Economic observers who monitor monetary policy often compare the timing of interest rate increase or decrease cycle decisions across countries to determine which countries were ahead and which were behind in their decisions. This might be correct if the countries had identical economic performance. But we know that this is not the case. For this reason, a judgment of this nature requires a more sophisticated analysis, which compares the calendars and the performance of key economic indicators at the beginning of the policy interest rate (MPR) increase and decrease cycles in each country. A recent note on monetary cycles published by the members of the Board of Directors of Banco de la República (the Central Bank of Colombia), Bibiana Taboada and Mauricio Villamizar, together with Manuela Bernal, addresses this complex task.

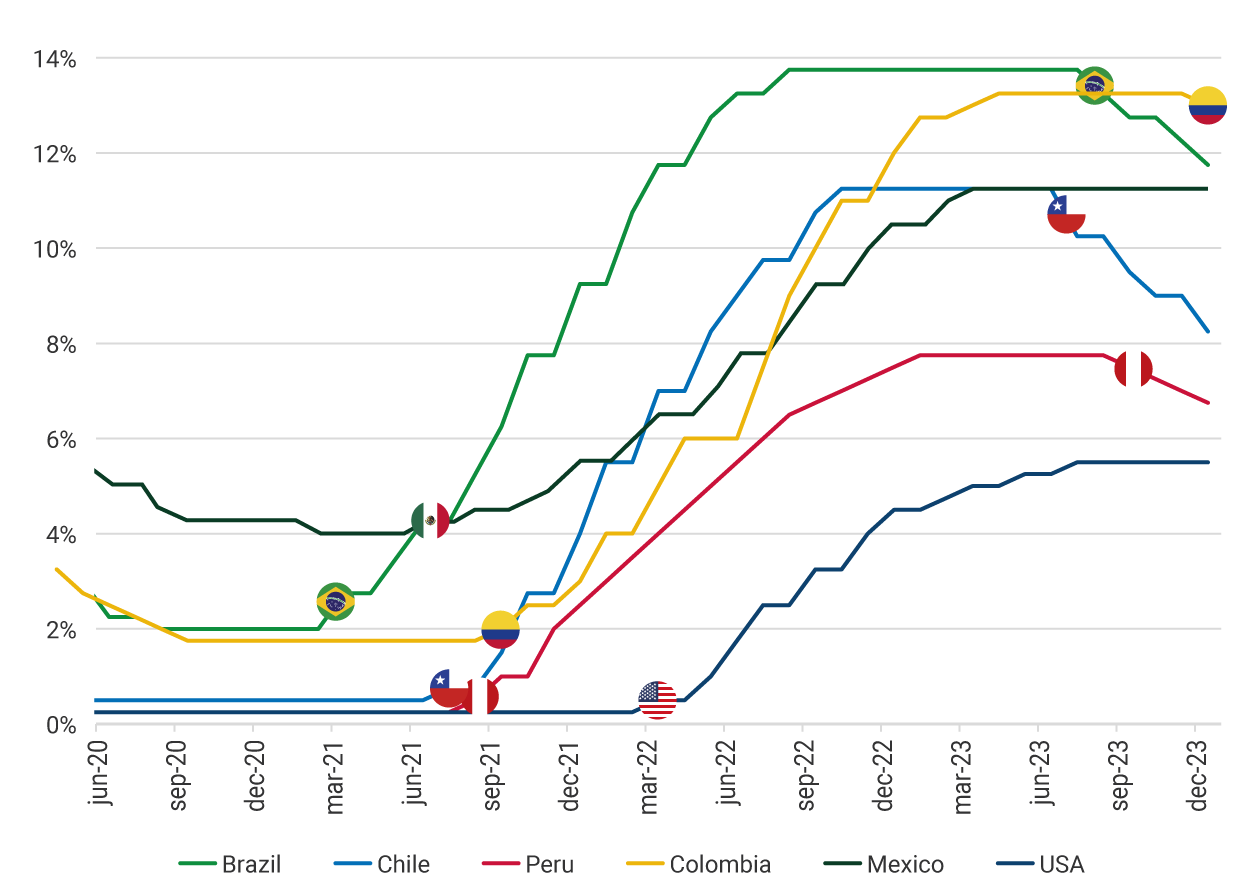

The note begins with the simple approach of comparing the beginning dates of Colombia's MPR increase and decrease cycles with similar countries in the region and with the United States. As shown in Graph 1, decisions to begin upward adjustments were made earlier in major Latin American economies, all of which began their policy tightening cycle in 2021. Brazil began in March of that year, while Mexico, Chile, Peru, and Colombia followed in June, July, August, and September, respectively, several months ahead of the advanced economies, and particularly the United States, which only did so in 2022, following Russia's invasion of Ukraine.

Graph 1. Dates that marked the beginning of monetary cycles for different countries

Source: Central bank of each country

If, instead of calendar dates, variables known or expected by the central banks at the beginning of the increase cycle of the MPR are used as a comparison criterion, it is possible to enrich the analysis (Table 1). For example, using observed inflation as a criterion, Chile and Peru appear ahead, and Colombia stands in the third place, in an intermediate position. In contrast, Brazil and Mexico are lagging, as their inflation rates were above 5.0% per year at the beginning of their hiking cycles.

An alternative comparison could be made considering the deviation of inflation in each country with respect to its target. Chile, Colombia, and Mexico have a 3.0% target; Peru and the United States have a 2.0% target, and Brazil's target for 2021 was 3.75%. The deviations in percentage points (pp) compared to these targets at the beginning of the upward path of the interest rate in each country are shown in Table 1. This shows that Colombia, Chile, and Brazil began to react when their inflation rates were farther away from the target than Peru and Mexico, which took a little longer. The case of the United States stands out, as it waited to begin its rate hike cycle until its observed inflation was 5.9 pp above its target.

