Economic-knowledge: Gross Domestic Product (GDP)

In previous Economic-knowledge editions, we learned that the current monetary policy scheme adopted by the monetary authority in Colombia since the end of the nineties is the one of inflation targeting1, This is aimed at meeting an inflation target and to ensure that the economy can grow at the maximum level of its capabilities. In this sense, it can be said that there is a double goal of monetary policy: the Central Bank is concerned about the price level and, once this first goal is achieved, it contributes to reaching the maximum level of sustainable production.

In this and the next edition of Economic-Knowledge we will address in an easy way that second objective of monetary policy, which is not always understood correctly because it involves concepts that are not so clear for all citizens. This being the case, we will learn basic definitions of gross domestic product (nominal and real) and we will learn how to measure the potential output of an economy. Finally, we will understand the concept of output gap, its implications, and its importance for macroeconomic management.

Before learning these basic definitions, we should start by clarifying the concept of “gross domestic product” since it generally causes some confusion, despite being a close indicator for everyone. Let us imagine that each one of our families represents a country, and each member carries out a productive activity: farmer, merchant, teacher, transporter, builder, among others2. If everyone plays these roles, and we all contribute to our family’s economic prosperity, how are we going to measure such progress? Well, we would have to calculate the value created by each one of us and sum up the result of each member, for example, in three-month periods. Based on this quarterly exercise, we could see what the added value of a quarter was in comparison to the data from three months earlier and calculate its growth. This exercise can also be carried out by taking the value of the first quarter of a year compared to the first quarter of the previous year and calculate its growth.

The growth of wealth generated by a family in a quarter or in a year becomes an indicator of prosperity, and, in addition, it allows us to compare it with other families, neighbors, or the rest of the world. In fact, it could show if some negative (or positive) situation is influencing it or if it is something generalized in the neighborhood or the world.

You could also think that, if the results of that family measurement show that production is below the family’s standard capabilities, there would be room to somehow stimulate the production of the family members (or of those who buy what they produce), and thus achieve the optimal level for that family. The opposite would be that they produce more than what they are able to generate; in this case, we should be careful not to overload their capabilities, as this might cause someone to get sick, thus leading to a less favorable result for the family as a whole.

Although we could add more details to this example in order to understand GDP (which we will do in the following lines), it is interesting and close to start our explanation in a simple way.

