Remittance inflows are mainly flows of foreign currency sent periodically by emigrants to their families in the country of origin for various purposes such as contributing to household support, children's education, the purchase of housing or other investments that generate capital income for the emigrant.

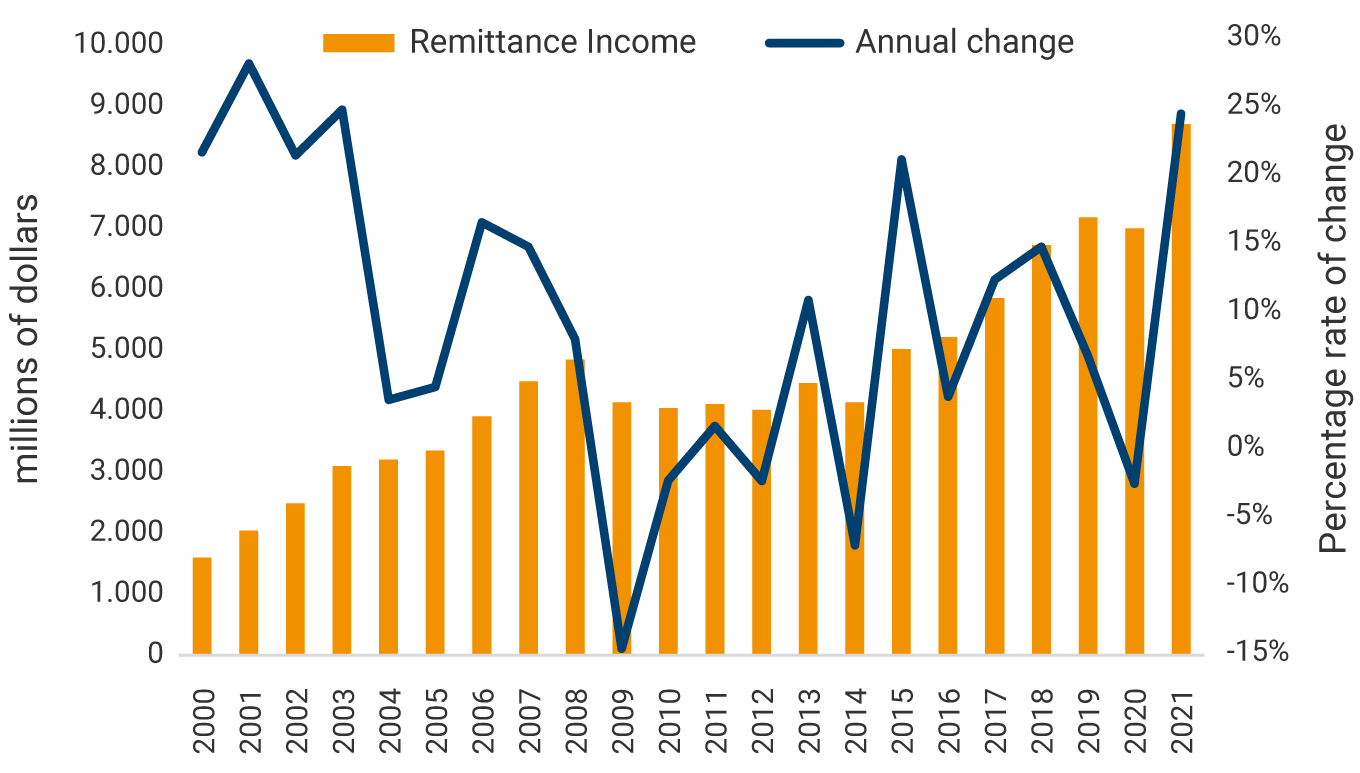

In 2021, the flow of remittances received by Colombian households reached a level of USD 8.597 b, with an annual increase of 24.4%, a percentage that has not been registered since the first four years of the 2000s, when its average annual growth was 24% (Graph 1). Note that remittance inflows had been growing annually by about 11% from 2015 through March 2020, a rate of increase that was interrupted in March and April 2020 by the pandemic. The growth rate of the flow of remittances in 2021, which was higher than that registered by the GDP and external current revenue, explains its greater macroeconomic relevance. Over the last year, remittances have represented 2.7% of the GDP in dollars and 12.6% of current external income.

Graph 1. Remittance Income and growth rate

Source: Colombia’s Balance of Payments, Banco de la República

The economic literature classifies the motivations for sending remittances to the country of origin into the following categories: i) altruism, ii) exchange motive, iii) smoothing consumption over time, iv) security, v) investment, and vi) inheritance motive or preservation of the right to family legacies, etc. Based on this classification, altruistic motivation would be the most relevant in the case of Colombia as documented in a study done by researchers at Banco de la República (Borradores, 1066).

