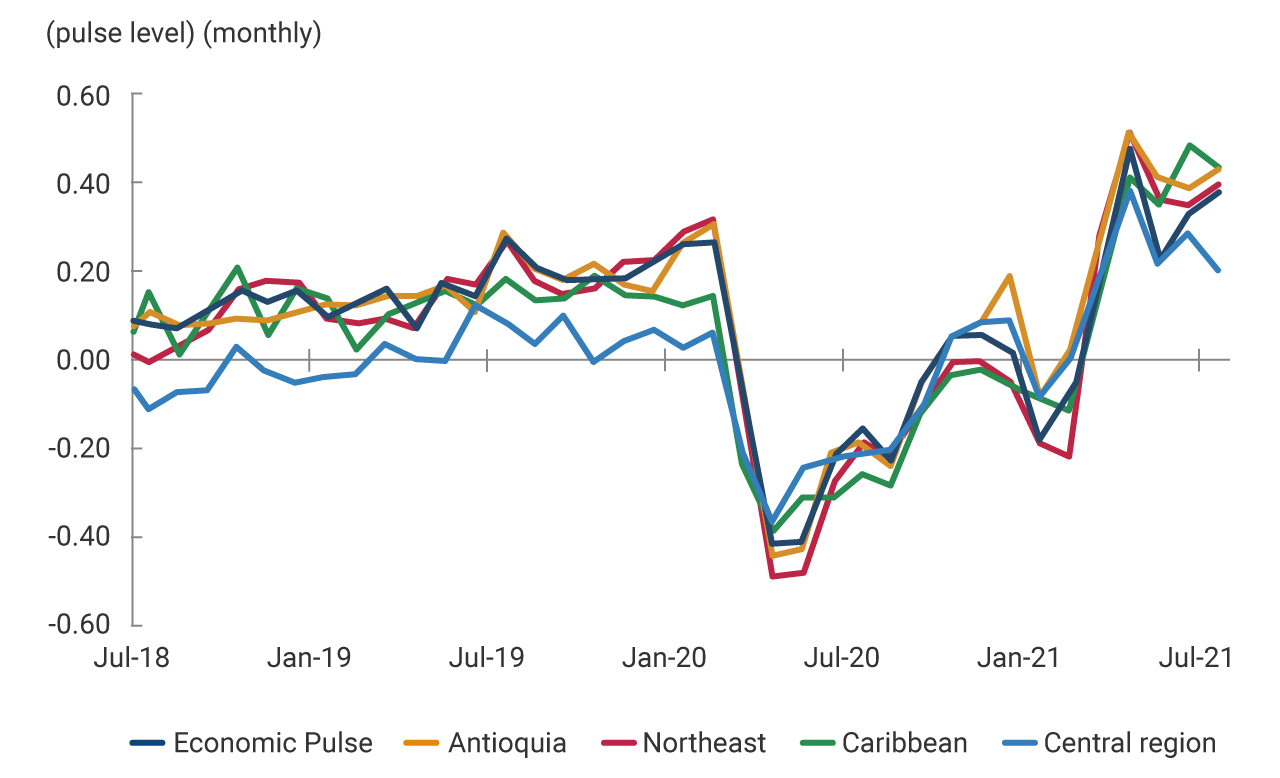

In its most broken-down form, the Pulse indicator can be obtained on a monthly basis and for each region and each sector covered by the survey. Graph 2 shows the monthly Pulse indicator for all the regions, grouped into two panels. The top panel contains the regions with an indicator of relatively high performance during 2021, reflecting a recovery above the national average. As shown, performance in the Caribbean and Antioquia during the last few months stands out.

The lower panel, on the other hand, groups the regions with performance that is below the national average during 2021. Given its weight in the national economy, the below-average performance of the Bogotá indicator in 2020, and its recovery during the most recent months, is noteworthy. In the Southwest, the coffee region and the Eastern Plains, the indicator reached negative values in May, given the slump in productive activity caused by problems with law and order. These were related to the national strike and disproportionately affected these regions. It is important to note that the drop in the indicator for the Southwest during May 2021 is comparable to the drop recorded in 2020, when the country's GDP suffered the worst setback in its recent history.