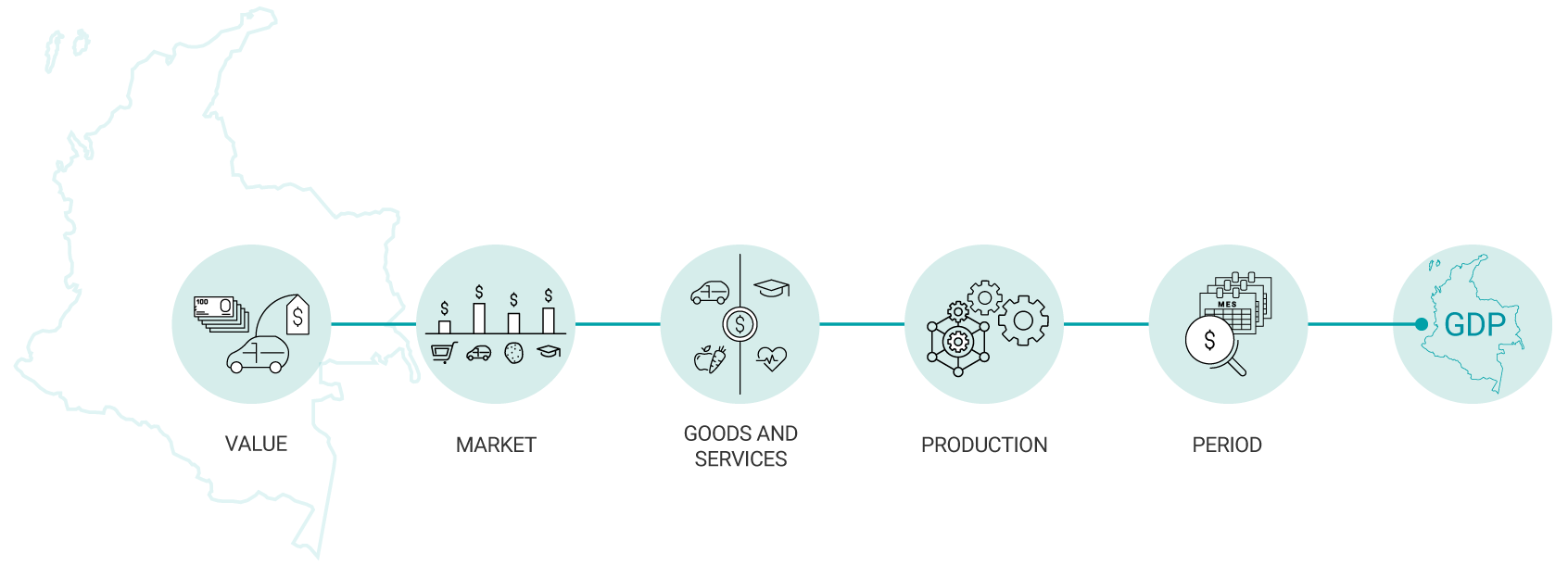

Let’s start with the basic definition of GDP: it is the market value of all final goods and services produced within a country’s geographic limits in a given period. To make it simpler, let’s break down its definition to understand each component. First, let’s address the term “value”. When we talk about Value, we are referring to two components: quantities produced and the price at which that production was sold. For example, in the case of a good produced in Colombia, such as flowers, we could think of Value as the number of flowers produced multiplied by the price at which the bouquets were sold. The second term is “market”, which is simply the price at which the sale transaction was actually made. The third concept is “of all final goods and services.”. You will probably remember that in a previous Economic-knowledge edition we had mentioned what a Good or Service3, means; however, this time, the important consideration is the term “final,” and you may ask why. The answer is simple: if we were including the value of intermediate goods and services, in addition to the value of final goods and services, we would be counting the same product twice.

To make it clearer, let’s think about your favorite bakery product. If we were to count what we paid for that product (for example, COP$500) but we add to it what the baker pays for the flour (COP$30), the egg (COP$100), sugar (COP$20), and butter (COP$15), then we would be counting twice the goods (or services) that were used in the production process. In this case, we would be counting only the value at which the baker sold his/her product, but not the value at which suppliers sold to him/her, since he/she is not the product’s consumer. At this point, it is important to clarify that, if flour, eggs, sugar, and butter were to be sold separately to the final consumer (as we find them in the supermarket), they would be counted in the GDP because they were intended for our consumption and not for a production process.

The fourth term of the definition is “goods and services produced” or which the factors available in the country (land, capital, labor, inputs, technology, etc.) are used. The fifth term is that they are produced “within a country’s geographic limits”. Although this precision is logical, it is crucial to examine it since GDP includes what is produced inside the country, regardless of whether the factors of production used are of domestic or foreign property4. Therefore, it is common to include in GDP several activities of foreign companies, which do not necessarily distribute their profits in Colombia but do use and, therefore, compensate for the domestic factors of production. The last crucial term in this definition is “in a given period”. In Colombia and following international recommendations, the GDP measurement contemplates production on a quarterly basis; that is, the sum of what is produced between January and March, April and June, July and September, and finally between October and December. Although these are quarterly values, it is natural to think that the value of production for a specific year results from adding up the values of each of the four quarters of a year. In Colombia, the National Administrative Department of Statistics (DANE, in Spanish) is responsible for these measurements, which, with some natural lag, publishes the quarterly and annual data and their corresponding growth, as well as other considerations that we will address below.

Now that we have understood the GDP definition, let’s distinguish two key concepts related to the prices used to value production. The first concept is Nominal GDP(or GDP at current prices), which is obtained from valuing production at the current prices when making the measurement. For a better understanding, let’s look at an example. Suppose we are measuring the first quarter of the year and analyzing the production of Pastusa potatoes (a variety of potatoes). The price we use for valuing the potato production is the price at which it was sold during that period. And so on, for the other final goods and services produced in the country.

