Monitoring of Financial Infrastructures

What are financial infrastructures?

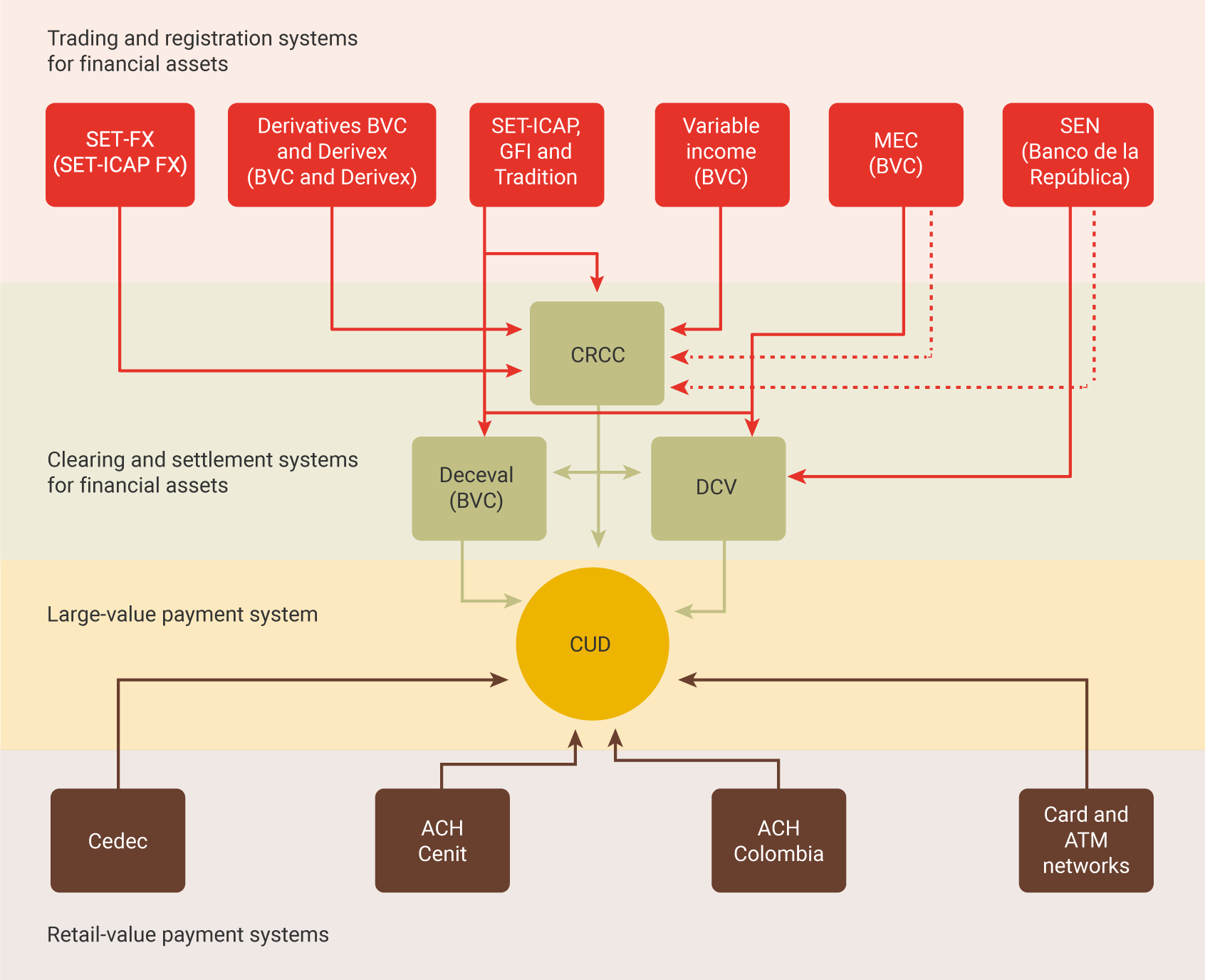

Financial infrastructure or financial market infrastructures (FMI) enable the clearing, settlement, and recording of financial transactions (payments, securities, derivatives, and other financial assets) between participating entities.

They include:

- Payment systems (PS)

- Central Securities Depositories (CSD)

- Central Counterparties Entities (CCE)

- Trade repositories and other clearing and settlement infrastructures.

In 2021, an average of COP$56 trillion corresponding to 4.5% of the GDP was offset daily in Colombia through the Deposit Accounts System (CUD in Spanish, only in this language); through the Central Securities Depositories (CSD) managed by Banco de la República (the Central Bank of Colombia) and the Centralized Securities Depository of Colombia S. A. (Deceval in Spanish), COP$34 trillion in public debt instruments and COP$2.6 trillion in private debt and shares; and COP$15.7 trillion through the central counterparty entity, the Central Counterparty Risk of Colombia S.A. (CRCC).

Why are financial infrastructures monitored?

The aim is to understand the functioning and interaction of FMIs and their participants, mitigate the systemic risk, facilitate the normal functioning of the payment system, and contribute to the maintenance of financial stability in Colombia.

The Board of Directors of Banco de la República (BDBR) assigned through the External Resolution 5 of 2009 (only in Spanish) the power to monitor the Deposit Accounts System and demand from participants and managers the information it may deem relevant to achieve the safe and efficient operation of the payment system given its impact upon the systemic risk and the stability of the financial system.

Who performs the monitoring in Colombia?

The Financial Infrastructure Oversight Department (DSIF in Spanish) created by Banco de la República in October 2010.

The DSIF is a technical department, separate from the activities of direct provision of payment services offered by Banco de la República and is part of the Office for Monetary Operations and International Investments. (SGMII in Spanish).

Banco de la República achieves a comprehensive view of the financial system through the SGMII, which also includes the Financial Stability Division (DEFI in Spanish), in charge of monitoring the performance of financial institutions and the Operations and Financial Markets Analysis Department (DOAM in Spanish), which permanently monitors local financial markets.

Which infrastructures are monitored?

The DSIF monitors the Deposit Accounts System (CUD) and external systems interconnected to the CUD that are responsible for the clearing and settlement of financial assets. These include the securities clearing and settlement systems (DCV and Deceval) and the central counterparty entity (CRCC).

It also monitors the retail-value payment systems interconnected to the CUD, which are responsible for the settlement of electronic payments made between individuals and companies in the circuit of goods and services. These are: ACH Cenit, ACH Colombia, Cedec, and several ATM and credit and debit card networks.

Note: The dotted lines refer to the fact that the CRCC manages the risks in TES sell/buy-back transactions sent from SEN and MEC, while gross settlement is done concurrently in the DCV-CUD.

In addition, Banco de la República includes within the follow-up function, the monitoring of payment instruments associated with these FMIs, such as checks, debit and credit cards, and electronic funds transfers, as well as the use of cash.

How are financial infrastructures monitored?

The follow-up work consists of monitoring the country’s financial infrastructure from a comprehensive view, as well as the interconnections between the systems that constitute it and the participants, to identify and size possible risks related to clearing and settlement activities that have a systemic impact, in addition to proposing alternatives to mitigate them. All of this is aimed at generating complementary elements for the analysis of the financial sector, thus contributing to the stability of the payment system as a whole and, consequently, to the financial stability of the country.

In addition to that, by implementing the follow-up work, Banco de la República seeks to strengthen research in this area, develop methodologies to analyze the stability of the payment systems, and contribute to the generation of knowledge.