Table 1. Policy Interest Rate (MPR) Hiking Cycle

| Brazil | Chile | Peru | Colombia | Mexico | USA | |

|---|---|---|---|---|---|---|

| Cycle start date | Mar-21 | Jul-21 | Aug-21 | Sep-21 | Jun-21 | Mar-22 |

| Observed inflation | 5.20 % | 3.80 % | 3.81 % | 4.44 % | 5.89 % | 7.90 % |

| Deviation from target (pp) | 1.45 | 0.80 | 1.81 | 1.44 | 2.89 | 5.90 |

| 12-month inflation expectations | 4.27 % | 3.40 % | 3.03 % | 3.49 % | 3.20 % | 6.00 % |

| GDP growth1 | -3.60 % | -6.10 % | 6.30 % | 1.3 % | -8.8 % | 5.80 % |

| GDP growth expectations (year) | 3.25 % | 8 % | 9 % | 6.50 % | 5.15 % | 3.70 % |

1 12-month GDP growth to the quarter preceding the beginning of the cycle

On the other hand, by using the 12-month inflation expectation as a criterion for comparison instead of observed inflation, Colombia's diagnosis remains unchanged, as it continues to stand at an intermediate point. In turn, Mexico's diagnosis improved significantly because at the beginning of the hiking cycle, inflation expectations in that country remained tied to its 3.0% target, exhibiting the significant degree of credibility enjoyed by Mexican monetary policy at the time.

Another essential criterion for judging the timing of monetary policy decisions is economic growth at the beginning of the MPR hiking cycle. To ensure uniformity of this criterion across countries, the 12-month GDP growth figures known in the quarter prior to the interest rate movement are used. As exhibited in Table 1, Brazil, Chile, and Mexico started the rate hike cycle when their observed annual growth rates was negative. In contrast, Peru and the United States, with relatively high growth rates at the beginning of their MPR hiking cycle, would be considered laggards in this decision. Colombia, with an observed growth of 1.3%, is at an intermediate point.

An alternative criterion, possibly a more accurate one considering the lags with which monetary policy acts, is the annual growth expectations that existed when the decision to initiate the cycle of policy rate hikes was made. For all countries, these expectations were positive. Colombia stands once again at an intermediate point. Brazil and Mexico began their hiking cycle when their growth expectations for 2021 were at 3.25% and 5.15%, respectively. Colombia did so when expectations were at 6.5%, while Peru and Chile began their hiking cycle when their growth expectations for 2021 were at 9.0% and 8.0%, respectively. Despite the expected economic recovery, GDP levels in 2021 remained below those observed before the pandemic. As a result, central banks did not see the expected high growth data as unequivocal signals to accelerate the start of monetary tightening.

Similar criteria can also be used to compare the timing of this decision across central banks (Table 2). In this case, both the observed inflation and 12-month inflation expectations data show that Banco de la República's decision to start the downward cycle was considerably ahead of its peers insofar as both were at relatively high levels. In contrast, most countries waited to start their rate reduction cycles until inflation was at low values, at least below 8.0%. Colombia was the only country that began its cycle of reductions when inflation was still above 10% per year. However, it should also be noted that, along with Brazil and Chile, Colombia had one of the highest real rates in the region when it began its downward interest rate cycle.

Table 2. Policy Interest Rate (MPR) Downward Cycle

| Brazil | Chile | Peru | Colombia | Mexico | USA | |

|---|---|---|---|---|---|---|

| Cycle start date | Aug-23 | Jul-23 | Sep-23 | Dic-23 | NA3 | NA3 |

| Observed inflation | 3.16 % | 7.60 % | 5.58 % | 10.15 % | 4.32 % | 3.10 % |

| 12-month inflation expectations | 4.11 % | 3.20 % | 3.36 % | 5.70 % | 3.96 % | 3.36 % |

| Ex-ante real interest rate1 | 9.60 % | 8.10 % | 4.40 % | 7.60 % | 7.30 % | 1.90 % |

| GDP growth2 | 3.70 % | 0.60 % | 0.80 % | 1.30 % | 3.20 % | 2.50 % |

| GDP growth expectations (year) | 2.24 % | -0.50 % | 0.95 % | 1.20 % | 3.40 % | 2.40 % |

1 Calculated based on 12-month inflation expectations.

2 12-month GDP growth to the quarter preceding the beginning of the cycle.

3 By February 2024, these countries had not started the interest rate downward cycle.

Finally, Table 2 exhibits the 12-month GDP growth known in the quarter prior to the beginning of the downward cycle and annual growth expectations. At the time of the first policy rate cut, observed growth was moderate in Colombia, Chile, and Peru, and their growth expectations were low and even negative in the case of Chile. This would qualify the decision to initiate rate cuts in these countries as timely. Brazil had higher observed growth at the beginning of its rate cuts, but its expected growth was declining. It also had the highest real interest rate in the region. Accordingly, its decision can be considered to be adjusted to the circumstances it was going through. Mexico and the United States had not begun their MPR downward cycle in February 2024.

In conclusion, the rationale on the timing of the start of monetary tightening cycles across countries has little to do with calendar dates. Sound judgment requires considering conditional criteria that make it possible to assess the conformity of central bank decisions with the economic facts that were observed and expected. In this context, interest rate decisions in Colombia are not very different in terms of timing from those of other countries in the region and are often at an intermediate point.