The econometric evidence contained in the aforementioned document concludes that remittance inflows to the country grow as the emigration of Colombians increases and as their income improves, and this is approximated by the economic growth of the countries where emigrants are concentrated. Although less conclusive, the study also found evidence of a temporary increase in remittances during periods of exchange rate depreciation. These factors help explain the recent growth in remittance inflows.

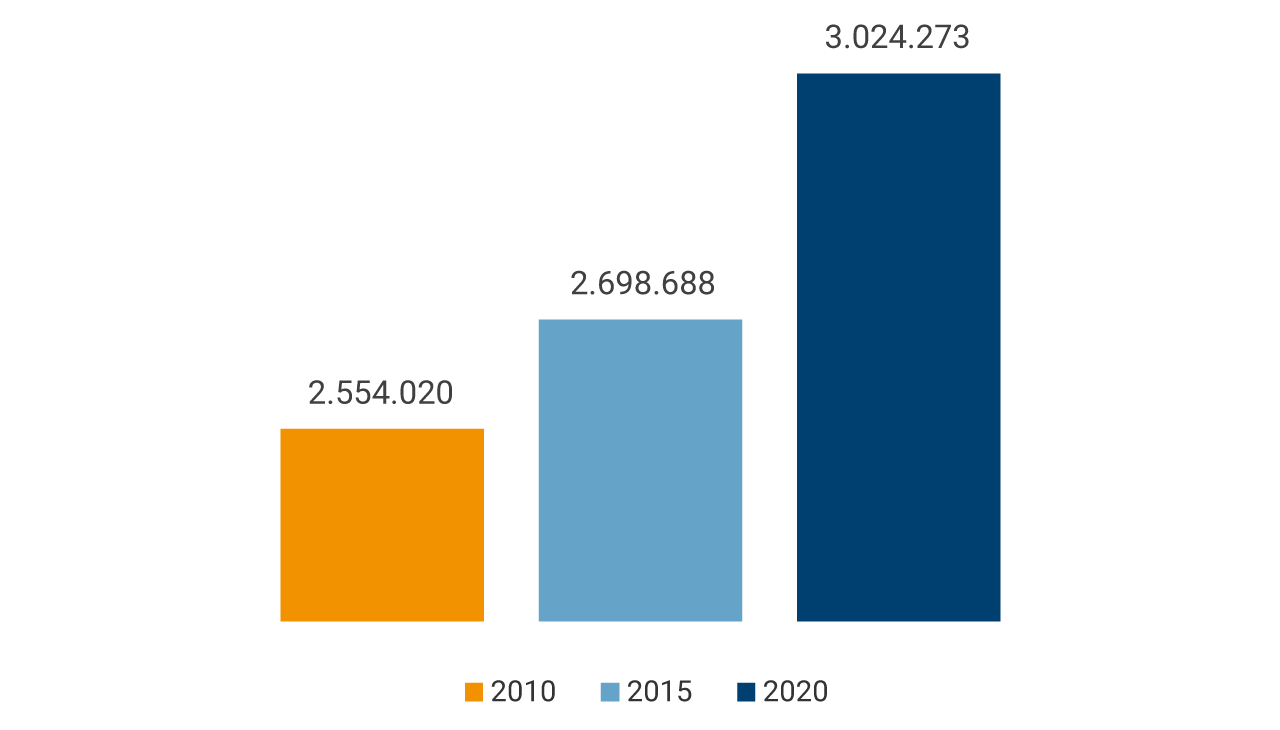

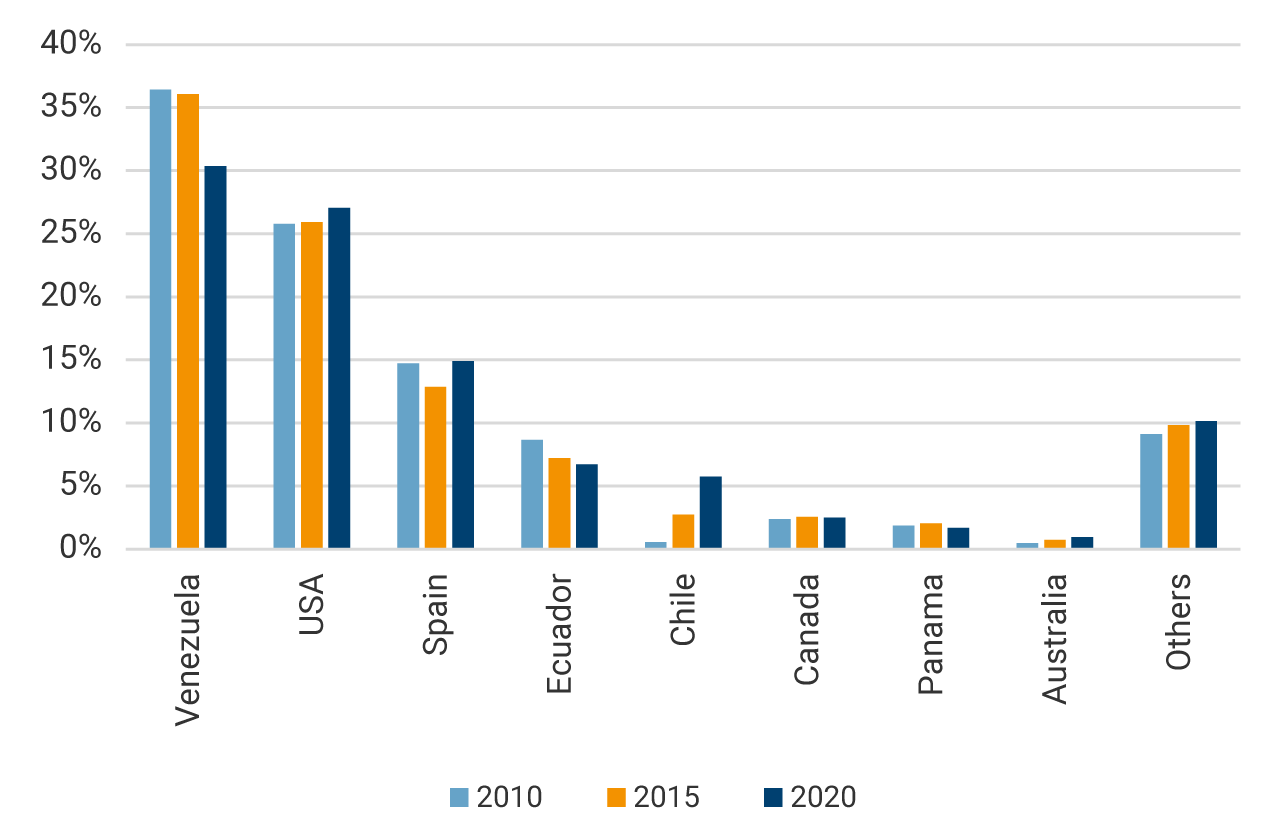

International emigration has been a recurrent phenomenon in Colombia since the 1960s. International migration statistics published by the United Nations reveal that Colombia has registered a new episode of international migration of its residents in the last decade. The number of Colombian emigrants went from 2.5 million in 2010 to 3.02 million in 2020 and, in 2021, their flow was likely 279,831 Colombians (Graph 2.1). The destination of Colombian emigrants in recent years has mostly been the United States (27%), Spain (14.9%), Chile (5.7%) and new destinations such as Australia and Canada while traditional destinations such as Venezuela, Ecuador, and Panama have declined.

Graph 2.1 Number of international migrants from Colombia

Graph 2.2. Geographical distribution of Colombian migration

Source: United Nations and Colombia Migration

The increase in remittances in 2021 was associated with the assistance provided to households during the pandemic in the countries where emigrants reside. These subsidies and the increase in salaries made it possible to raise disposable household income while, at the same time, spending was reduced due to travel restrictions. This created conditions conducive to the growth of remittances to their families in Colombia. The deterioration of the economic conditions for Colombian households and the accelerated depreciation of the exchange rate of the peso vis-à-vis the dollar and the euro that occurred between 2020 and 2021 were also another stimulus for increased remittances to the country.