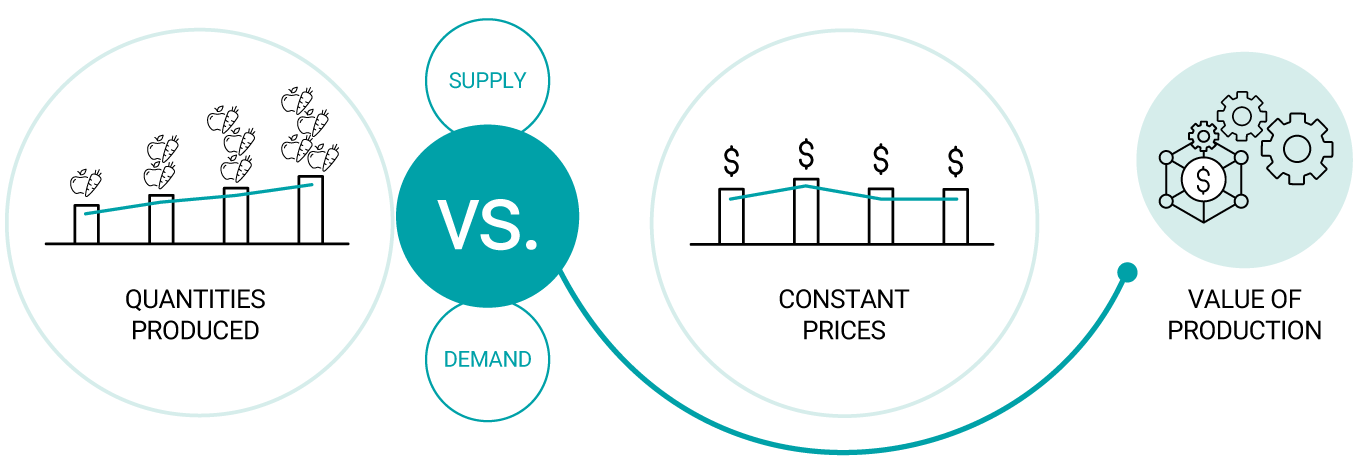

The second concept of price is the one considered in the so-called Real GDP also known as Constant price GDP). It uses prices from a year other than the measuring period (known as the base year)5. Continuing with the Pastusa Potato example, in this case, the valuation of the current production (in 2021) would be carried out considering the prices of this potato variety in the base year, for example, in 2015. Thus, the natural question is: why is this distinction made? And the answer is quite simple: to separate the effect price increases (inflation) may have on the valuation of the production, and exclusively focus on the variation of quantities produced during that period, which is ultimately the one measuring how much our economy grows. In other words, what is aimed with the Real GDP measurement is to maintain prices constant in that base year, and thus analyze the behavior of the quantities produced. In this way, if Real GDP shows positive growth, it is a clear indication that production (measured in quantities) is increasing, suggesting that the economic activity in the country is growing. However, if we analyze the Nominal GDP variation, we would not know whether the higher value in production comes from an increase in quantities or in prices.

Another important aspect to consider when measuring GDP is that it can be measured from the supply side, that is, considering the value of production of the different productive sectors offering their goods or services (industry, agriculture, commerce, etc.). On the demand side, it considers the expenditure from agents demanding those goods and services (families, businesses, the government, or the rest of the world). The reason is that all products sold are bought by one of these agents. These two GDP measurements are published by DANE quarterly and annually and can be used to perform various analyses by sector or demand, thus supporting the country’s decisions on macroeconomic policy.

Finally, and to conclude this simple explanation of GDP, it is important to mention that the original data(known as the original series), where prices and quantities produced are used to obtain the value of the production, undergo some modifications. It is common for these data to be subjected to such changes so that they truly reflect what is happening in the economic cycle, without considering effects other than economic activity. Those modifications are known as seasonal adjustments and calendar adjustments, which simply means eliminating some effects of regular seasonal movements that are caused at certain times of the year. For example, the increase in Christmas sales in December; the influence that holidays may have on the number of working days in the quarter, such as Easter, which sometimes takes place in March (first quarter) and other times in April (second quarter). These adjustments are expected to provide more refined and easier-to-interpret information. Also, these are published by DANE and are generally the most consulted for analysis by the economic authorities.

Considering all we have learned up to this point, we are ready to move to the next edition of Economic-knowledge which addresses two concepts related to GDP. These very important components for the macro analysis are: estimation of potential output and the output gap.

Keep in mind

| The productive activity of a country is measured by different indicators that have become popular over the years and, according to the dynamics of their economies, certain countries may give more importance to some indicators than to others. |

| The most common indicator to measure countries’ economic activity is the Gross Domestic Product (GDP), although there are other measures of economic activity, such as Gross National Product (GNP). |

| If we include in GDP and GNP the depreciation of capital assets, we would have two new indicators known as Net Domestic Product (NDP) and Net National Product (NNP), respectively. |

| The measurement of economic activity through GDP is internationally criticized because, among other things, it excludes other activities that are not necessarily physically produced or accounted for but which contribute to the standard of living of citizens. For example, it excludes household chores, volunteering, or production for self-consumption, among many other activities. |

| Furthermore, GDP is also criticized because it does not consider negative (or positive) externalities, such as pollution or distribution. However, it is the most widely accepted and used internationally, and for those other factors, other specialized indicators have been created. |

1/ It could also be called a flexible inflation targeting scheme since it is not exclusively oriented to meeting an inflation target but also aims at sustained economic growth.

2/ These activities represent the productive sectors, and we could think of all the activities a country can carry out according to its particular characteristics.

3/ Let’s remember that a Good mainly refers to tangible elements that we use to satisfy a need or a desire, for example, food, shelter, furniture, etc. Meanwhile, Services include non-tangible items that also serve to satisfy our needs and desires, such as education, health, or communications.

4/ There are other measures of economic activity that focus on national production regardless of geographic limits. That is the case of Gross National Product (GNP) which extracts the contributions of foreign production factors and includes the contribution of our production factors found in other countries.

5/ In Colombia, we have had the following base years: 1975, 1994, 2000, 2005, and the current 2015.