Graph 2. Regional Economic Pulse (PER). National Total2

2/ Includes the Southwest, Antioquia, the coffee region, the Eastern Plains, the Northeast, the Caribbean, central Colombia, Bogotá and Cundinamarca.

Source: Banco de la República.

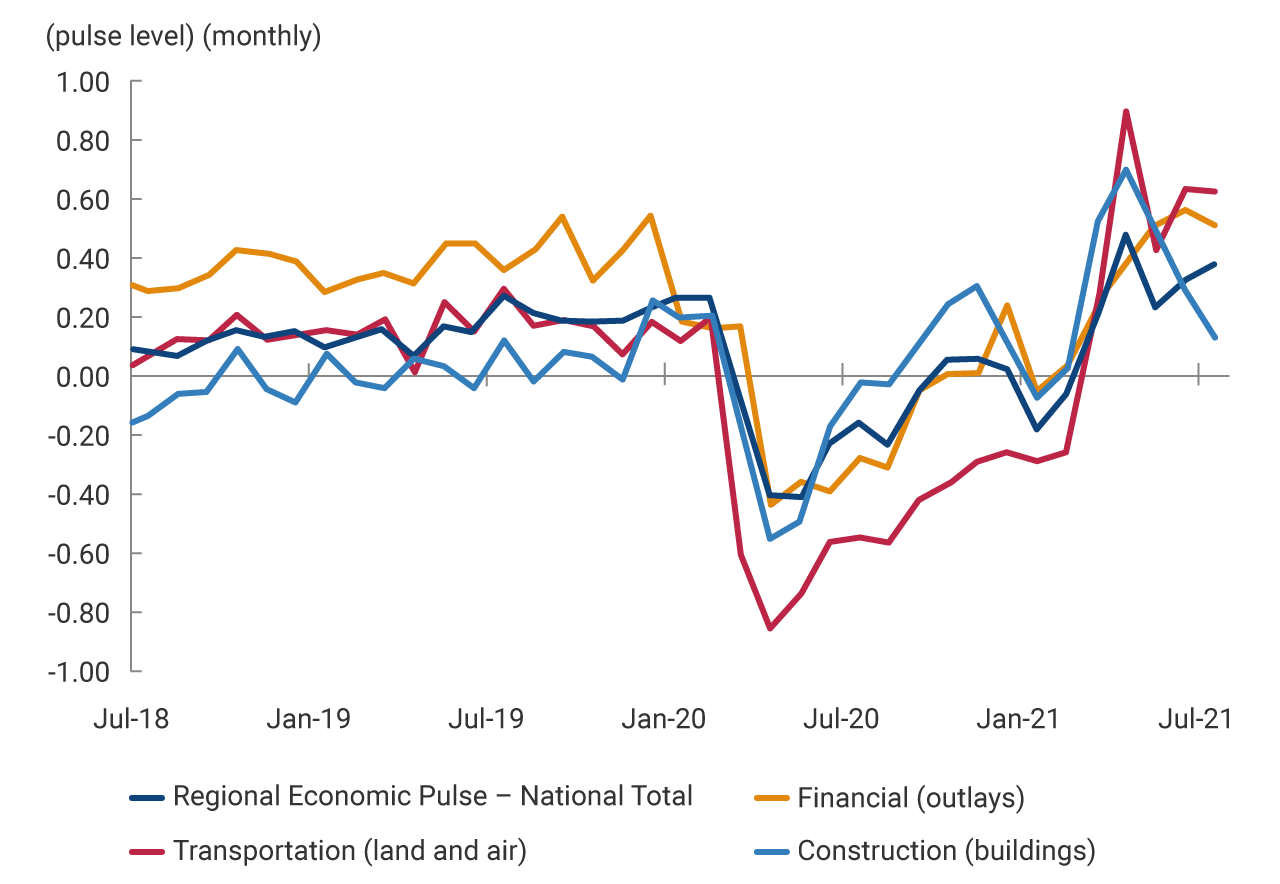

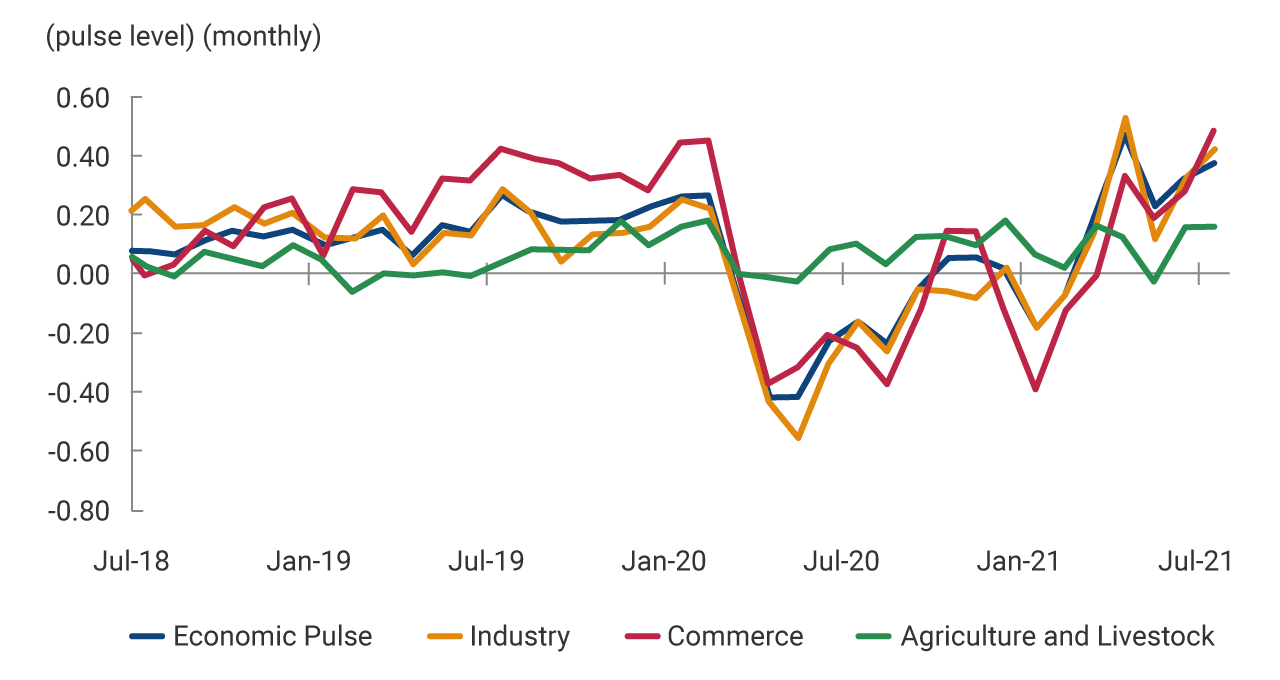

Graph 3. Regional Economic Pulse (PER). National Total3

3/ Includes the Southwest, Antioquia, the coffee region, the Eastern Plains, the Northeast, the Caribbean, central Colombia, Bogotá, and Cundinamarca.

Source: Banco de la República.

Graph 3 illustrates the sector Pulse indicator, grouped into two panels. The upper panel shows the indicator for sectors with performance that is generally above average for the last few months. The recovery in the transportation sector during 2021 stands out. However, it should be noted that this sector reported the worst performance in 2020 of all the productive branches surveyed. The indicators for the construction and financial sectors suggest they have performed close to average throughout the crisis and recovery period.

The lower panel in Graph 3 shows the sector indicators with growth that, in general, has been below the national average during the last few months. These branches include the agricultural sector. Its low balance during 2021 is due to the fact that it was the sector least affected by the pandemic in 2020. The sectors that were apparently most affected by the problems with law and order in May were industry and commerce. In any case, all the sectors show positive balances for the month of July, which is the last month covered by the survey.

The Regional Economic Pulse conveniently complements the other leading indicators that provide national or sector monitoring of the Colombian economy. The specific reasons that led to a significant difference in performance among the regions during the pandemic period pose an interesting challenge to the country's economic and social researchers.