As a result of the growth in remittances registered between 2015 and 2021, the share of remittances in the annual GDP expressed in dollars has grown in importance in recent years. While this indicator was 1.1% of the GDP in 2014, it is estimated at 2.7% in 2021. Similarly, its relevance as a source of income for Colombian households has grown. The amount in remittances expressed in pesos as a proportion of disposable household income went from 2.8% to 3.4% between 2019 and 2021. A similar trend showed the share of remittances in household expenditure on final consumption as it went from 3.2% in 2019 to 3.8% in 2021. The magnitude of remittances received compared to Colombia's current external balance of payments income is also higher, having gone from 10.4% to 12.6% between 2019 and 2021 respectively. In addition, this income from abroad has benefited a greater number of recipients; 26% of the annual increase, US$ 1.688 b, is due to remittances to new beneficiaries.

The growth of remittances since 2020 has been characterized by an increased use of international currency transfer mechanisms through internet platforms (digital channels) which overcame the travel restrictions imposed during the Covid-19 pandemic. Remittances received through digital channels in 2021 were estimated to have reached 21% of the total compared to 12% in 2019. This has been accompanied by a higher proportion of remittances to Colombia that are received directly into savings or checking accounts. This share reached 46.4% of the total in 2021 while, in 2019, it was 31.5%. Competition from digital remittance platforms that offer lower commissions than traditional channels (banks and remittance intermediaries) has put downward pressure on their remittance costs. Their receipt in savings accounts, in turn, has allowed the beneficiaries to increase their possibilities of getting access to bank credit.